Aflac 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2009 ANNUAL REPORT

Under Our Wing

We’ve Got You

®

Table of contents

-

Page 1

We've Got You Under Our Wing 2009 ANNUAL REPORT ® -

Page 2

... dru t-of cop d emod o c a ment mo ymen We've Got You Under Our Wing When a policyholder gets sick or hurt, Aï¬,ac pays cash beneï¬ts fast. For 55 years, Aï¬,ac insurance policies have given policyholders the opportunity to focus on recovery, not ï¬nancial stress. ent as m y opa s ible uct age... -

Page 3

..., we successfully introduced new products and reached consumers through advertising that created a marketing phenomenon and advanced opportunities for sales through the recently opened bank channel. 8 This section provides an analysis of Aflac's overall financial condition, and reviews the company... -

Page 4

... care Specified health event Fixed-benefit dental Vision Life insurance products, including: Term life Whole life Juvenile life Who Buys It At the worksite: Employees at more than 443,200 payroll accounts, including businesses of all sizes, banks, hospitals, school districts, and city and state... -

Page 5

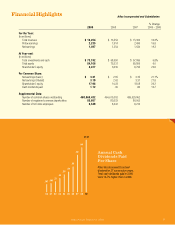

... earnings (basic) Net earnings (diluted) Shareholders' equity Cash dividends paid Supplemental Data: Number of common shares outstanding Number of registered common shareholders Number of full-time employees 2008 Aflac Incorporated and Subsidiaries 2007 % Change 2009 - 2008 $ 18,254 2,235 1,497... -

Page 6

... business. Combined, we generated more than $2.8 billion of new annualized premium in the United States and Japan in 2009. Total revenues rose 10.3% to $18.3 billion, reflecting solid growth in premium income and net investment income, as well as the benefit of the stronger yen/dollar exchange rate... -

Page 7

... of shareholder value over the long term. Net earnings increased 19.3% in 2009 to $1.5 billion. This reflected the strong growth of our insurance operations, particularly Aflac Japan, as well as a stronger yen/dollar exchange rate. However, for the second year in a row, net earnings were impacted by... -

Page 8

... policy and a child endowment policy, which is basically an educational savings plan. Both of these products were very well received by our sales force and customers. At the same time, we achieved greater distribution through new agent recruitment and growth of the recently opened bank channel... -

Page 9

... sales associates to expand our reach in the market. We also enhanced our product portfolio and distribution through a strategic acquisition. After spending a significant amount of time on market research, we acquired Continental American Insurance Company based in Columbia, South Carolina, in 2009... -

Page 10

... covered by some form of national heath care. Actually, it's not that much different in the United States where most of our coverage is sold at the worksite and most employees already have some kind of health insurance. Personally, I would like to see every American covered by major medical health... -

Page 11

...community and being a good corporate citizen makes good business sense. For example, 15 years ago we began sponsoring the Aflac Cancer Center and Blood Disorders Service of Children's Healthcare of Atlanta. Since then, the fight against childhood cancer is something everyone at Aflac has become very... -

Page 12

... premium sales target with a 6.7% increase. Our sales growth in 2009 was a particularly significant accomplishment for Aflac Japan, given a challenged economy and a competitive environment. Aflac Japan retained its distinction as the number one seller of both cancer and medical insurance policies... -

Page 13

... the first year banks could begin offering the types of products Aflac sells to their own customers, so now Yasuyuki and Koji's customers look to them to suggest products that can provide solutions to help mitigate the financial burden of medical costs. A usual day on the job means Yasuyuki and... -

Page 14

...life insurance products, like our child endowment plan, often help secure an opportunity to interact with consumers and cross-sell other Aflac products with living benefits, Not only does Aflac Chairman and CEO Dan Amos believe that "If you take care of the people, they'll take care of the business... -

Page 15

... cancer and medical. In fact, for every 10 child endowment plans purchased in 2009, Aflac agencies sold two additional Aflac products to the same customers. Since first launching our stand-alone medical product, EVER, in 2002, we have been the number one seller of medical insurance policies in Japan... -

Page 16

12 -

Page 17

... set of "tools": a supportive wife and family, excellent medical care and Aflac cancer insurance. The policy provided cash benefits that helped Mr. Hatada and his family focus on his recovery, not financial concerns. Mr. Hatada has long since stopped smoking, and spends time encouraging others to do... -

