Aflac 2009 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For additional information concerning our investments in

QSPEs and VIEs, see Note 3.

SEC Guidance

On October 14, 2008, the SEC issued a letter to the

FASB addressing questions raised by various interested

parties regarding declines in the fair value of perpetual

preferred securities, or so-called “hybrid securities,” and the

assessment of those declines under existing accounting

guidelines for other-than-temporary impairments. In its

letter, the SEC recognized that hybrid securities are often

structured in equity form but generally possess signicant

debt-like characteristics. The SEC also recognized that

existing accounting guidance does not specically address

the impact, if any, of the debt-like characteristics of these

hybrid securities on the assessment of other-than-temporary

impairments.

After consultation with and concurrence of the FASB staff,

the SEC concluded that it will not object to the use of an

other-than-temporary impairment model that considers

the debt-like characteristics of hybrid securities (including

the anticipated recovery period), provided there has been

no evidence of a deterioration in credit of the issuer (for

example, a decline in the cash ows from holding the

investment or a downgrade of the rating of the security

below investment grade), in lings after the date of its letter

until the matter can be addressed further by the FASB.

We maintain investments in subordinated nancial

instruments, or hybrid securities. Within this class of

investments, we own perpetual securities. These perpetual

securities are subordinated to other debt obligations of the

issuer, but rank higher than the issuers’ equity securities.

Perpetual securities have characteristics of both debt and

equity investments, along with unique features that create

economic maturity dates for the securities. Although

perpetual securities have no contractual maturity date,

they have stated interest coupons that were xed at their

issuance and subsequently change to a oating short-

term rate of interest of 125 to more than 300 basis points

above an appropriate market index, generally by the 25th

year after issuance. We believe this interest step-up penalty

has the effect of creating an economic maturity date for

our perpetual securities. We accounted for and reported

perpetual securities as debt securities and classied them

as both available-for-sale and held-to-maturity securities until

the third quarter of 2008.

We concluded in the third quarter of 2008 that all of our

investments in perpetual securities should be classied as

available-for-sale securities. We also concluded that our

perpetual securities should be evaluated for other-than-

temporary impairments using an equity security impairment

model for periods prior to June 30, 2008, as opposed to

our previous policy of using a debt security impairment

model. We recognized realized investment losses of $294

million ($191 million after-tax) in the third quarter of 2008

as a result of applying our equity impairment model to this

class of securities through June 30, 2008. Included in the

$191 million other-than-temporary impairment charge is $40

million, $53 million, $50 million, and $38 million, net of tax,

that relate to the years ended December 31, 2007, 2006,

2005 and 2004, respectively; and, $10 million, net of tax,

that relates to the quarter ended June 30, 2008. There were

no impairment charges related to the perpetual securities

in the rst quarter of 2008. The impact of classifying all

of our perpetual securities as available-for-sale securities

and assessing them for other-than-temporary impairments

under our equity impairment model was determined to be

immaterial to our results of operations and nancial position

for any previously reported period. Consistent with the

previously mentioned SEC letter regarding the appropriate

impairment model for hybrid securities, we have applied our

debt security impairment model to our perpetual securities

in periods subsequent to June 30, 2008, with the exception

of certain securities that are rated below investment

grade and are therefore being evaluated under our equity

impairment model. We will continue with this approach

pending further guidance from the SEC or the FASB.

Recent accounting guidance not discussed above is not

applicable or did not have an impact to our business.

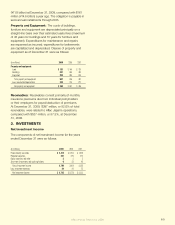

2. BUSINESS SEGMENT AND FOREIGN

INFORMATION

The Company consists of two reportable insurance

business segments: Aac Japan and Aac U.S., both

of which sell supplemental health and life insurance. As

discussed in Note 1, in the fourth quarter of 2009 we

purchased CAIG which includes its wholly owned subsidiary

CAIC. CAIC is included in the Aac U.S. business segment

effective October 1, 2009.

Operating business segments that are not individually

reportable are included in the “Other business segments”

category. We do not allocate corporate overhead expenses

to business segments. We evaluate and manage our

business segments using a nancial performance measure

called pretax operating earnings. Our denition of operating

earnings excludes the following items from net earnings

on an after-tax basis: realized investment gains/losses, the

impact from ASC 815 (formerly referred to as SFAS 133), and

nonrecurring items. We then exclude income taxes related to

operations to arrive at pretax operating earnings. Information

regarding operations by segment for the years ended

December 31 appears in the tables on the following page.

Aflac Annual Report for 2009 61