Aflac 2009 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Samurai and Uridashi notes. ASC 815, “Derivatives and

Hedging,” requires that the change in the fair value of the

interest rate component of the cross-currency swaps,

which does not qualify for hedge accounting, be reected

in net earnings. This change in fair value was determined by

relative dollar and yen interest rates and had no cash impact

on our results of operations. At maturity, the fair value

equaled initial contract fair value, and the cumulative impact

of gains and losses from the changes in fair value of the

interest component was zero. We demonstrated the ability

and intent to retain the cross-currency swaps until they

expired in April 2009. The impact from ASC 815 includes

the change in fair value of the interest rate component of

the cross-currency swaps, which did not qualify for hedge

accounting, and is included in other income.

We have issued yen-denominated Samurai and Uridashi

notes and have entered into two yen-denominated loans.

We have designated these notes and loans as a hedge of

our investment in Aac Japan. If the value of these yen-

denominated notes exceeds our investment in Aac Japan,

we would be required to recognize the foreign currency

effect on the excess in net earnings (other income). The

foreign currency gain or loss on the excess liabilities

would be included in the impact from ASC 815. When

we made our hedge designations at the beginning of the

second quarter of 2009, the notional amount of our yen-

denominated liabilities exceeded our yen net asset position

in Aac Japan. Therefore, we de-designated this excess

portion of our yen-denominated liabilities from our net

investment hedge. An immaterial loss was recorded in net

earnings (other income) and included in the impact from

ASC 815 during the quarter ended June 30, 2009, as a

result of the negative foreign currency effect on the portion

of our yen-denominated liabilities that was not designated

as a hedge of our investment in Aac Japan. When we

reassessed our hedge designations at the beginning of

the third and fourth quarters of 2009, our yen net asset

position in Aac Japan exceeded our total yen-denominated

liabilities; therefore, all of these liabilities were designated as

a hedge of our net investment in Aac Japan, resulting in no

impact on net earnings during the third and fourth quarters

of 2009. Our net investment hedge was effective during the

years ended December 31, 2008, and 2007; therefore, there

was no impact on net earnings during those periods.

We have interest rate swap agreements related to the

¥20 billion variable interest rate Uridashi notes and have

designated the swap agreements as a hedge of the

variability of the debt cash ows. The notional amounts

and terms of the swaps match the principal amount and

terms of the variable interest rate Uridashi notes, and the

swaps had no value at inception. GAAP requires that the

change in the fair value of the swap contracts be recorded

in other comprehensive income so long as the hedge is

deemed effective. Any ineffectiveness would be recognized

in net earnings (other income) and would be included in the

impact from ASC 815. These hedges were effective during

the three-year period ended December 31, 2009; therefore,

there was no impact on net earnings. See Notes 1, 4 and

7 of the Notes to the Consolidated Financial Statements for

additional information.

Debt Extinguishment

During the rst six months of 2009, we extinguished

portions of our yen-denominated Uridashi and Samurai

debt by buying the notes on the open market. We realized

a total gain from extinguishment of debt of ¥1.6 billion, or

$17 million ($11 million after-tax), which we included in other

income. We did not extinguish any debt during the second

half of 2009.

Foreign Currency Translation

Aac Japan’s premiums and most of its investment income

are received in yen. Claims and expenses are paid in yen,

and we primarily purchase yen-denominated assets to

support yen-denominated policy liabilities. These and other

yen-denominated nancial statement items are translated

into dollars for nancial reporting purposes. We translate

Aac Japan’s yen-denominated income statement into

dollars using an average exchange rate for the reporting

period, and we translate its yen-denominated balance sheet

using the exchange rate at the end of the period. However,

it is important to distinguish between translating and

converting foreign currency. Except for a limited number of

transactions, we do not actually convert yen into dollars.

Due to the size of Aac Japan, where our functional

currency is the Japanese yen, uctuations in the yen/dollar

exchange rate can have a signicant effect on our reported

results. In periods when the yen weakens, translating yen

into dollars results in fewer dollars being reported. When

the yen strengthens, translating yen into dollars results in

more dollars being reported. Consequently, yen weakening

has the effect of suppressing current year results in relation

to the prior year, while yen strengthening has the effect

of magnifying current year results in relation to the prior

year. As a result, we view foreign currency translation as

a nancial reporting issue for Aac and not an economic

event to our Company or shareholders. Because changes

in exchange rates distort the growth rates of our operations,

management evaluates Aac’s nancial performance

excluding the impact of foreign currency translation.

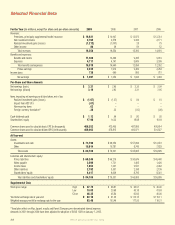

Income Taxes

Our combined U.S. and Japanese effective income tax rate

on pretax earnings was 33.0% in 2009, 34.5% in 2008 and

34.6% in 2007. The effective tax rate declined in 2009 due

Aflac Annual Report for 2009 29