The Hartford 2010 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-61

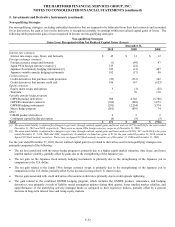

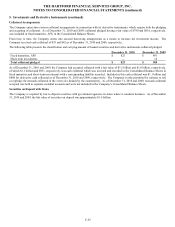

8. Goodwill and Other Intangible Assets (continued)

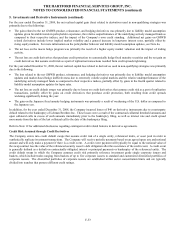

On June 24, 2009, the Company acquired 100% of the equity interests in FTC, a savings and loan holding company, for $10, enabling

the Company to participate in the Capital Purchase Program. The acquisition resulted in goodwill of $168. The goodwill generated,

which is tax deductible, was due, in part, to the fair value discount on mortgage loans acquired in comparison to their expected cash

flows. Mortgage loans acquired were fair valued at $288. Contractual cash flows from the mortgage loans acquired were $450. The

Company’ s best estimate of contractual cash flows not expected to be collected at the acquisition date was $129. Other assets acquired

included $27 of fixed maturity securities, $46 of short-term investments and $3 of cash. Liabilities assumed included other liabilities of

$389 in bank deposits and $149 in Federal Home Loan Bank advances and long-term debt of $25. The acquired assets and liabilities

have been stated at fair value. As of December 31, 2009, these fair values were subject to adjustment based upon management’ s

subsequent receipt of additional information. The Company completed its fair value estimates as of June 30, 2010 with no material

changes.

The Company's goodwill impairment test performed during the first quarter of 2009 for the individual reporting units within Wealth

Management and Corporate and Other, resulted in a write-down of $32 in the Institutional reporting unit within Corporate and Other.

As a result of rating agency downgrades of the Company’ s financial strength ratings during the first quarter of 2009 and high credit

spreads related to the Company, the Company believed its ability to generate new business in the Institutional reporting unit would

remain pressured for ratings-sensitive products. The Company believed goodwill associated with the Institutional reporting unit was

impaired due to the pressure on new sales for ratings-sensitive business and the significant unrealized losses on investment portfolios.

In addition, the Company completed its annual goodwill assessment for the remaining individual reporting units within Property &

Casualty Commercial and Consumer Markets as of September 30, 2009, which resulted in no write-downs of goodwill for the year

ended December 31, 2009.

The Company's interim goodwill impairment test for the year ended December 31, 2008, resulted in a pre-tax impairment charge of

$422 in the Individual Annuity reporting unit within Global Annuity and $323 within the Individual Annuity and International reporting

units of Corporate and Other. The impairment charges taken in 2008 were primarily due to the Company’ s estimate of the International

and Individual Annuity reporting units’ fair values falling significantly below the related book values. The fair values of these reporting

units declined as the statutory capital and surplus risks associated with the death and living benefit guarantees sold with products offered

by these reporting units increased. These concerns had a comparable impact on the Company’ s share price. The determination of fair

values for the Individual Annuity and International reporting units incorporated multiple inputs including discounted cash flow

calculations, market participant assumptions and the Company’ s share price.

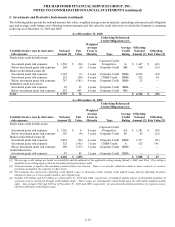

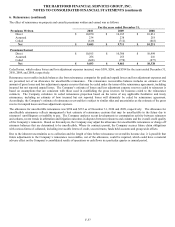

Other Intangible Assets

Accounting Policy

Net amortization expense for other intangible assets is included in other insurance operating and other expenses in the Consolidated

Statement of Operations. Acquired intangible assets primarily consist of distribution agreements and servicing intangibles, and are

included in other assets in the Consolidated Balance Sheets. With the exception of goodwill, the Company has no intangible assets with

indefinite useful lives.

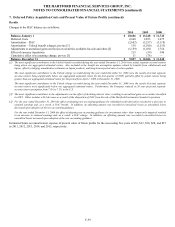

Results

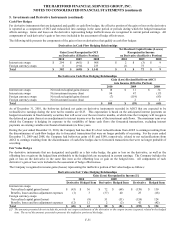

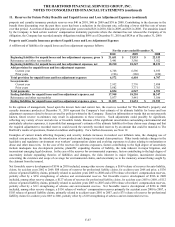

The following table shows the Company’ s acquired intangible assets that are subject to amortization and aggregate amortization

expense, net of interest accretion.

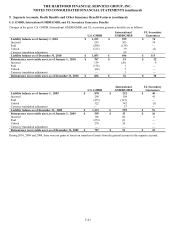

For the years ended December 31,

2010 2009 2008

Gross carrying amount, beginning of year $ 90 $ 121 $ 106

Accumulated net amortization 18 47 39

Net carrying amount, beginning of year 72 74 67

Acquisition of business (1) 6 15

Amortization, net of the accretion of interest (7) (8) (8)

Net carrying amount, end of year 64 72 74

Accumulated net amortization 25 18 47

Gross carrying amount, end of year $ 89 $ 90 $ 121

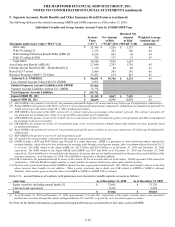

In 2009, the Company completed two acquisitions that resulted in additional acquired intangible assets of $1 in distribution agreements

and $5 in other. In 2009, the Company fully amortized acquired intangible assets for renewal rights and other of $22 and $14,

respectively.

For the years ended December 31, 2010, 2009 and 2008, the Company did not capitalize any costs to extend or renew the term of a

recognized intangible asset. As of December 31, 2010, the weighted average amortization period was 13 years for total acquired

intangible assets. Net amortization expense for other intangibles is expected to be approximately $7 in each of the succeeding five

years.

For a discussion of present value of future profits that continue to be subject to amortization and aggregate amortization expense, see

Note 7.