Page 18

...put our resources into making affordable products. We believe that the Aflac Contact Center plays a critical role in establishing and maintaining strong relationships with our customers, agencies and banks. We believe it is important to operate efficiently while providing high-quality service. When... -

Page 19

... number one position in terms of individual insurance policies in force. • Expand our reach - We will focus on enhancing the productivity of our sales force, while also tapping into new channels to better reach new customers. • Enhance operational efï¬ciency - We will streamline our business... -

Page 20

... and their family. The help and support they received from their large, close-knit family has made a huge difference, including Aflac sales agent Ginny Daisley, who was with them every step of the way. Macy's father said, "The financial benefits of the Aflac insurance policy have helped pay for so... -

Page 21

... policies respond to household budget constraints by providing a basic level of coverage for their respective lines of business. As we look ahead to product offerings in 2010, we will be introducing a revised life insurance portfolio that will allow consumers various customizable life insurance... -

Page 22

... Premium Income (In billions) Benefiting from strong persistency in Japan and a stronger average yen/dollar exchange rate, premium income rose 11.2% in 2009. 00 01 02 03 04 05 06 07 08 09 Japan U.S. The Aflac Cancer Center and Blood Disorders Service of Children's Healthcare of Atlanta provides... -

Page 23

... with Aflac's interest in health and wellness. Aflac Cancer Center: Wings That Nurture and Protect Kids Fighting Cancer Since 1995, the combined Aflac family has given more than $50 million to the Aflac Cancer Center and Blood Disorders Service of Children's Healthcare of Atlanta - a national... -

Page 24

... in the right people and to create positive culture of caring. One way they attract and help retain employees is by offering the option to purchase Aflac policies, which they have done since 2002. Alure has completed seven renovations for ABC's hit show "Extreme Makeover: Home Edition," received... -

Page 25

...to consumer needs and offer customized solutions with innovative and affordable products that provide value with benefits that meet those needs. • Empower and develop odr sales distribdtion system - We will focus on continued growth, training, support, motivation and leadership of our sales force... -

Page 26

... shareholders' equity: Policy liabilities Notes payable Income taxes Other liabilities Shareholders' equity Total liabilities and shareholders' equity Supplemental Data Stock price range: Yen/dollar exchange rate at year-end Weighted-average yen/dollar exchange rate for the year High Low Close 2009... -

Page 27

... 107.83 $ 32,024 5,017 $ 37,041 $ 29,604 1,018 1,511 1,040 3,868 $ 37,041 $ 28.38 19.50 23.60 ¥ 102.40 113.96 Aflac Annual Report for 2009 23 -

Page 28

... cash OUR BUSINESS Aflac Incorporated (the Parent Company) and its subsidiaries (collectively, the Company) primarily sell supplemental health and life insurance in the United States and Japan. The Company's insurance business is marketed and administered through American Family Life Assurance 24... -

Page 29

... of Aflac's policies are individually underwritten and marketed through independent agents. Our insurance operations in the United States and our branch in Japan service the two markets for our insurance business. During the fourth quarter of 2009, the Parent Company closed its $100 million purchase... -

Page 30

... Cost Ratios Aflac Japan (In millions) 2009 2008 2007 2009 Aflac U.S. 2008 2007 Deferred Policy Acquisition Costs and Policy Liabilities Aflac's products are generally long-duration fixedbenefit indemnity contracts. We make estimates of certain factors that affect the profitability of our business... -

Page 31

... unpaid policy claims regularly and incorporate our historical experience as well as other data that provides information regarding our outstanding liability. Our insurance products provide fixed-benefit amounts per occurrence that are not subject to medical-cost inflation. Furthermore, our business... -

Page 32

... of changes in the financial markets and the creditworthiness of specific issuers, tax planning strategies, and/or general portfolio maintenance and rebalancing. The realization of investment gains and losses is independent of the underwriting and administration of our insurance products, which... -

Page 33

... as a financial reporting issue for Aflac and not an economic event to our Company or shareholders. Because changes in exchange rates distort the growth rates of our operations, management evaluates Aflac's financial performance excluding the impact of foreign currency translation. Income Taxes Our... -

Page 34

...to conversions, represent the premiums that we would collect over a 12-month period, assuming the policies remain in force. For Aflac Japan, total new annualized premium sales are determined by applications submitted during the reporting period. For Aflac U.S., total new annualized premium sales are... -

