Aflac 2009 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Company of Columbus (Aac), which operates in the United

States (Aac U.S.) and as a branch in Japan (Aac Japan).

Additionally, Aac U.S. markets and administers group

products through Continental American Insurance Company

(CAIC). Most of Aac’s policies are individually underwritten

and marketed through independent agents. Our insurance

operations in the United States and our branch in Japan

service the two markets for our insurance business.

During the fourth quarter of 2009, the Parent Company

closed its $100 million purchase of Continental American

Insurance Group, Inc. (CAIG), which includes its wholly

owned subsidiary CAIC. Subsequent to the closing, CAIG

merged into Continental American Group, LLC, a limited

liability company wholly owned by CAIC. As a result of

the merger, CAIC became directly wholly owned by the

Parent Company. CAIC is headquartered in Columbia,

South Carolina, and equips Aac U.S. with a platform for

offering attractive voluntary group insurance products that

are well-suited for distribution by insurance brokers at the

worksite. The purchase business combination resulted in

the recognition of $97 million of net assets at fair value. An

immaterial amount of intangible assets, including goodwill,

was recognized as part of the business combination.

2009 PERFORMANCE HIGHLIGHTS

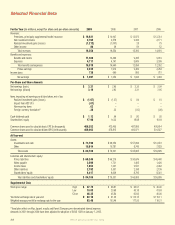

Results for 2009 beneted from the stronger yen. Total

revenues rose 10.3% to $18.3 billion, compared with $16.6

billion a year ago. Net earnings were $1.5 billion, or $3.19

per diluted share, compared with $1.3 billion, or $2.62 per

share, in 2008.

We experienced net realized investment losses of $1.2

billion in 2009, which included the recognition of other-than-

temporary impairments of $1.4 billion. During 2009, we had

a $1.0 billion decrease in gross unrealized losses on our

available-for-sale debt and perpetual securities due to the

recognition of impairment losses and improved fair values

for many categories of investment securities.

In 2009, we borrowed a total of $1.4 billion, consisting

of $1.3 billion in dollar-denominated senior notes raised

through U.S. public debt offerings and loans totaling ¥15

billion. We used $450 million of this capital to redeem

our senior notes that were due in 2009, and we plan to

use some of this capital to redeem our yen-denominated

Samurai notes due July 2010, a liability of $428 million using

the December 31, 2009 exchange rate. We have suspended

stock repurchase activity in the open market. The raising

of capital and suspension of stock repurchase activity have

had a favorable impact on our capital position.

CRITICAL ACCOUNTING ESTIMATES

We prepare our nancial statements in accordance with

U.S. generally accepted accounting principles (GAAP).

These principles are established primarily by the Financial

Accounting Standards Board (FASB). References to

GAAP issued by the FASB in this MD&A are to the FASB

Accounting Standards CodicationTM (ASC). The preparation

of nancial statements in conformity with GAAP requires us

to make estimates based on currently available information

when recording transactions resulting from business

operations. The estimates that we deem to be most critical

to an understanding of Aac’s results of operations and

nancial condition are those related to the valuation of

investments, deferred policy acquisition costs, liabilities for

future policy benets and unpaid policy claims, and income

taxes. The preparation and evaluation of these critical

accounting estimates involve the use of various assumptions

developed from management’s analyses and judgments.

The application of these critical accounting estimates

determines the values at which 94% of our assets and 88%

of our liabilities are reported as of December 31, 2009, and

thus has a direct effect on net earnings and shareholders’

equity. Subsequent experience or use of other assumptions

could produce signicantly different results.

Investments

Aac’s investments in debt, perpetual and equity securities

include both publicly issued and privately issued securities.

For privately issued securities, we receive pricing data from

external sources that take into account each security’s

credit quality and liquidity characteristics. We also routinely

review our investments that have experienced declines in

fair value to determine if the decline is other than temporary.

These reviews are performed with consideration of the

facts and circumstances of an issuer in accordance with

applicable accounting guidance. The identication of

distressed investments, the determination of fair value if not

publicly traded, and the assessment of whether a decline

is other than temporary involve signicant management

judgment and require evaluation of factors, including but not

limited to:

• issuer nancial condition, including protability and cash

ows

• credit status of the issuer

• the issuer’s specic and general competitive environment

• published reports

• general economic environment

• regulatory, legislative and political environment

• the severity of the decline in fair value

• the length of time the fair value is below cost

• our intent, need, or both to sell the security prior to

its anticipated recovery in value

• other factors as may become available from time

to time

Aflac Annual Report for 2009 25