Aflac 2009 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

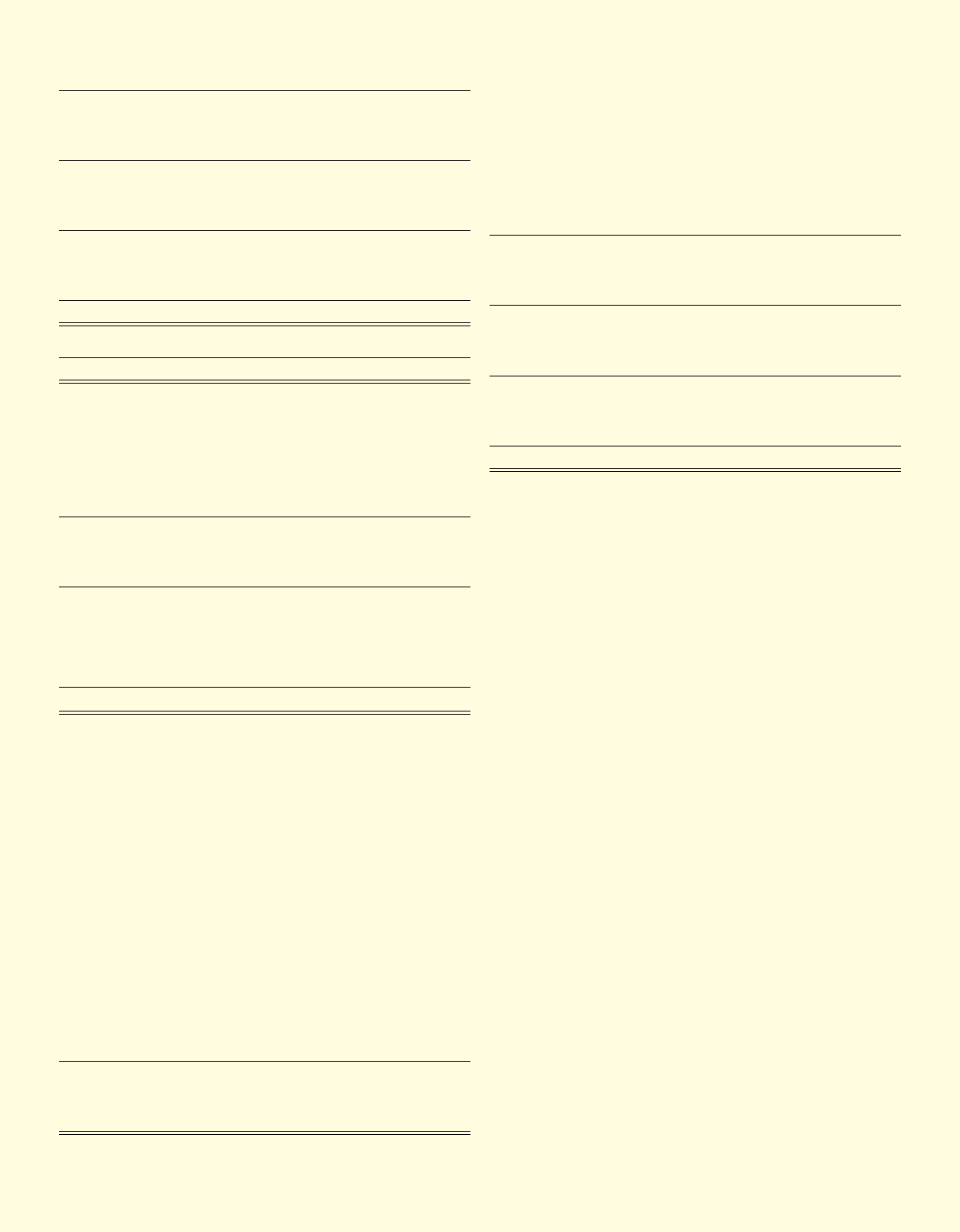

Stock Option Weighted-Average

(In thousands of shares) Shares Exercise Price Per Share

Outstanding at December 31, 2006 20,106 $ 30.48

Granted in 2007 1,244 49.35

Canceled in 2007 (133) 43.64

Exercised in 2007 (4,640) 20.94

Outstanding at December 31, 2007 16,577 34.46

Granted in 2008 1,703 59.78

Canceled in 2008 (146) 44.69

Exercised in 2008 (1,798) 25.91

Outstanding at December 31, 2008 16,336 37.95

Granted in 2009 2,220 26.74

Canceled in 2009 (161) 35.62

Exercised in 2009 (1,978) 26.13

Outstanding at December 31, 2009 16,417 $ 37.89

(In thousands of shares) 2009 2008 2007

Shares exercisable, end of year 12,523 12,382 12,653

The following table summarizes information about stock

options outstanding and exercisable at December 31, 2009.

