Aflac 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The methods of determining the fair values of our

investments in debt securities, perpetual securities and

equity securities are described in Note 4.

During 2009, we reclassied 12 investments from the held-

to-maturity portfolio to the available-for-sale portfolio as a

result of signicant declines in the issuers’ creditworthiness.

At the time of transfer, the securities had an aggregate

amortized cost of $1.3 billion and an aggregate unrealized

loss of $548 million.

During 2008, Lehman Brothers Special Financing Inc.

(LBSF), the swap counterparty under four of our CDO debt

securities, led for bankruptcy protection along with certain

of its afliates (including Lehman Brothers Holdings Inc.,

the guarantor of LBSF’s obligations relating to the CDOs).

We transferred these CDOs from the held-to-maturity

portfolio to the available-for-sale portfolio as a result of the

default by LBSF under the swaps. In connection with the

transfer, we took an impairment charge primarily related to

the foreign currency component of three of these CDOs

totaling $20 million ($13 million after-tax). This impairment

charge was included in realized investment losses during

2008. At the time of the transfer and after impairment

charges, these CDO debt securities had a total amortized

cost of $245 million and an unrealized gain of $3 million.

The unrealized gain related to the only CDO of the four

that was not impaired. In the fourth quarter of 2009, we

redeemed these four CDO securities and received the

underlying collateral assets.

We transferred four other debt securities from the held-to-

maturity portfolio to the available-for-sale portfolio during

2008 as a result of signicant deterioration in the issuers’

creditworthiness. At the time of the transfer, the securities

had an aggregate amortized cost of $268 million and an

aggregate unrealized loss of $131 million.

During 2007, we reclassied an investment from the held-

to-maturity portfolio to the available-for-sale portfolio

as a result of a signicant deterioration in the issuer’s

creditworthiness. At the date of transfer, this debt security

had an amortized cost of $169 million and an unrealized

loss of $8 million. The investment was subsequently sold at

a realized gain of $12 million.

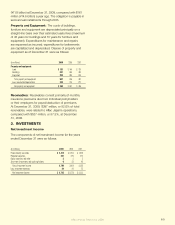

Contractual and Economic Maturities

The contractual maturities of our investments in xed

maturities at December 31, 2009, appear in the table at the

top of the next column.

Aflac Japan Aflac U.S.

Amortized Fair Amortized Fair

(In millions) Cost Value Cost Value

Available for sale:

Due in one year or less $ 624 $ 632 $ 5 $ 5

Due after one year through five years 5,384 5,840 279 309

Due after five years through 10 years 2,433 2,594 790 883

Due after 10 years 21,464 20,007 5,403 5,317

Mortgage- and asset-backed securities 883 879 250 198

Total fixed maturities

available for sale $ 30,788 $ 29,952 $ 6,727 $ 6,712

Held to maturity:

Due after one year through five years $ 1,595 $ 1,643 $ 200 $ 102

Due after five years through 10 years 2,554 2,853 – –

Due after 10 years 22,171 21,067 – –

Mortgage- and asset-backed securities 167 163 – –

Total fixed maturities

held to maturity $ 26,487 $ 25,726 $ 200 $ 102

At December 31, 2009, the Parent Company had a portfolio

of investment-grade available-for-sale xed-maturity

securities totaling $118 million at amortized cost and $117

million at fair value, which is not included in the table above.

Expected maturities may differ from contractual maturities

because some issuers have the right to call or prepay

obligations with or without call or prepayment penalties.

As previously described in Note 1, our perpetual securities

are subordinated to other debt obligations of the issuer, but

rank higher than equity securities. Although these securities

have no contractual maturity, the interest coupons that

were xed at issuance subsequently change to a oating

short-term interest rate of 125 to more than 300 basis

points above an appropriate market index, generally by the

25th year after issuance, thereby creating an economic

maturity date. The economic maturities of our investments in

perpetual securities, which were all reported as available for

sale at December 31, 2009, were as follows:

Aflac Japan Aflac U.S.

Amortized Fair Amortized Fair

(In millions) Cost Value Cost Value

Available for sale:

Due in one year or less $ 109 $ 111 $ – $ –

Due after one year through five years 1,060 1,177 – –

Due after five years through 10 years 1,543 1,691 5 4

Due after 10 years through 15 years – – – –

Due after 15 years 4,603 4,062 234 218

Total perpetual securities

available for sale $ 7,315 $ 7,041 $ 239 $ 222

Aflac Annual Report for 2009 65