Page 35

...in premium income reflect the growth of premiums in force. The increases in annualized premiums in force in yen of 3.3% in 2009, 3.2% in 2008 and 3.9% in 2007 reflect the high persistency of Aflac Japan's business and the sales of new policies. Annualized premiums in force at December 31, 2009, were... -

Page 36

...market-leading cancer policies. We are convinced that the affordable cancer products Aflac Japan provides will continue to be an important part of our product portfolio. Sales of cancer and medical insurance in Japan have benefited from the bank channel. In December 2007, 32 Aflac Japan Investments... -

Page 37

... Aflac Japan's debt and perpetual securities were rated investment grade, on an amortized cost basis. See the Credit Risk section of this MD&A for additional information. Japanese Economy The Bank of Japan's January 2010 Monthly Report of Recent Economic and Financial Developments stated that Japan... -

Page 38

...) over prior year The following table details the contributions to total new annualized premium sales by major insurance product category for the years ended December 31. 2009 Accident/disability Cancer Hospital indemnity Life Fixed-benefit dental Other Total 48% 18 18 6 5 5 100% 2008 49% 19 16... -

Page 39

... sales growth, we also believe our products remain affordable to the average American consumer. We believe that consumers' underlying need for our U.S. product line remains strong, and the United States remains a sizeable and attractive market for our products. Aflac Annual Report for 2009 35 -

Page 40

... by the Parent Company of $117 in 2009 and $100 in 2008. Because we invest in fixed-income securities, our financial instruments are exposed primarily to three types of market risks: currency risk, interest rate risk and credit risk. Currency Risk The functional currency of Aflac Japan's insurance... -

Page 41

...time the yen profits were earned. A portion of the repatriation may be used to service Aflac Incorporated's yen-denominated notes payable with the remainder converted into dollars. Interest Rate Risk Our primary interest rate exposure is to the impact of changes in interest rates on the fair value... -

Page 42

... yen-denominated investments for Aflac Japan that support policy obligations and therefore excludes Aflac Japan's annuity products, and dollar-denominated investments and related investment income Cross-currency** and interest rate swap liabilities $ Japanese policyholder protection corporation... -

Page 43

... services and internal credit analysis. The distributions by credit rating of our purchases of debt securities for the years ended December 31, based on acquisition cost, were as follows: Subordination Distribution The majority of our total investments in debt and perpetual securities was senior... -

Page 44

Largest Global Investment Positions (In millions) Government of Japan* Israel Electric Corp. Republic of Tunisia HSBC Holdings PLC HSBC Finance Corporation (formerly Household Finance) Republic New York Corp. HSBC Bank PLC (RAV Int'l. Ltd.) The Hong Kong & Shanghai Banking Corp Ltd (RAV Int'l. Ltd.)... -

Page 45

... with our investment policy. We have investments in both publicly and privately issued securities. The outstanding amount of a particular issuance, as well as the level of activity in a particular issuance and market conditions, including credit events and the interest rate environment, affect... -

Page 46

... as below investment grade. Our policy is to review each issue on a case-by-case basis to determine if a split-rated security should be classified as investment grade or below investment grade. Our review includes evaluating the issuer's credit position as well as current market pricing and other... -

Page 47

... in debt and perpetual securities by investment-grade status as of December 31, 2009. Total Total Percentage Gross Gross Amortized Fair of Total Unrealized Unrealized Cost Value Fair Value Gains Losses (In millions) Available-for-sale securities: Investment-grade securities $ 40,437 $ 40,113... -

Page 48

... the Consolidated Financial Statements for the fair value hierarchy classification of our securities available for sale as of December 31, 2009. The increase in Aflac Japan's deferred policy acquisition costs was primarily driven by total new annualized premium sales. See Note 5 of the Notes to the... -

Page 49

...provide funds to Yamato Life Insurance in the amount of ¥27.7 billion. Although our future assessments for the LIPPC cannot be determined at this time, we believe the bankruptcy will not have a material adverse effect on our financial position or results of operations. Aflac Annual Report for 2009... -

Page 50

...are premiums and investment income. The primary uses of cash by our insurance operations are policy claims, commissions, operating expenses, income taxes and payments to the Parent Company for management fees and dividends. Both the sources and uses of cash are reasonably predictable. When making an... -

