Aflac 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investment Concentrations

Our investment discipline begins with a top-down approach

for each investment opportunity we consider. Consistent

with that approach, we rst approve each country in

which we invest. In our approach to sovereign analysis,

we consider the political, legal and nancial context of

the sovereign entity in which an issuer is domiciled and

operates. Next we approve the issuer’s industry sector,

including such factors as the stability of results and the

importance of the sector to the overall economy. Specic

credit names within approved countries and industry

sectors are evaluated for their market positions and specic

strengths and potential weaknesses. Structures in which

we invest are chosen for specic portfolio management

purposes, including asset/liability management, portfolio

diversication and net investment income.

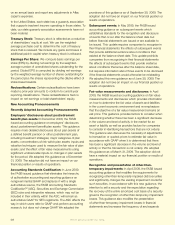

Investment exposures that individually exceeded 10% of

shareholders’ equity as of December 31 were as follows:

2009 2008

Credit Amortized Fair Credit Amortized Fair

(In millions) Rating Cost Value Rating Cost Value

Japan National Government AA $ 11,167 $ 11,375 AA $ 10,604 $ 11,533

Israel Electric Corp. BBB 889 869 BBB 902 902

Republic of Tunisia BBB 868 862 BBB 880 909

HSBC Holdings PLC ** * * * AA 856 860

HBOS PLC** * * * AA 686 611

Republic of South Africa * * * BBB 674 727

* Less than 10% of shareholders’ equity at reporting date

** For this issuer, we own more than one security with different ratings.

Our largest investment industry sector concentration is

banks and nancial institutions. Within the countries we

approve for investment opportunities, we primarily invest

in nancial institutions that are strategically crucial to each

approved country’s economy. The bank and nancial

institution sector is a highly regulated industry and plays

a strategic role in the global economy. We achieve some

degree of diversication in the bank and nancial institution

sector through a geographically diverse universe of

credit exposures. Within this sector, the more signicant

concentration of our credit risk by geographic region

or country of issuer at December 31, 2009, based on

amortized cost, was: Europe, excluding the United Kingdom

(48%); United States (20%); United Kingdom (8%); Japan

(9%); and other (15%).

Our total investments in the bank and nancial institution

sector as of December 31, including those classied as

perpetual securities, appear in the table at the top of the

next column.

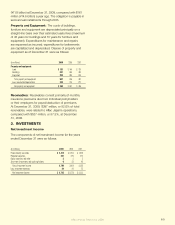

Realized Investment Gains and Losses

Information regarding pretax realized gains and losses from

investments for the years ended December 31 follows:

(In millions) 2009 2008 2007

Realized investment gains (losses) on securities:

Debt securities:

Available for sale:

Gross gains from sales $ 258 $ 10 $ 40

Gross losses from sales (18) (265) (6)

Net gains (losses) from redemptions 1 3 17

Impairment losses (630) (298) (22)

Held to maturity:

Impairment losses – (75) –

Net gains (losses) from redemptions 1 – –

Total debt securities (388) (625) 29

Perpetual securities:

Available for sale:

Gross gains from sales 4 – –

Gross losses from sales (101) – –

Impairment losses (729) (379) –

Held to maturity:

Gross gains from sales – 5 –

Total perpetual securities (826) (374) –

Equity securities:

Impairment losses (2) (1) (1)

Total equity securities (2) (1) (1)

Other long-term assets 4 (7) –

Total realized investment gains (losses) $ (1,212) $ (1,007) $ 28

In 2009, we realized pretax investment losses of $1,361

million ($884 million after-tax) as a result of the recognition

of other-than-temporary impairment losses. We realized

2009 2008

Total Investments in Total Investments in

Banks and Financial Percentage of Banks and Financial Percentage of

Institutions Sector Total Investment Institutions Sector Total Investment

(in millions) Portfolio (in millions) Portfolio

Debt securities:

Amortized cost $ 19,691 28% $ 19,868 28%

Fair value 18,023 26 17,793 27

Perpetual securities:

Upper Tier II:

Amortized cost $ 4,909 7% $ 6,238 9%

Fair value 4,938 7 5,960 9

Tier I:

Amortized cost 2,354 3 2,542 4

Fair value 2,006 3 1,780 3

Total:

Amortized cost $ 26,954 38% $ 28,648 41%

Fair value 24,967 36 25,533 39

We’ve got you under our wing.

66