Aflac 2009 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

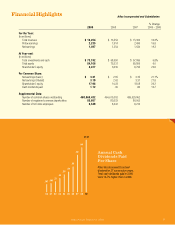

00 01 02 03 04 05 06 07 08 09

Net Earnings Per Diluted Share

Internal Performance Measure

1.26 1.22

1.49 1.47

2.45

2.922.95

3.31

2.62

$3.19

Net Earnings

Per Diluted Share

Net earnings benefited from record operating

results, although realized investment losses

were elevated in 2009. Based on the

internal financial measure we use to assess

management’s performance, which excludes

items that are either outside management’s

control or inherently unpredictable, we

achieved our primary financial target for the

20th consecutive year.

or unpredictable. We view this measure

as the best indicator of both the growth

of our business and management’s

role in generating that growth. We also

believe that achieving our objective on

a consistent basis for 20 consecutive

years has been the principal driver of

shareholder value over the long term.

Net earnings increased 19.3% in 2009

to $1.5 billion. This reected the strong

growth of our insurance operations,

particularly Aac Japan, as well as

a stronger yen/dollar exchange rate.

However, for the second year in a

row, net earnings were impacted by

higher-than-normal realized investment

losses attributable to the nancial crisis.

Realized investment losses were $788

million in 2009, compared with losses

of $655 million in 2008. Net earnings

per diluted share rose to $3.19 in 2009,

or 21.8% higher than net earnings of

$2.62 per share, in 2008.

Investing Prudently in a Sensitive Market

Aac’s greatest investment challenge

has always been in Japan, where our

policies generate long-duration, yen-

denominated liabilities. As a result, we

match those liability characteristics

by purchasing long-duration, yen-

denominated, investment-grade

securities. In addition to unique liability

characteristics, Aac Japan also

generates very strong cash ows.

In 2009 for instance, Aac Japan’s

cash ow to investments was ¥604.1

billion, or $6.5 billion, which equated to

investing more than $26 million every

business day. And with investment

yields remaining at very low levels

in Japan, putting those signicant

cash ows to work in investments at

attractive returns with a reasonable risk

prole is challenging. Yet during 2009,

we were able to invest that cash ow

at yields that were consistent with

our objectives.

Without a doubt, the most prevalent

investment issue we addressed

with investors throughout 2009 was

our ownership of perpetual, or so-

called hybrid, investments, which

have characteristics of both bonds

and equities. The yen-denominated

perpetual securities we purchased from

the early 1990s through 2005 provided

us with the long-duration assets that we

needed to support our policy liabilities.

These securities came under increased

scrutiny last year because of concern

over the nancial strength of banks,

particularly those in Europe and Great

Britain where most of our perpetual

investments originated. When we

purchased these perpetual securities,

we primarily invested in large nancial

institutions that underpin the economies

in which they operate. We believed that

in a time of severe nancial stress, the

governments in those countries would

take signicant measures to ensure that

these large banking institutions would

continue to operate, which would help

provide safety to our investments. We

never anticipated how rigorously that

proposition would be tested. Reecting

investors’ concerns over the health

of the banks, our perpetual holdings

experienced dramatic declines in value

early in the year. However, governments

around the world have taken action

to stabilize the banking system. As

a result, the prices of our perpetual

holdings steadily recovered in value

during 2009, and we still believe they

are effectively meeting our investment

needs.

Aflac Annual Report for 2009 3