Page 51

...against the U.S. dollar. Despite an overall increase in 2009, Aflac U.S. operating cash flows have been reduced by the payout of lump-sum return-of-premium benefits to policyholders on a closed block of U.S. cancer insurance business. These benefit payouts began in 2008 and will conclude in 2012. We... -

Page 52

... on payments of dividends, management fees, loans and advances by Aflac to the Parent Company. The Nebraska insurance statutes require prior approval for dividend distributions that exceed the Treasury stock purchases Number of shares purchased: Open market Other Total shares purchased $ 10... -

Page 53

....8 Aflac Japan remitted less profit to Aflac U.S. in 2009 to support its solvency margin ratio. For additional information on regulatory restrictions on dividends, profit repatriations and other transfers, see Note 11 of the Notes to the Consolidated Financial Statements. Rating Agencies Aflac is... -

Page 54

Consolidated Statements of Earnings (In millions, except for share and per-share amounts) Years Ended December 31, Revenues: Premiums, principally supplemental health insurance Net investment income Realized investment gains (losses): Other-than-temporary impairment losses: Total other-than-... -

Page 55

...assets Liabilities and shareholders' equity: Liabilities: Policy liabilities: Future policy benefits Unpaid policy claims Unearned premiums Other policyholders' funds Total policy liabilities Notes payable Income taxes Payables for return of cash collateral on loaned securities Other Commitments and... -

Page 56

... of income taxes Total change in unrealized gains (losses) on investment securities during period, net of income taxes Pension liability adjustment during period, net of income taxes Balance, end of period Treasury stock: Balance, beginning of period Purchases of treasury stock Cost of shares issued... -

Page 57

... premiums Increase in deferred policy acquisition costs Increase in policy liabilities Change in income tax liabilities Realized investment (gains) losses Other, net Net cash provided by operating activities Cash flows from investing activities: Proceeds from investments sold or matured: Securities... -

Page 58

... ACCOUNTING POLICIES Description of Business Aflac Incorporated (the Parent Company) and its subsidiaries (the Company) primarily sell supplemental health and life insurance in the United States and Japan. The Company's insurance business is marketed and administered through American Family Life... -

Page 59

... and with the approval of state insurance regulatory authorities. Insurance premiums for health and life policies are recognized ratably as earned income over the premium payment periods of the policies. When revenues are reported, the related amounts of benefits and expenses are charged against... -

Page 60

... loans collateralized by securities, the collateral is not reported as an asset or liability. Deferred Policy Acquisition Costs: The costs of acquiring new business are deferred and amortized with interest over the premium payment periods in proportion to the ratio of annual premium income to total... -

Page 61

... new policy are capitalized and amortized in accordance with our accounting policies for deferred acquisition costs. Policy Liabilities: Future policy benefits represent claims that are expected to occur in the future and are computed by a net level premium method using estimated future investment... -

Page 62

... an annual basis and report any adjustments in Aflac Japan's expenses. In the United States, each state has a guaranty association that supports insolvent insurers operating in those states. To date, our state guaranty association assessments have not been material. Treasury Stock: Treasury stock is... -

Page 63

... Executive Committee of the American Institute of Certified Public Accountants (AICPA) issued accounting guidance on deferred acquisition costs in connection with modifications or exchanges of insurance contracts. It provides accounting guidance on internal replacements of insurance and investment... -

Page 64

... highly rated underlying assets as collateral with a credit default swap (CDS) linked to a portfolio of reference assets. These structures produce an investment security that consists of multiple asset tranches with varying levels of subordination within the VIE. We currently own only senior CDO... -

Page 65

... an impact to our business. 2. BUSINESS SEGMENT AND FOREIGN INFORMATION The Company consists of two reportable insurance business segments: Aflac Japan and Aflac U.S., both of which sell supplemental health and life insurance. As discussed in Note 1, in the fourth quarter of 2009 we purchased CAIG... -

Page 66

...income Total Aflac Japan Aflac U.S.: Earned premiums: Accident/disability Cancer Other health Life insurance Net investment income Other income Total Aflac U.S. Other business segments Total business segments Realized investment gains (losses) Corporate Intercompany eliminations Total revenues 2009... -

