Aflac 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

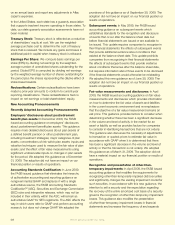

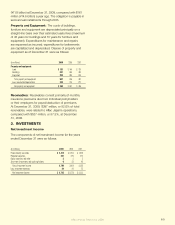

amortization of premium, and recognition of impairment

charges, if any. The amortized cost of debt and perpetual

securities we purchase at a discount or premium will

equal the face or par value at maturity or the call date, if

applicable. Interest is reported as income when earned and

is adjusted for amortization of any premium or discount.

Our investments in qualied special purpose entities (QSPEs)

are accounted for as xed-maturity or perpetual securities.

All of our investments in QSPEs are held in our available-for-

sale portfolio. See the New Accounting Pronouncements

section of Note 1 for a discussion of changes to the

accounting for these investments effective January 1, 2010.

For the collateralized mortgage obligations (CMOs) held

in our xed-maturity securities portfolio, we recognize

income using a constant effective yield, which is based

on anticipated prepayments and the estimated economic

life of the securities. When estimates of prepayments

change, the effective yield is recalculated to reect actual

payments to date and anticipated future payments. The

net investment in CMO securities is adjusted to the amount

that would have existed had the new effective yield been

applied at the time of acquisition. This adjustment is

reected in net investment income.

We use the specic identication method to determine the

gain or loss from securities transactions and report the

realized gain or loss in the consolidated statements

of earnings.

Our credit analysts/research personnel routinely monitor and

evaluate the difference between the amortized cost and fair

value of our investments. Additionally, credit analysis and/

or credit rating issues related to specic investments may

trigger more intensive monitoring to determine if a decline

in fair value is other than temporary. For investments with

a fair value below amortized cost, the process includes

evaluating, among other factors, the length of time and

the extent to which amortized cost exceeds fair value, the

nancial condition, operations, credit and liquidity posture,

and future prospects of the issuer as well as our intent

or need to dispose of the security prior to recovery of its

fair value to amortized cost. This process is not exact and

requires consideration of risks such as credit risk, which to a

certain extent can be controlled, and interest rate risk, which

cannot be controlled. Therefore, if an investment’s amortized

cost exceeds its fair value solely due to changes in interest

rates, impairment may not be appropriate.

In periods prior to 2009, if, after monitoring and analyses,

management believed that a decline in fair value was other

than temporary, we adjusted the amortized cost of the

security to fair value and reported a realized loss in the

consolidated statements of earnings. Subsequent to the

adoption of updated accounting guidance on impairments

in 2009, our accounting policy changed. If, after monitoring

and analyses, management believes that fair value will

not recover to amortized cost prior to the disposal of

the security, we recognize an other-than-temporary

impairment of the security. Once a security is considered

to be other-than-temporarily impaired, the impairment

loss is separated into two separate components: the

portion of the impairment related to credit and the portion

of the impairment related to factors other than credit.

We automatically recognize a charge to earnings for the

credit-related portion of other-than-temporary impairments.

Impairments related to factors other than credit are charged

to earnings in the event we intend to sell the security prior to

the recovery of its amortized cost or if it is more likely than

not that we would be required to dispose of the security

prior to recovery of its amortized cost; otherwise, non-credit-

related other-than-temporary impairments are charged to

other comprehensive income.

We lend xed-maturity securities to nancial institutions in

short-term security lending transactions. These securities

continue to be carried as investment assets on our

balance sheet during the terms of the loans and are not

reported as sales. We receive cash or other securities as

collateral for such loans. For loans involving unrestricted

cash collateral, the collateral is reported as an asset with

a corresponding liability for the return of the collateral.

For loans collateralized by securities, the collateral is not

reported as an asset or liability.

Deferred Policy Acquisition Costs: The costs of

acquiring new business are deferred and amortized with

interest over the premium payment periods in proportion

to the ratio of annual premium income to total anticipated

premium income. Anticipated premium income is estimated

by using the same mortality, persistency and interest

assumptions used in computing liabilities for future policy

benets. In this manner, the related acquisition expenses are

matched with revenues. Deferred costs include the excess

of current-year commissions over ultimate renewal-year

commissions and certain direct and allocated policy issue,

underwriting and marketing expenses. All of these costs

vary with and are primarily related to the production of new

business.

For some products, policyholders can elect to modify

product benets, features, rights or coverages by

exchanging a contract for a new contract or by amendment,

endorsement, or rider to a contract, or by the election of a

feature or coverage within a contract. These transactions are

known as internal replacements. For internal replacement

transactions where the resulting contract is substantially

unchanged, the policy is accounted for as a continuation

We’ve got you under our wing.

56