Aflac 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

(¥11.8 billion) at December 31, 2009, compared with $161

million (¥14.6 billion) a year ago. The obligation is payable in

semi-annual installments through 2013.

Property and Equipment: The costs of buildings,

furniture and equipment are depreciated principally on a

straight-line basis over their estimated useful lives (maximum

of 45 years for buildings and 10 years for furniture and

equipment). Expenditures for maintenance and repairs

are expensed as incurred; expenditures for betterments

are capitalized and depreciated. Classes of property and

equipment as of December 31 were as follows:

(In millions) 2009 2008 2007

Property and equipment:

Land $ 153 $ 146 $ 120

Buildings 501 505 403

Equipment 293 265 244

Total property and equipment 947 916 767

Less accumulated depreciation 354 319 271

Net property and equipment $ 593 $ 597 $ 496

Receivables: Receivables consist primarily of monthly

insurance premiums due from individual policyholders

or their employers for payroll deduction of premiums.

At December 31, 2009, $397 million, or 52.0% of total

receivables, were related to Aac Japan’s operations,

compared with $527 million, or 57.3%, at December

31, 2008.

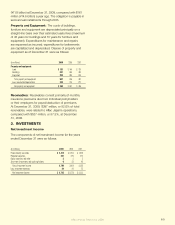

3. INVESTMENTS

Net Investment Income

The components of net investment income for the years

ended December 31 were as follows:

(In millions) 2009 2008 2007

Fixed-maturity securities $ 2,413 $ 2,204 $ 1,936

Perpetual securities 367 375 372

Equity securities and other 3 3 2

Short-term investments and cash equivalents 6 22 45

Gross investment income 2,789 2,604 2,355

Less investment expenses 24 26 22

Net investment income $ 2,765 $ 2,578 $ 2,333

Aflac Annual Report for 2009 63