Page 67

... employers for payroll deduction of premiums. At December 31, 2009, $397 million, or 52.0% of total receivables, were related to Aflac Japan's operations, compared with $527 million, or 57.3%, at December 31, 2008. 3. INVESTMENTS Net Investment Income The components of net investment income for the... -

Page 68

... for sale, carried at fair value: Fixed maturities: Yen-denominated: Japan government and agencies $ 11,710 Mortgage- and asset-backed securities 549 Public utilities 2,284 Collateralized debt obligations 165 Sovereign and supranational 833 Banks/financial institutions 5,248 Other corporate 6,401... -

Page 69

...basis points above an appropriate market index, generally by the 25th year after issuance, thereby creating an economic maturity date. The economic maturities of our investments in perpetual securities, which were all reported as available for sale at December 31, 2009, were as follows: Aflac Japan... -

Page 70

... Information regarding pretax realized gains and losses from investments for the years ended December 31 follows: 2009 (In millions) Japan National Government Israel Electric Corp. Republic of Tunisia HSBC Holdings PLC ** HBOS PLC** Republic of South Africa Credit Amortized Fair Rating Cost Value... -

Page 71

... after-tax) from securities sold or redeemed in the normal course of business. Other-than-temporary Impairment The fair value of our debt and perpetual security investments fluctuates based on changes in credit spreads in the global financial markets. Credit spreads are most impacted by market rates... -

Page 72

... for sale Equity securities Total change in unrealized gains (losses) 2009 2008 2007 $ 170 (31) 736 (1) $ 874 $ (2,134) (165) (850) (3) $ (3,152) $ (838) (35) - (3) $ (876) Effect on Shareholders' Equity The net effect on shareholders' equity of unrealized gains and losses from investment... -

Page 73

... income taxes Other Shareholders' equity, unrealized gains (losses) on investment securities 2009 $ (1,141) 148 356 (3) $ (640) 2008 $ (2,046) 179 659 (3) $ (1,211) Analysis of Securities in Unrealized Loss Positions The unrealized losses on our investments have been primarily related to changes... -

Page 74

... to the well-publicized structured investment vehicles (SIVs), coupled with their exposure to the continued weakness in the housing sector in the UK, Europe and the United States, led to significant write-downs of asset values and capital pressure. In the second half of 2009, the valuation of credit... -

Page 75

...Investments As of December 31, 2009, 58% of the securities in the other corporate sector in an unrealized loss position was investment grade, compared with 70% at the end of 2008. For any credit-related declines in market value, we perform a more focused review of the related issuer's credit ratings... -

Page 76

... Total VIEs not consolidated Total VIEs Amortized Cost Fair Value 2008 Amortized Cost $ 4,458* Fair Value $ 4,372 investment decision-making process, we have not been involved in establishing these entities. We have not been nor are we required to purchase the securities issued in the future by any... -

Page 77

...value of $14 million were on deposit with regulatory authorities in the United States and Japan. We retain ownership of all securities on deposit and receive the related investment income. For general information regarding our investment accounting policies, see Note 1. Aflac Annual Report for 2009... -

Page 78

... inactive markets. The estimated fair values developed by the DCF pricing models are most sensitive to prevailing credit spreads, the level of interest rates (yields) and interest rate volatility. Credit spreads are derived based on pricing data obtained from investment brokers and take into account... -

Page 79

... cost. We review each of these investments periodically and, in the event we determine that any are other-than-temporarily impaired, we write them down to their estimated fair value at that time. Level 3 Rollforward The tables to the right present the changes in our availablefor-sale securities... -

Page 80

... active and inactive markets. The estimated fair values developed by the DCF pricing models are most sensitive to prevailing credit spreads, the level of interest rates (yields) and interest rate volatility. Management believes that under normal market conditions, a movement of 50 basis points (bps... -

Page 81

... trading purposes, nor do we engage in leveraged derivative transactions. See Note 1 for a discussion of our accounting policy for derivatives and hedging and for a discussion of changes in accounting for derivative instruments associated with our investments in QSPEs and VIEs. Aflac Annual Report... -

Page 82

... of our investment in Aflac Japan. (In millions) Interest rate component Foreign currency component Accrued interest component Total fair value of cross-currency and interest rate swaps 2009 $ (3) - - (3) 2008 $ 2 (164) 4 $(158) $ 5. DEFERRED POLICY ACQUISITION COSTS AND INSURANCE EXPENSES... -

