Aflac 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aflac Annual Report for 2009 81

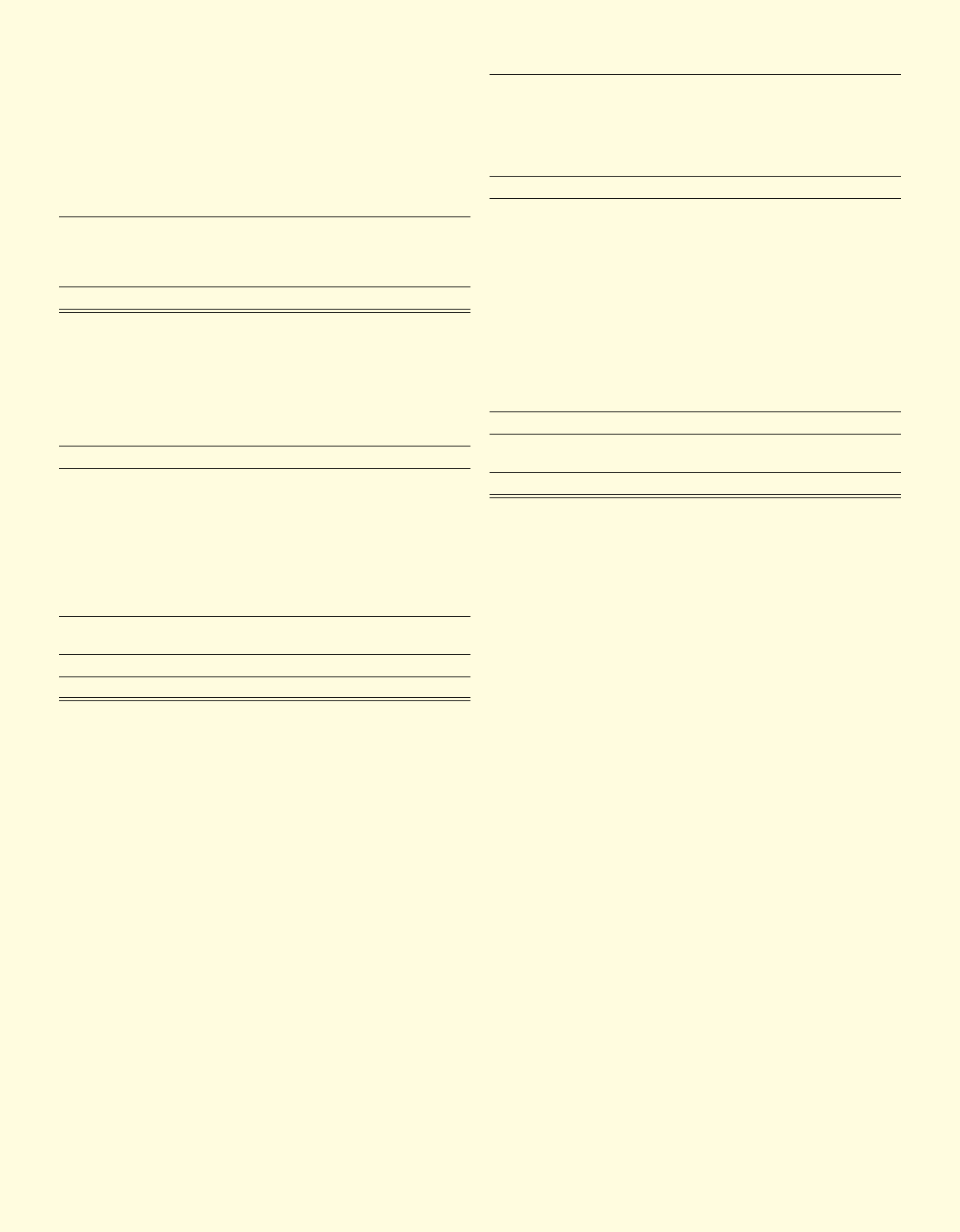

Income tax expense in the accompanying statements of

earnings varies from the amount computed by applying

the expected U.S. tax rate of 35% to pretax earnings. The

principal reasons for the differences and the related tax

effects for the years ended December 31 were as follows:

