Aflac 2009 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

their activities beyond the underlying collateral and CDS

contracts.

We currently own only senior CDO tranches within these

VIEs. At inception of our investment in these VIEs, we

identify the variable interests created by the VIE and, using

statistical analysis techniques, evaluate our participation in

the variable interests created by them.

Consistent with other debt and perpetual securities we own,

we are exposed to credit losses within these CDOs that

could result in principal losses to our investments. We have

mitigated our risk of credit loss through the structure of the

VIE, which contractually requires the subordinated tranches

within these VIEs to absorb the majority of the expected

losses from the underlying credit default swaps. Based

on our statistical models, each of the VIEs can sustain a

reasonable number of defaults in the underlying CDS pools

with no loss to our CDO investments.

While we may own a signicant portion of the securities

issued by these VIEs, we have determined that we do not

participate in the majority of the variable interests created

by the VIE. We also conrm with the arranging investment

banks that the variable interests in which we do not retain an

interest are issued to third parties unrelated to the arranging

investment bank. Because we participate in less than 50%

of the variable interests created by these VIEs, we are not

the primary beneciary and are therefore not required to

consolidate these VIEs.

Included in the CDOs described above are variable interest

rate CDOs purchased with the proceeds from $200 million

of variable interest rate funding agreements issued to third

party investors during the second quarter of 2008. We

earn a spread between the coupon received on the CDOs

and the interest credited on the funding agreements. Our

obligation under these funding agreements is included in

other policyholder funds.

The remaining VIEs that we are not required to consolidate

are investments that are limited to loans in the form of

debt obligations from the VIEs that are irrevocably and

unconditionally guaranteed by their corporate parents.

These VIEs are the primary nancing vehicles used by their

corporate sponsors to raise nancing in the international

capital markets. The variable interests created by these

VIEs are principally or solely a result of the debt instruments

issued by them. We invest in less than 50% of the security

interests issued by these VIEs and therefore participate in

less than 50% of the variable interests created by them. As

such, we are not the primary beneciary of these VIEs and

are therefore not required to consolidate them.

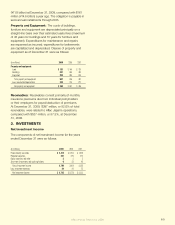

The categories, ratings and weighted-average lives of the

assets held by the non-consolidated VIEs that we own as of

December 31, 2009, are reected in the table below.

CDO Weighted-

Amortized Cost Average Moody’s S&P Fitch

Category (In millions) Life Rating Rating Rating

Floating Rate Credit Card ABS $ 364 4.62 Aaa AAA AAA

Floating Rate Guaranteed

Investment Contracts (GIC) 5 7.50 Aa3 AAA AA

Floating Rate Note (Rabobank) 20 7.00 Aaa AAA AA+

Japan National Government 109 8.75 Aa2 AA AA-

Total $ 498

See Note 1 for a discussion of our evaluation of our VIEs

for consolidation under the provisions of the amended

FASB guidance on accounting for VIEs, effective for us on

January 1, 2010. We do not anticipate any impact on debt

covenants, capital ratios, credit ratings or dividends as a

result of consolidating any of the VIEs we own. In the event

that we incur losses on the debt securities issued by these

VIEs, the impact on debt covenants, capital ratios, credit

ratings or dividends would be no different than the impact

from losses on any of the other debt securities we own.

Securities Lending and Pledged Securities

We lend xed-maturity securities to nancial institutions in

short-term security-lending transactions. These short-term

security-lending arrangements increase investment income

with minimal risk. Our security-lending policy requires that

the fair value of the securities and/or cash received as

collateral be 102% or more of the fair value of the loaned

securities. The following table presents our security loans

outstanding and the corresponding collateral held as of

December 31:

(In millions) 2009 2008

Security loans outstanding, fair value $ 467 $ 1,679

Cash collateral on loaned securities 483 1,733

All security-lending agreements are callable by us at any

time.

At December 31, 2009, debt securities with a fair value of

$14 million were on deposit with regulatory authorities in

the United States and Japan. We retain ownership of all

securities on deposit and receive the related investment

income.

For general information regarding our investment accounting

policies, see Note 1.

Aflac Annual Report for 2009 73