(In thousands of shares) Options Outstanding Options Exercisable

Stock Wgtd.-Avg. Weighted- Stock Weighted-

Range of Option Remaining Average Option Average

Exercise Prices Shares Contractual Exercise Shares Exercise

Per Share Outstanding Life (Yrs.) Price Per Share Exercisable Price Per Share

$ 14.99 – $ 23.23 3,238 4.8 $ 22.59 1,626 $ 23.10

23.65 – 31.71 3,376 2.7 29.62 3,371 29.62

31.73 – 40.43 3,745 5.1 39.32 3,289 39.28

40.61 – 47.25 3,224 6.4 44.69 3,027 44.73

47.33 – 62.18 2,749 7.8 55.27 1,205 53.54

62.41 – 67.67 85 8.3 65.76 5 67.45

$ 14.99 – $ 67.67 16,417 5.3 $ 37.89 12,523 $ 37.28

The aggregate intrinsic value represents the difference

between the company’s closing stock price of $46.25 as

of December 31, 2009, and the exercise price multiplied

by the number of options outstanding or exercisable as of

that date. As of December 31, 2009, the aggregate intrinsic

value of stock options outstanding was $165 million, with

a weighted-average remaining term of 5.3 years. The

aggregate intrinsic value of stock options exercisable at

that same date was $122 million, with a weighted-average

remaining term of 4.2 years.

The following table summarizes stock option activity during

the years ended December 31.

(In millions) 2009 2008 2007

Total intrinsic value of options exercised $ 34 $ 59 $ 154

Cash received from options exercised 22 38 52

Tax benefit realized as a result of options exercised

and restricted stock releases 15 23 51

The value of restricted stock awards is based on the fair

market value of our common stock at the date of grant. The

following table summarizes restricted stock activity during

the years ended December 31.

Weighted-Average

Grant-Date Fair

(In thousands of shares) Shares Value Per Share

Restricted stock at December 31, 2006 613 $ 43.84

Granted in 2007 391 48.43

Canceled in 2007 (21) 45.88

Vested in 2007 (9) 42.06

Restricted stock at December 31, 2007 974 45.65

Granted in 2008 302 61.00

Canceled in 2008 (17) 52.86

Vested in 2008 (262) 39.95

Restricted stock at December 31, 2008 997 51.68

Granted in 2009 579 23.79

Canceled in 2009 (15) 39.97

Vested in 2009 (342) 47.30

Restricted stock at December 31, 2009 1,219 $ 39.81

As of December 31, 2009, total compensation cost not yet

recognized in our nancial statements related to restricted

stock awards was $18 million, of which $8 million (588

thousand shares) was related to restricted stock awards

with a performance-based vesting condition. We expect to

recognize these amounts over a weighted-average period

of approximately 1.3 years. There are no other contractual

terms covering restricted stock awards once vested.

11. STATUTORY ACCOUNTING AND

DIVIDEND RESTRICTIONS

Our insurance subsidiary is required to report its results

of operations and nancial position to state insurance

regulatory authorities on the basis of statutory accounting

practices prescribed or permitted by such authorities.

Aac’s statutory nancial statements are prepared on the

basis of accounting practices prescribed or permitted by

the Nebraska Department of Insurance (NEDOI). The NEDOI

recognizes statutory accounting principles and practices

prescribed or permitted by the state of Nebraska for

determining and reporting the nancial condition and results

of operations of an insurance company, and for determining

a company’s solvency under Nebraska insurance law. The

National Association of Insurance Commissioners’ (NAIC)

Accounting Practices and Procedures Manual, (SAP) has

been adopted by the state of Nebraska as a component of

those prescribed or permitted practices. Additionally, the

Director of the NEDOI has the right to permit other specic

practices which deviate from prescribed practices. Aac

has been given explicit permission by the Director of the

We’ve got you under our wing.

84