The Hartford 2010 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

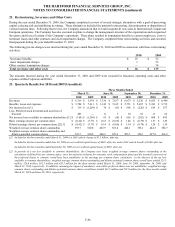

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-94

21. Investment by Allianz SE in The Hartford

On October 17, 2008, the Company entered into an Investment Agreement (the “Investment Agreement”), with Allianz SE (“Allianz”)

under which, among other things, the Company agreed to issue and sell in a private placement to Allianz for aggregate cash

consideration of $2.5 billion: (i) $1.75 billion of the Company’ s 10% Fixed-to-Floating Rate Junior Subordinated Debentures due 2068

(the “Debentures”); (ii) 6,048,387 shares of the Company’ s Series D Non-Voting Contingent Convertible Preferred Stock (the “Series D

Preferred Stock”), initially convertible (as discussed below) into 24,193,548 shares of the Company’ s common stock at an issue price of

$31.00 per share, resulting in proceeds of $750; and (iii) warrants (the “Warrants”) to purchase the Company’ s Series B Non-Voting

Contingent Convertible Preferred Stock (the “Series B Preferred Stock”) and Series C Non-Voting Contingent Convertible Preferred

Stock (the “Series C Preferred Stock” and, together with the Series B Preferred Stock and the Series D Preferred Stock, the “Preferred

Stock”) structured to entitle Allianz, upon receipt of necessary approvals, to purchase 69,115,324 shares of common stock at an initial

exercise price of $25.32 per share.

The Company agreed that, for the one-year period following October 17, 2008, it would pay certain amounts to Allianz if the Company

effects or agrees to effect any transaction (or series of transactions) pursuant to which any person or group (within the meaning of the

U.S. federal securities laws) is issued common stock or certain equity-related instruments constituting more than 5% of the Company’ s

fully-diluted common stock outstanding at the time for an effective price per share (determined as provided in the Investment

Agreement) of less than $25.32. Amounts so payable depend on the effective price for the applicable transaction (or the weighted

average price for a series of transactions) and range from $50 if the effective price per share is between $25.31 and $23.00, $150 if the

effective price per share is between $22.99 and $20.00, $200 if the effective price per share is between $19.99 and $15.00 and $300 if

the effective price per share is $14.99 or less.

The issuance of warrants to Treasury, see Note 15, triggered the contingency payment in the Investment Agreement related to additional

investors. Upon receipt of preliminary approval to participate in the CPP, The Hartford negotiated with Allianz to modify the form of

the $300 contingency payment. The settlement of the contingency payment was negotiated to allow Allianz a one-time extension of the

exercise period of its outstanding warrants from seven to ten years and $200 in cash paid on October 15, 2009. The Hartford recorded a

liability for the cash payment and an adjustment to additional paid-in capital for the warrant modification resulting in a net realized

capital loss of approximately $300.

Debentures

The 10% Fixed-to-Floating Rate Junior Subordinated Debentures due 2068 bear interest at an annual fixed rate of 10% from the date of

issuance to, but excluding, October 15, 2018, payable semi-annually in arrears on April 15 and October 15. From and including October

15, 2018, the Debentures will bear interest at an annual rate, reset quarterly, equal to three-month LIBOR plus 6.824%, payable

quarterly in arrears. The Company has the right, on one or more occasions, to defer the payment of interest on the Debentures. The

Company may defer interest for up to ten consecutive years without giving rise to an event of default. Deferred interest will accumulate

additional interest at an annual rate equal to the annual interest rate then applicable to the Debentures. If the Company defers interest for

five consecutive years or, if earlier, pays current interest during a deferral period, which may be paid from any source of funds, the

Company will be required to pay deferred interest from proceeds from the sale of certain qualifying securities.

In connection with the offering of the debentures, the Company entered into a "Replacement Capital Covenant" for the benefit of

holders of one or more designated series of the Company's indebtedness, initially the Company’ s 6.1% notes due 2041. Under the terms

of the Replacement Capital Covenant, if the Company redeems the Debentures at any time prior to October 15, 2048 it can only do so

with the proceeds from the sale of certain qualifying replacement securities. Subject to the Replacement Capital Covenant, the

Company can redeem the Debentures at its option, in whole or in part, at any time on or after October 15, 2018 at a redemption price of

100% of the principal amount being redeemed plus accrued but unpaid interest.

The Debentures were issued with the detachable Warrants. The allocation of the $1.75 billion proceeds between the Debentures and

Warrants was based on the relative fair values of these financial instruments at the time of issuance. As such, the Debentures were

recorded at a fair value of $1,201 and are classified as long-term debt.