The Hartford 2010 Annual Report Download - page 220

Download and view the complete annual report

Please find page 220 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-92

18. Stock Compensation Plans (continued)

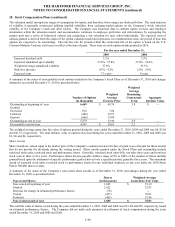

Employee Stock Purchase Plan

In 1996, the Company established The Hartford Employee Stock Purchase Plan (“ESPP”). Beginning in 2010, under this plan, eligible

employees of The Hartford purchase common stock of the Company at a discount rate of 5% of the market price per share on the last

trading day of the offering period. In 2009 and prior years, eligible employees of The Hartford purchased common stock of the

Company at a 15% discount from the lower of the closing market price at the beginning or end of the offering period. Employees

purchase a variable number of shares of stock through payroll deductions elected as of the beginning of the offering period. The

Company may sell up to 15,400,000 shares of stock to eligible employees under the ESPP. As of December 31, 2010, there were

7,240,661 shares available for future issuance. During the years ended December 31, 2010, 2009 and 2008, 729,598, 2,557,893 and

964,365 shares were sold, respectively. The weighted average per share fair value of the discount under the ESPP was $1.24, $5.99 and

$14.12 during the years ended December 31, 2010, 2009 and 2008, respectively. In 2010, the fair value is estimated based on the 5%

discount off the market price per share on the last trading day of the offering period. In 2009 and prior years, the fair value was

estimated based on the 15% discount off of the beginning stock price plus the value of six-month European call and put options on

shares of stock at the beginning stock price calculated using the Black-Scholes model and the following weighted average valuation

assumptions:

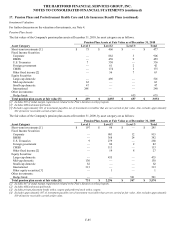

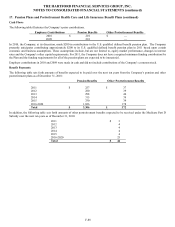

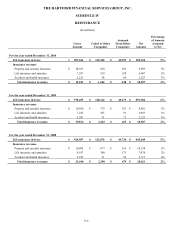

For the year ended December 31,

2009 2008

Dividend yield 1.4% 3.5%

Implied volatility 91.4% 45.5%

Risk-free spot rate 0.3% 1.9%

Expected term 6 months 3 months

Implied volatility was derived from exchange-traded options on the Company’ s stock. The risk-free rate is based on the U.S. Constant

Maturity Treasury yield curve in effect at the time of grant. The total intrinsic value of the discounts at purchase was $5 and $5 for the

years ended December 31, 2009 and 2008, respectively. Additionally, The Hartford has established employee stock purchase plans for

certain employees of the Company’ s international subsidiaries. Under these plans, participants may purchase common stock of The

Hartford at a fixed price. The activity under these programs is not material.

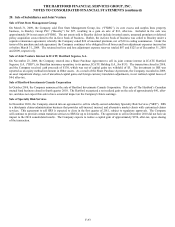

19. Investment and Savings Plan

Substantially all U.S. employees are eligible to participate in The Hartford’ s Investment and Savings Plan under which designated

contributions may be invested in common stock of The Hartford or certain other investments. These contributions are matched, up to

3% of base salary, by the Company. In 2010, employees who had earnings of less than $110,000 in the preceding year received a

contribution of 1.5% of base salary and employees who had earnings of $110,000 or more in the preceding year received a contribution

of 0.5% of base salary. The cost to The Hartford for this plan was approximately $62, $64, and $64 for 2010, 2009, and 2008,

respectively. Additionally, The Hartford has established defined contribution pension plans for certain employees of the Company’ s

international subsidiaries. Under this plan, the Company contributes 5% of base salary to the participant accounts. The cost to The

Hartford in 2010, 2009, and 2008 for this plan was $1, $2 and $2, respectively.