Aflac 2009 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

See Notes 1, 3 and 4 of the Notes to the

Consolidated Financial Statements for additional

information.

Deferred Policy Acquisition Costs and

Policy Liabilities

Aac’s products are generally long-duration xed-

benet indemnity contracts. We make estimates

of certain factors that affect the protability of

our business to match expected policy benets

and deferrable acquisition costs with expected

policy premiums. These assumptions include persistency,

morbidity, mortality, investment yields and expenses. If

actual results match the assumptions used in establishing

policy liabilities and the deferral and amortization of

acquisition costs, prots will emerge as a level percentage of

earned premiums. However, because actual results will vary

from the assumptions, prots as a percentage of earned

premiums will vary from year to year.

We measure the adequacy of our policy reserves and

recoverability of deferred policy acquisition costs (DAC)

annually by performing gross premium valuations on our

business. Our testing indicates that our insurance liabilities

are adequate and that our DAC is recoverable.

Deferred Policy Acquisition Costs

Certain costs of acquiring new business are deferred

and amortized over the policy’s premium payment period

in proportion to anticipated premium income. Future

amortization of DAC is based upon our estimates of

persistency, interest and future premium revenue generally

established at the time of policy issuance. However, the

unamortized balance of DAC reects actual persistency.

As presented in the table at the top of the page, the ratio of

unamortized DAC to annualized premiums in force increased

slightly for Aac U.S. in 2009 and 2008, compared with prior

years. This increase was primarily driven by the introduction

of an accelerated commission payment option for new

associates and the renement of our rst-year commission

deferrals on certain products. The ratio of unamortized DAC

to annualized premiums in force has shown a slight upward

trend for Aac Japan for the last three years. This trend is

a result of a greater proportion of our annualized premiums

being under the alternative commission schedule, which

pays a higher commission on rst-year premiums and lower

commissions on renewal premiums. This schedule is very

popular with our new agents as it helps them with cash

ow for personal and business needs as they build their

business. While this has resulted in a higher unamortized

DAC balance, the overall cost to the Company has been

reduced.

Policy Liabilities

The following table provides details of policy liabilities by

segment and in total as of December 31.

Our policy liabilities, which are determined in accordance

with applicable guidelines as dened under GAAP and

Actuarial Standards of Practice, include two primary

components: future policy benets and unpaid policy claims,

which accounted for 89% and 5% of total policy liabilities as

of December 31, 2009, respectively.

Future policy benets provide for claims that will occur in

the future and are generally calculated as the present value

of future expected benets to be incurred less the present

value of future expected net benet premiums. We calculate

future policy benets based on assumptions of morbidity,

mortality, persistency and interest. These assumptions are

generally established at the time a policy is issued. The

assumptions used in the calculations are closely related

to those used in developing the gross premiums for a

policy. As required by GAAP, we also include a provision

for adverse deviation, which is intended to accommodate

adverse uctuations in actual experience.

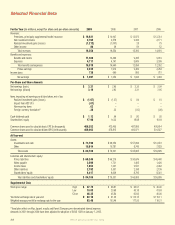

Deferred Policy Acquisition Cost Ratios

Aflac Japan Aflac U.S.

(In millions) 2009 2008 2007 2009 2008 2007

Deferred policy acquisition costs $ 5,846 $ 5,644 $ 4,269 $ 2,687 $ 2,593 $ 2,385

Annualized premiums in force 13,034 12,761 9,860 4,956 4,789 4,510

Deferred policy acquisition costs

as a percentage of annualized

premiums in force 44.9% 44.2% 43.3% 54.2% 54.1% 52.9%

Policy Liabilities

(In millions)

2009

2008

U.S. segment:

Future policy benefits $ 5,779 $ 5,442

Unpaid policy claims 1,023 933

Other policy liabilities 385 375

Total U.S. policy liabilities $ 7,187 $ 6,750

Japan segment:

Future policy benefits $ 55,720 $ 53,866

Unpaid policy claims 2,246 2,184

Other policy liabilities 4,089 3,416

Total Japan policy liabilities $ 62,055 $ 59,466

Consolidated:

Future policy benefits $ 61,501 $ 59,310

Unpaid policy claims 3,270 3,118

Other policy liabilities 4,474 3,791

Total consolidated policy liabilities $ 69,245 $ 66,219

We’ve got you under our wing.

26