Aflac 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aflac Japan Sales

Our stated objective for 2009 was for sales to be at to

up 5%. We exceeded our objective with a 6.7% increase

in sales during 2009. The following table presents Aac

Japan’s total new annualized premium sales for the years

ended December 31.

The following table details the contributions to total new

annualized premium sales by major insurance product for

the years ended December 31.

Medical insurance sales increased 15.7% over 2008. Since

rst launching our stand-alone medical product, EVER,

in 2002, we have been the number one seller of medical

insurance policies in Japan. In the past six years, we have

segmented the market by creating a suite of EVER products

with variations that appeal to specic Japanese consumers.

In August 2009, we introduced a new generation of our

popular EVER product, the most notable changes being

an enhanced surgical benet and gender-specic premium

rates. Overall, the protability of the new plan is similar to

our original EVER product. We have had a positive initial

response to our revised EVER product, selling more than

346,800 of the revised policies since it was introduced. With

continued cost pressure on Japan’s health care system, we

expect the need for medical products will continue to rise in

the future, and we remain encouraged about the outlook for

the medical insurance market.

Cancer insurance sales declined 11.3% in 2009, compared

with 2008. Despite this decrease, Aac remained the

number one seller of cancer insurance policies in Japan.

Our cancer policies are also marketed through a strategic

alliance with Dai-ichi Mutual Life. In 2009, Dai-ichi Life sold

more than 122,000 of our market-leading cancer policies.

We are convinced that the affordable cancer products Aac

Japan provides will continue to be an important part of our

product portfolio.

Sales of cancer and medical insurance in Japan have

beneted from the bank channel. In December 2007,

banks were permitted to sell supplemental health insurance

products to their customers. Our bank channel sales

increased 132.2% during 2009, compared with 2008, and

represented 6% of total new sales. By the end of 2009,

we had agreements with 353 banks to sell our products.

We have signicantly more selling agreements with banks

than any of our competitors in Japan. We believe our long-

standing and strong relationships within the Japanese

banking sector, along with our strategic preparations, have

proven to be an advantage as this channel opened up for

our products.

Ordinary life product sales increased 33.9% during 2009,

compared with 2008. The increase in our ordinary life

products was driven by a favorable consumer response

to our child endowment product that we introduced at the

end of rst quarter 2009. Our child endowment product

is appropriate for new parents who are re-evaluating their

insurance coverage. This product offers a death benet until

the child reaches age 18, and it pays a lump-sum benet

at the time of the child’s entry into high school as well as

an educational annuity for each of the four years during

his or her college education. We believe that traditional

life insurance products, like our child endowment plan,

provide opportunities for us to sell our third sector cancer

and medical products. For every 10 child endowment plans

that were purchased in 2009, we sold two additional Aac

products to the same customers.

We remain committed to selling through our traditional

channels, which allows us to reach consumers through

afliated corporate agencies, independent corporate

agencies and individual agencies. In 2009, we recruited

approximately 4,600 new sales agencies, an increase of

17.9% over 2008. At the end of the year, Aac Japan was

represented by more than 19,600 sales agencies, or more

than 110,500 licensed sales associates employed by those

agencies.

We believe that there is still a strong need for our products

in Japan. Our objective for 2010 is for total new annualized

premium sales to be at to up 5% in Japan.

Aflac Japan Investments

Growth of investment income in yen is affected by available

cash ow from operations, the timing of investing the cash

ow, yields on new investments, and the effect of yen/dollar

exchange rates on dollar-denominated investment income.

Aac Japan has invested in privately issued securities to

secure higher yields than those available on Japanese

government or other public corporate bonds, while still

adhering to prudent standards for credit quality. All of our

privately issued securities are rated investment grade at

the time of purchase. These securities are generally issued

with documentation consistent with standard medium-term

note programs. In addition, many of these investments have

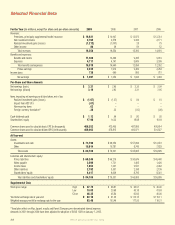

In Dollars In Yen

(In millions of dollars

and billions of yen) 2009 2008 2007 2009 2008 2007

Total new annualized

premium sales $1,310 $1,115 $974 ¥122.3 ¥114.7 ¥114.6

Increase (decrease)

over prior year 17.5% 14.4% (3.5)% 6.7% – % (2.4)%

2009 2008 2007

Medical 36% 34% 33%

Cancer 28 34 33

Ordinary life 29 23 22

Rider MAX 3 5 7

Other 4 4 5

Total 100% 100% 100%

We’ve got you under our wing.

32