Aflac 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

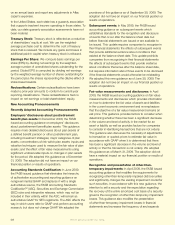

already required disclosures about other-than-temporary

impairment for debt and equity securities. We adopted

this guidance as of March 31, 2009. The adoption did not

have a material impact on our nancial position or results of

operations.

In January 2009, the FASB issued accounting guidance

on impairments. This guidance applies to all entities with

certain benecial interests in securitized nancial assets. It

amends the impairment model on benecial interests held

by a transferor in securitized nancial assets, to be similar

to the impairment model of debt and equity securities.

In determining other-than-temporary impairments on the

aforementioned interests, this guidance permits the use

of reasonable management judgment on the probability

that the holder will be unable to collect all amounts due,

in addition to the former policy of reliance on market

participant assumptions about future cash ows. We

adopted this guidance as of December 31, 2008. The

adoption did not have a material impact on our nancial

position or results of operations.

Disclosures about derivative instruments and

hedging activities: In March 2008, the FASB issued

accounting guidance on derivatives and hedging. This

guidance establishes, among other things, the disclosure

requirements for derivative instruments and for hedging

activities. It expands disclosure requirements with the intent

to provide users of nancial statements with an enhanced

understanding of how and why an entity uses derivative

instruments, how derivative instruments and related hedged

items are accounted for in accordance with GAAP, and how

derivative instruments and related hedged items affect an

entity’s nancial position, nancial performance, and cash

ows. To meet those objectives, this new guidance requires

qualitative disclosures about objectives and strategies for

using derivatives, quantitative disclosures about fair value

amounts of and gains and losses on derivative instruments,

and disclosures about credit-risk-related contingent features

in derivative agreements. We adopted this new guidance as

of January 1, 2009. The adoption did not have an effect on

our nancial position or results of operations.

Disclosures about transfers of nancial assets and

interests in variable interest entities: In December

2008, the FASB issued accounting guidance on transfers

of nancial assets and interests in variable interest entities.

This guidance pertains to disclosures only, improving

the transparency of transfers of nancial assets and an

enterprise’s involvement with VIEs, including QSPEs. The

additional required disclosures related to asset transfers

primarily focus on the transferor’s continuing involvement

with transferred nancial assets and the related risks

retained. This guidance also requires additional disclosures

that focus on a company’s involvement with VIEs and its

judgments about the accounting for them. In addition,

it requires certain nontransferor public enterprises to

disclose details about QSPEs with which they are involved.

We adopted the provisions of this new guidance as of

December 31, 2008. The adoption did not have an impact

on our nancial position or results of operations.

Accounting for deferred acquisition costs: In

September 2005, the Accounting Standards Executive

Committee of the American Institute of Certied Public

Accountants (AICPA) issued accounting guidance on

deferred acquisition costs in connection with modications

or exchanges of insurance contracts. It provides accounting

guidance on internal replacements of insurance and

investment contracts other than those specically described

in the accounting guidance issued by the FASB regarding

accounting and reporting by insurance enterprises for

certain long-duration contracts and for realized gains

and losses from the sale of investments. We adopted the

provisions of this guidance effective January 1, 2007. We

have determined that certain of our policy modications

in both the United States and Japan that were previously

accounted for as a continuation of existing coverage will

be considered internal replacements that are substantially

changed as contemplated by this new guidance and will be

accounted for as the extinguishment of the affected policies

and the issuance of new contracts. The adoption of this

guidance increased net earnings in 2007 by $6 million, or

$.01 per diluted share, and was insignicant to our nancial

position and results of operations.

Accounting Pronouncements Pending Adoption

Fair value measurements and disclosures: In January

2010, the FASB issued amended accounting guidance

on fair value disclosures. This guidance requires new

disclosures about transfers in and out of fair value hierarchy

Levels 1 and 2. This portion of the guidance is effective

for interim and annual periods beginning after December

15, 2009. This guidance also requires the activity in Level

3 for purchases, sales, issuances, and settlements to be

reported on a gross, rather than net, basis. This portion

of the guidance is effective for interim and annual periods

beginning after December 15, 2010. We do not expect the

adoption of this standard to have any impact on our nancial

position or results of operations.

Accounting for variable interest entities and

transfers of nancial assets: In June 2009, the FASB

issued amended guidance on accounting for VIEs and

transfers of nancial assets. This guidance denes new

criteria for determining the primary beneciary of a VIE;

increases the frequency of required reassessments to

determine whether a company is the primary beneciary

Aflac Annual Report for 2009 59