Page 83

... in the unpaid policy claims liability previously provided for. There are no additional or return of premium considerations associated with that development. 7. NOTES PAYABLE A summary of notes payable as of December 31 follows: Health insurance: Japan: 2005 - 2009 $ 798 1999 - 2009 10,815 1997... -

Page 84

... of a tax event as specified in the respective bond agreement and is not available to U.S. persons. During the first six months of 2009, we extinguished portions of our yen-denominated Uridashi and Samurai debt by buying the notes on the open market. We extinguished ¥2.0 billion (par value) of our... -

Page 85

...the related tax effects for the years ended December 31 were as follows: (In millions) Deferred income tax liabilities: Deferred policy acquisition costs Difference in tax basis of investment in Aflac Japan Other basis differences in investment securities Premiums receivable Policy benefit reserves... -

Page 86

... if reversed would not have a material effect on the annual effective rate. The Company recognizes accrued interest and penalties related to unrecognized tax benefits in income tax expense. We recognized approximately $1 million in interest and penalties in 2009, compared with $5 million in 2008 and... -

Page 87

...directors for purchase in 2008. Voting Rights: In accordance with the Parent Company's articles of incorporation, shares of common stock are generally entitled to one vote per share until they have been held by the same beneficial owner for a continuous period of 48 months, at which time they become... -

Page 88

...has been given explicit permission by the Director of the The aggregate intrinsic value represents the difference between the company's closing stock price of $46.25 as of December 31, 2009, and the exercise price multiplied by the number of options outstanding or exercisable as of that date. As of... -

Page 89

... the services of two Japanese rating agencies - Rating and Investment Information, Incorporated (R&I) and Japan Credit Rating Agency, Limited (JCR) - for rating Aflac's investment holdings in Tohoku Electric Power Company Incorporated (Tohoku). The securities issued by Tohoku are no longer rated by... -

Page 90

... loss (income) for the years ended December 31. 12. BENEFIT PLANS Our basic employee defined-benefit pension plans cover substantially all of our full-time employees in the United States and Japan. Reconciliations of the funded status of the basic employee defined-benefit pension plans with amounts... -

Page 91

...such as real estate, venture capital investments, and privately issued securities. The Japanese pension plan assets totaling $114 million at fair value as of December 31, 2009, are all categorized as Level 2 because their fair values are based on quoted prices for similar assets in markets that are... -

Page 92

... plans. Stock Bonus Plan: Aflac U.S. maintains a stock bonus plan for eligible U.S. sales associates. Plan participants receive shares of Aflac Incorporated common stock based on their new annualized premium sales and their first-year persistency of substantially all new insurance policies. The cost... -

Page 93

...(COSO), and our report dated February 26, 2010, expressed an unqualified opinion on the effectiveness of the Company's internal control over financial reporting. Atlanta, Georgia February 26, 2010 Management's Annual Report on Internal Control Over Financial Reporting Management is responsible for... -

Page 94

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of Aflac Incorporated and subsidiaries as of December 31, 2009 and 2008, and the related consolidated statements of earnings, shareholders' equity, cash flows, and comprehensive income for each... -

Page 95

... on a basis consistent with our annual audited financial statements. (In millions, except for per-share amounts) Premium income Net investment income Realized investment gains (losses) Other income Total revenues Total benefits and expenses Earnings before income taxes Total income tax Net earnings... -

Page 96

...public accountant and retired Ernst & Young LLP audit partner, has spent the majority of his career auditing companies in the life, health and property/ casualty segments of the insurance industry. He joined Aflac Incorporated's board in 2003. Robert B. Johnson, 65, senior advisor, Porter Novelli PR... -

Page 97

..., Human Resources, Human Resources Support, General Affairs © 2010 Aflac Incorporated. All rights reserved. Aflac®, Maximum Difference®, SmartApp®, SmartApp Next Generation® and "We've Got You Under Our Wing®" are registered trademarks of American Family Life Assurance Company of Columbus... -

Page 98

... Company's public disclosure. Copies of Aflac Incorporated's Form 10-K can be obtained free of charge by calling the Investor Relations Department at 800.235.2667 - option 3. New York Stock Exchange Certification In 2009 the Company submitted to the NYSE a certificate of the Chief Executive Officer...