(In millions) 2009 2008 2007

Income taxes based on U.S. statutory rates $ 782 $ 670 $ 875

Utilization of foreign tax credit (29) (27) (23)

Nondeductible expenses 11 11 11

Other, net (26) 6 2

Income tax expense $ 738 $ 660 $ 865

Total income tax expense for the years ended December 31

was allocated as follows:

(In millions) 2009 2008 2007

Statements of earnings $ 738 $ 660 $ 865

Other comprehensive income:

Change in unrealized foreign currency

translation gains (losses) during period 39 (457) (82)

Unrealized gains (losses) on investment securities:

Unrealized holding gains (losses) on investment

securities during period 728 (716) (291)

Reclassification adjustment for realized (gains) losses

on investment securities included in net earnings (424) (353) (10)

Pension liability adjustment during period 8 (29) 5

Total income tax expense ( benefit) allocated

to other comprehensive income 351 (1,555) (378)

Additional paid-in capital (exercise of stock options) (3) (16) (51)

Total income taxes $ 1,086 $ (911) $ 436

Changes in unrealized foreign currency translation gains/

losses included a deferred income tax expense of $14

million in 2009, compared with a deferred income tax

benet of $329 million in 2008 and $55 million in 2007.

The income tax effects of the temporary differences that

gave rise to deferred income tax assets and liabilities as

of December 31 appear in the table at the top of the next

column:

(In millions) 2009 2008

Deferred income tax liabilities:

Deferred policy acquisition costs $ 2,422 $ 2,356

Difference in tax basis of investment in Aflac Japan 369 –

Other basis differences in investment securities – 112

Premiums receivable 149 155

Policy benefit reserves 751 735

Total deferred income tax liabilities 3,691 3,358

Deferred income tax assets:

Depreciation 109 128

Policyholder protection corporation obligation 27 48

Difference in tax basis of investment in Aflac Japan – 172

Other basis differences in investment securities 426 –

Unfunded retirement benefits 44 44

Other accrued expenses 64 65

Unrealized losses on investment securities 700 1,189

Policy and contract claims 83 106

Unrealized exchange loss on yen-denominated notes payable 124 184

Deferred compensation 118 131

Capital loss carryforwards 188 76

Other 505 229

Total deferred income tax assets 2,388 2,372

Net deferred income tax liability 1,303 986

Current income tax liability 350 215

Total income tax liability $ 1,653 $ 1,201

A valuation allowance is provided when it is more likely

than not that deferred tax assets will not be realized. In

prior years, we established valuation allowances primarily

for alternative minimum tax credit and non-life operating

loss carryforwards that exceeded projected future offsets.

As of December 31, 2009, no valuation allowances were

required. Under U.S. income tax rules, only 35% of non-life

operating losses can be offset against life insurance taxable

income each year. For current U.S. income tax purposes,

there were non-life operating loss carryforwards of $17

million expiring in 2029 and no tax credit carryforwards

available at December 31, 2009. The Company has capital

loss carryforwards of $537 million available to offset capital

gains, of which $7 million expires in 2011, $213 million

expires in 2013 and $317 million expires in 2014.

We le federal income tax returns in the United States and

Japan as well as state or prefecture income tax returns

in various jurisdictions in the two countries. U.S. federal

and state income tax returns for years before 2006 are no

longer subject to examination. During the year, we settled

an examination by the IRS in the U.S. for tax years 2006

and 2007. In Japan, the National Tax Agency (NTA) has

completed exams through tax year 2007.

A reconciliation of the beginning and ending amount of

unrecognized tax benets for the years ended December 31

appear in the table at the top of the next page.