The Hartford 2010 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

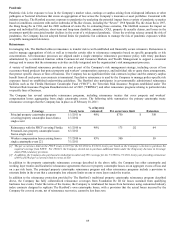

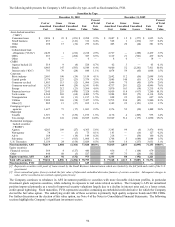

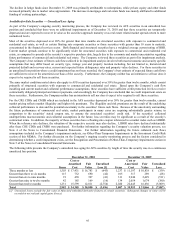

The following table summarizes the terms of the reinsurance treaties with Foundation Re III that were in place as of February 21, 2011:

Covered perils Treaty term Covered losses

Bond amount issued

by Foundation Re III

Hurricane loss events affecting the

Gulf and Eastern Coast of the

United States

1/27/2010 to

1/27/2014

90% of $200 in losses in excess of an index

loss trigger equating to approximately $1.2

billion in losses to The Hartford

$ 180

Hurricane loss events affecting the

Gulf and Eastern Coast of the

United States

2/18/2011 to

2/18/2015

67.5% of $200 in losses in excess of an index

loss trigger equating to approximately $1.4

billion in losses to The Hartford

135

As of February 21, 2011, there have been no events that are expected to trigger a recovery under the Foundation Re III reinsurance

program and, accordingly, the Company has not recorded any recoveries from the associated reinsurance treaty.

For the risk of terrorism, private sector catastrophe reinsurance capacity is generally limited and largely unavailable for terrorism losses

caused by nuclear, biological, chemical or radiological weapons attacks. As such, the Company’ s principal reinsurance protection

against large-scale terrorist attacks is the coverage currently provided through the TRIPRA. On December 26, 2007, the President signed

TRIPRA extending the Terrorism Risk Insurance Act of 2002 (“TRIA”) through the end of 2014. TRIPRA provides a backstop for

insurance-related losses resulting from any “act of terrorism” certified by the Secretary of the Treasury, in concurrence with the

Secretary of State and Attorney General, that result in industry losses in excess of $100. In addition, TRIPRA revised the TRIA

definition of a certified “act of terrorism” by removing the requirement that an act be committed “on behalf of any foreign person or

foreign interest.” As a result, domestic acts of terrorism can now be certified as “acts of terrorism” under the program, subject to the

other requirements of TRIPRA. Under the program, in any one calendar year, the federal government would pay 85% of covered losses

from a certified act of terrorism after an insurer’ s losses exceed 20% of the company’ s eligible direct commercial earned premiums of

the prior calendar year, up to a combined annual aggregate limit for the federal government and all insurers of $100 billion. If an act of

terrorism or acts of terrorism result in covered losses exceeding the $100 billion annual industry aggregate limit, a future Congress

would be responsible for determining how additional losses in excess of $100 billion will be paid.

Among other items, TRIPRA required that the President’ s Working Group on Financial Markets (“PWG”) continue to perform an

analysis regarding the long-term availability and affordability of insurance for terrorism risk. Among the findings detailed in the PWG’ s

initial report, released October 2, 2006, were that the high level of uncertainty associated with predicting the frequency of terrorist

attacks, coupled with the unwillingness of some insurance policyholders to purchase insurance coverage, makes predicting long-term

development of the terrorism risk market difficult, and that there is likely little potential for future market development for NBCR

coverage. The January 2011 PWG report notes some improvements in capacity and modeling, but also noted that take-up rates for

terrorism coverage remained relatively flat over the past three years and that insurers remain uncertain about the ability of models to

predict the frequency and severity of terrorist attacks. With respect to NBCR coverage, a December 2008 study by the U.S. Government

Accountability Office (“GAO”) found that property and casualty insurers still generally seek to exclude NBCR coverage from their

commercial policies when permitted. However, while nuclear, pollution and contamination exclusions are contained in many property

and liability insurance policies, the GAO report concluded that such exclusions may be subject to challenges in court because they were

not specifically drafted to address terrorist attacks. Furthermore, workers’ compensation policies generally have no exclusions or

limitations. The GAO found that commercial property and casualty policyholders, including companies that own high-value properties

in large cities, generally reported that they could not obtain NBCR coverage. Commercial property and casualty insurers generally

remain unwilling to offer NBCR coverage because of uncertainties about the risk and the potential for catastrophic losses.

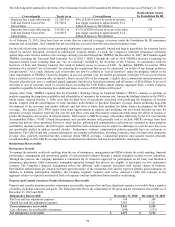

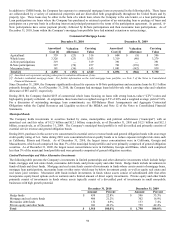

Reinsurance Recoverables

Reinsurance Security

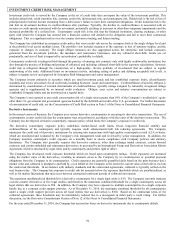

To manage the potential credit risk resulting from the use of reinsurance, management and ERM evaluate the credit standing, financial

performance, management and operational quality of each potential reinsurer through a regular enterprise security review committee.

Through this process, the Company maintains a centralized list of reinsurers approved for participation on all treaty and facultative

reinsurance placements. Only reinsurance companies approved through this process are eligible to participate on new reinsurance

cessions. The Company’ s approval designations reflect the differing credit exposure associated with various classes of business.

Participation authorizations are categorized based upon the nature of the reinsurance risk and the expected liability payout duration. In

addition to defining participation eligibility, the Company regularly monitors each active reinsurer’ s credit risk exposure in the

aggregate relative to expected and stressed levels of exposure and has established limits tiered by credit rating.

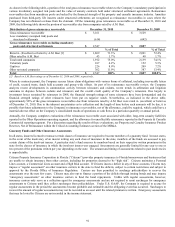

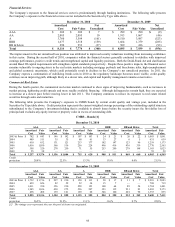

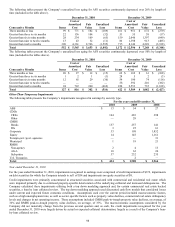

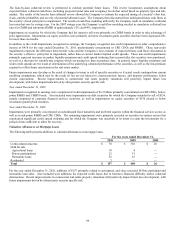

Property and Casualty Insurance Product Reinsurance Recoverable

Property and casualty insurance product reinsurance recoverables represent loss and loss adjustment expense recoverable from a number

of entities, including reinsurers and pools. The following table shows the components of the gross and net reinsurance recoverable as of

December 31, 2010 and 2009:

Reinsurance Recoverable December 31, 2010 December 31, 2009

Paid loss and loss adjustment expenses $ 198 $ 208

Unpaid loss and loss adjustment expenses 2,963 3,321

Gross reinsurance recoverable 3,161 3,529

Less: allowance for uncollectible reinsurance (290) (335)

Net reinsurance recoverable $ 2,871 $ 3,194