Aflac 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of the annual average investment portfolio of debt and

perpetual securities available for sale during the year ended

December 31, 2009, compared with 4% for the years ended

December 31, 2008, and 2007. This increase in 2009 was

due primarily to a bond-swap program that we executed

to generate investment gains to take advantage of tax loss

carryforwards.

Financing Activities

Consolidated cash provided by nancing activities was

$699 million in 2009, compared with consolidated cash

used by nancing activities of $1.4 billion in 2008 and $655

million in 2007. In April 2009, we redeemed our $450 million

senior notes and settled the related cross-currency, interest

rate swaps that were used to convert the original dollar-

denominated debt obligation into yen. In May 2009, the

Parent Company issued $850 million in senior notes that

are due in May 2019, and in December 2009, also issued

$400 million in senior notes that are due in December 2039.

In July 2009, the Parent Company executed a ¥10 billion

loan that is due in July 2015. In August 2009, the Parent

Company executed a ¥5 billion loan that is due in August

2015. Cash returned to shareholders through dividends

was $524 million in 2009, compared with cash returned

to shareholders through dividends and treasury stock

purchases of $1.9 billion in 2008 and $979 million in 2007.

During 2009, we extinguished portions of our yen-

denominated Uridashi and Samurai debt by buying

the notes on the open market. We paid ¥4.4 billion to

extinguish ¥6.0 billion of debt, yielding a realized gain from

extinguishment of debt of ¥1.6 billion, or $17 million ($11

million after-tax), which we included in other income.

In July 2010, ¥39.4 billion (approximately $428 million using

the December 31, 2009, exchange rate) of our Samurai

notes will mature. We plan to use existing cash to pay off

these notes.

We have no restrictive nancial covenants related to our

notes payable. We were in compliance with all of the

covenants of our notes payable at December 31, 2009.

The following tables present a summary of treasury stock

activity during the years ended December 31.

During 2009, we did not repurchase shares of our common

stock in the open market. In 2008, under share repurchase

authorizations from our board of directors, we purchased

23.2 million shares of our common stock in the open

market, funded with internal capital. The total 23.2 million

shares was comprised of 12.5 million shares purchased

through an afliate of Merrill Lynch, Pierce, Fenner &

Smith Incorporated (Merrill Lynch) and 10.7 million shares

purchased through Goldman, Sachs & Co. (GS&Co.).

See Note 9 of the Notes to the Consolidated Financial

Statements for additional information.

As of December 31, 2009, a remaining balance of 32.4

million shares of our common stock was available for

purchase under share repurchase authorizations by our

board of directors. The 32.4 million shares available for

purchase were comprised of 2.4 million shares remaining

from an authorization from the board of directors in 2006

and 30.0 million shares from a board authorization in

2008. We will closely monitor global nancial markets and

our capital position before we commit to further share

repurchases.

Cash dividends paid to shareholders in 2009 of $1.12 per

share increased 16.7% over 2008. The 2008 dividend paid

of $.96 per share increased 20.0% over 2007. The following

table presents the sources of dividends to shareholders for

the years ended December 31.

In February 2010, the board of directors declared the rst

quarter 2010 cash dividend of $.28 per share. The dividend

is payable on March 1, 2010, to shareholders of record at

the close of business on February 16, 2010.

Regulatory Restrictions

Aac is domiciled in Nebraska and is subject to its

regulations. The Nebraska insurance department imposes

certain limitations and restrictions on payments of dividends,

management fees, loans and advances by Aac to the

Parent Company. The Nebraska insurance statutes require

prior approval for dividend distributions that exceed the

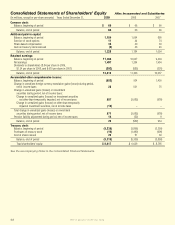

Treasury Stock Issued

(In millions of dollars and thousands of shares) 2009 2008

2007

Stock issued from treasury $ 17 $ 32 $ 47

Number of shares issued 1,043 2,001 2,723

Treasury Stock Purchased

(In millions of dollars and thousands of shares) 2009 2008

2007

Treasury stock purchases $ 10 $ 1,490 $ 606

Number of shares purchased:

Open market – 23,201 11,073

Other 264 146 559

Total shares purchased 264 23,347 11,632

(In millions) 2009 2008

2007

Dividends paid in cash $ 524 $ 434 $ 373

Dividends declared but not paid (131) 131 (91)

Dividends through issuance of treasury shares – 20 19

Total dividends to shareholders $ 393 $ 585 $ 301

We’ve got you under our wing.

48