Aflac 2009 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

authorities. The second step is measurement, whereby a

tax position that meets the more-likely-than-not recognition

threshold is measured to determine the amount of benet to

recognize in the nancial statements.

See Note 8 of the Notes to the Consolidated Financial

Statements for additional information.

New Accounting Pronouncements

During the last three years, various accounting standard-

setting bodies have been active in soliciting comments and

issuing statements, interpretations and exposure drafts.

For information on new accounting pronouncements and

the impact, if any, on our nancial position or results of

operations, see Note 1 of the Notes to the Consolidated

Financial Statements.

RESULTS OF OPERATIONS

The following table is a presentation of items impacting net

earnings and net earnings per diluted share for the years

ended December 31.

Realized Investment Gains and Losses

Our investment strategy is to invest in investment-grade

xed-income securities to provide a reliable stream of

investment income, which is one of the drivers of the

Company’s protability. This investment strategy aligns our

assets with our liability structure, which our assets support.

We do not purchase securities with the intent of generating

capital gains or losses. However, investment gains and

losses may be realized as a result of changes in the nancial

markets and the creditworthiness of specic issuers, tax

planning strategies, and/or general portfolio maintenance

and rebalancing. The realization of investment gains and

losses is independent of the underwriting and administration

of our insurance products, which are the principal drivers of

our protability.

In 2009, we realized pretax investment losses of $1,361

million ($884 million after-tax) as a result of the recognition

of other-than-temporary impairment losses. We realized

pretax investment losses of $101 million ($66 million after-

tax) from the exchange of two of our Lloyd’s Banking Group

plc perpetual security investments. We exchanged our

investment in Lloyds TSB Bank plc yen-denominated, Upper

Tier II perpetual securities into yen-denominated, Lower

Tier II xed-maturity securities. We also exchanged our

holdings of Bank of Scotland plc yen-denominated, Upper

Tier II perpetual securities into yen-denominated, Lower Tier

II xed-maturity securities. The losses were partially offset

by pretax investment gains of $250 million ($162 million

after-tax) that were generated primarily from a bond-swap

program that took advantage of tax loss carryforwards.

In 2008, we realized pretax investment losses of $753

million ($489 million after-tax) as a result of the recognition of

other-than-temporary impairment losses. We realized pretax

investment losses, net of gains, of $254 million ($166 million

after-tax) from securities sold or redeemed in the normal

course of business.

In 2007, we realized pretax investment losses of $23 million

($15 million after-tax) as a result of the recognition of other-

than-temporary impairment losses. We realized pretax

investment gains, net of losses, of $51 million ($34 million

after-tax) from securities sold or redeemed in the normal

course of business.

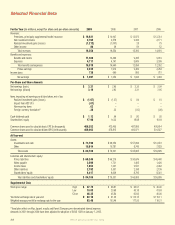

The following table details our pretax impairment losses by

category for the years ended December 31.

For additional information regarding realized investment

gains and losses, please see Notes 1, 3 and 4 of the Notes

to the Consolidated Financial Statements.

Impact from ASC 815 (formerly SFAS 133)

We had cross-currency interest rate swap agreements

that economically converted our dollar-denominated

senior notes, which matured in April 2009, into a yen-

denominated obligation. Until April 2009, we designated

the foreign currency component of these cross-currency

swaps as a hedge of the foreign currency exposure of our

investment in Aac Japan. The effect of issuing xed-rate,

dollar-denominated debt and swapping it into xed-rate,

yen-denominated debt had the same economic impact

on Aac as if we had issued yen-denominated debt of a

like amount. However, the accounting treatment for cross-

currency swaps is different from issuing yen-denominated

(In millions) 2009 2008 2007

Perpetual securities $ 729 $ 379 $ –

Corporate bonds 458 160 20

Collateralized debt obligations 148 213 –

Collateralized mortgage obligations 24 – 2

Equity securities 2

1

1

Total other-than-temporary impairments $ 1,361 $ 753 $ 23

Items Impacting Net Earnings

In Millions Per Diluted Share

2009 2008 2007 2009 2008 2007

Net earnings $1,497 $1,254 $1,634 $3.19 $2.62 $3.31

Items impacting net earnings, net of tax:

Realized investment gains (losses) (788) (655) 19 (1.67) (1.37) .04

Impact from ASC 815 (3) (3) 2 (.01) – –

Gain on extinguishment of debt 11 – – .02 – –

We’ve got you under our wing.

28