The Hartford 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

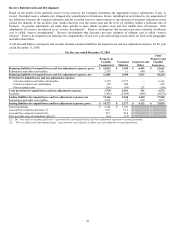

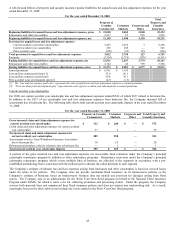

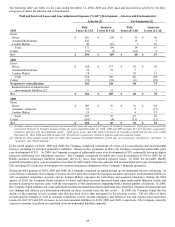

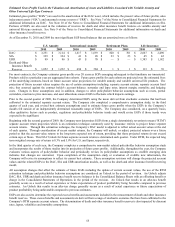

The following table displays gross asbestos reserves and other statistics by policyholder category as of December 31, 2010.

Summary of Gross Asbestos Reserves

As of December 31, 2010

Number of

Accounts [2]

All Time

Paid [3]

Total

Reserves

All Time

Ultimate [3]

Gross Asbestos Reserves as of June 30, 2010 [1]

Major asbestos defendants [5]

Structured settlements (includes 4 Wellington accounts) [6] 7 $ 312 $ 428 $ 740

Wellington (direct only) 29 908 44 952

Other major asbestos defendants 29 476 132 608

No known policies (includes 3 Wellington accounts) 5 — — —

Accounts with future exposure > $2.5 77 832 585 1,417

Accounts with future exposure < $2.5 1,122 409 133 542

Unallocated [7] 1,766 446 2,212

Total Direct 4,703 1,768 6,471

Assumed Reinsurance 1,199 469 1,668

London Market 605 308 913

Total as of June 30, 2010 [1] 6,507 2,545 9,052

Gross paid loss activity for the third quarter and fourth quarter 2010 242 (242) —

Gross incurred loss activity for the third quarter and fourth quarter 2010 5 5

Total as of December 31, 2010 [4] $6,749 $ 2,308 $ 9,057

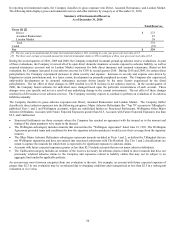

[1] Gross Asbestos Reserves based on the second quarter 2010 asbestos reserve study.

[2] An account may move between categories from one evaluation to the next. Reclassifications were made as a result of the reserve evaluation

completed in the second quarter of 2010.

[3] "All Time Paid" represents the total payments with respect to the indicated claim type that have already been made by the Company as of the

indicated balance sheet date. "All Time Ultimate" represents the Company's estimate, as of the indicated balance sheet date, of the total payments

that are ultimately expected to be made to fully settle the indicated payment type. The amount is the sum of the amounts already paid (e.g. "All

Time Paid") and the estimated future payments (e.g. the amount shown in the column labeled "Total Reserves").

[4] Survival ratio is a commonly used industry ratio for comparing reserve levels between companies. While the method is commonly used, it is not a

predictive technique. Survival ratios may vary over time for numerous reasons such as large payments due to the final resolution of certain

asbestos liabilities, or reserve re-estimates. The survival ratio is computed by dividing the recorded reserves by the average of the past three

years of payments. The ratio is the calculated number of years the recorded reserves would survive if future annual payments were equal to the

average annual payments for the past three years. The 3-year gross survival ratio of 7.5 as of December 31, 2010 is computed based on total paid

losses of $917 for the period from January 1, 2008 to December 31, 2010. As of December 31, 2010, the one year gross paid amount for total

asbestos claims is $378 resulting in a one year gross survival ratio of 6.1.

[5] Includes 25 open accounts at June 30, 2010. Included 25 open accounts at June 30, 2009.

[6] Structured settlements include the Company’s reserves related to PPG Industries, Inc. (“PPG”). In January 2009, the Company, along with

approximately three dozen other insurers, entered into a modified agreement in principle with PPG to resolve the Company’s coverage

obligations for all of its PPG asbestos liabilities, including principally those arising out of its 50% stock ownership of Pittsburgh Corning

Corporation (“PCC”), a joint venture with Corning, Inc. The agreement is contingent on the fulfillment of certain conditions, including the

confirmation of a PCC plan of reorganization under Section 524(g) of the Bankruptcy Code, which have not yet been met.

[7] Includes closed accounts (exclusive of Major Asbestos Defendants) and unallocated IBNR.

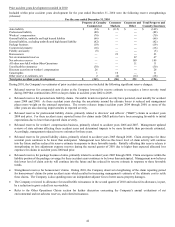

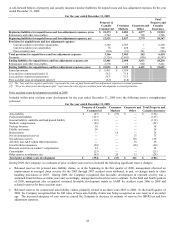

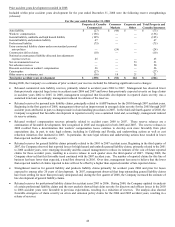

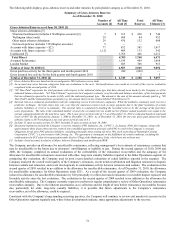

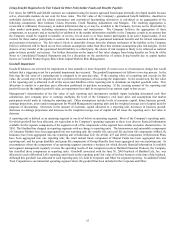

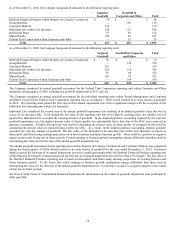

The Company provides an allowance for uncollectible reinsurance, reflecting management’ s best estimate of reinsurance cessions that

may be uncollectible in the future due to reinsurers’ unwillingness or inability to pay. During the second quarters of 2010, 2009 and

2008, the Company completed its annual evaluations of the collectability of the reinsurance recoverables and the adequacy of the

allowance for uncollectible reinsurance associated with older, long-term casualty liabilities reported in the Other Operations segment. In

conducting this evaluation, the Company used its most recent detailed evaluations of ceded liabilities reported in the segment. The

Company analyzed the overall credit quality of the Company’ s reinsurers, recent trends in arbitration and litigation outcomes in disputes

between cedants and reinsurers, and recent developments in commutation activity between reinsurers and cedants. The evaluation in the

second quarter of 2010 resulted in no addition to the allowance for uncollectible reinsurance. As of December 31, 2010, the allowance

for uncollectible reinsurance for Other Operations totals $211. As a result of the second quarter of 2009 evaluation, the Company

reduced its allowance for uncollectible reinsurance by $20 principally to reflect decreased reinsurance recoverable dispute exposure and

favorable activity since the last evaluation. The evaluation in the second quarter of 2008 resulted in no addition to the allowance for

uncollectible reinsurance. The Company currently expects to perform its regular comprehensive review of Other Operations reinsurance

recoverables annually. Due to the inherent uncertainties as to collection and the length of time before reinsurance recoverables become

due, particularly for older, long-term casualty liabilities, it is possible that future adjustments to the Company’ s reinsurance

recoverables, net of the allowance, could be required.

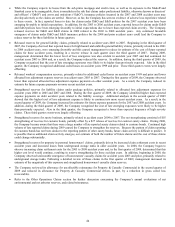

Consistent with the Company’ s long-standing reserving practices, the Company will continue to review and monitor its reserves in the

Other Operations segment regularly and, where future developments indicate, make appropriate adjustments to the reserves.