The Hartford 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-44

5. Investments and Derivative Instruments (continued)

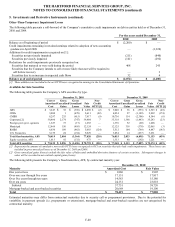

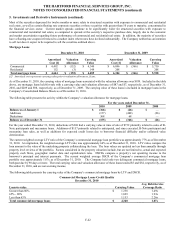

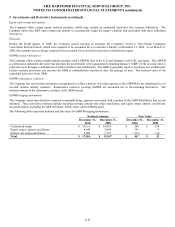

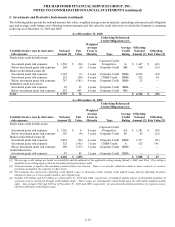

Consolidated VIEs

The following table presents the carrying value of assets and liabilities, and the maximum exposure to loss relating to the VIEs for

which the Company is the primary beneficiary. Creditors have no recourse against the Company in the event of default by these VIEs

nor does the Company have any implied or unfunded commitments to these VIEs. The Company’ s financial or other support provided

to these VIEs is limited to its investment management services and original investment. As a result of accounting guidance adopted on

January 1, 2010, certain CDO VIEs were consolidated in 2010 and are included in the following table, while in prior periods they were

reported in the Non-Consolidated VIEs table further below. For further information on the adoption, see Note 1.

December 31, 2010 December 31, 2009

Total

Assets

Total

Liabilities [1]

Maximum

Exposure

to Loss [2]

Total

Assets

Total

Liabilities [1]

Maximum

Exposure

to Loss [2]

CDOs [3] $ 729 $ 393 $ 289 $ 226 $ 32 $ 196

Limited partnerships 14 1 13 31 1 30

Other investments [3] — — — 111 20 87

Total $ 743 $ 394 $ 302 $ 368 $ 53 $ 313

[1] Included in other liabilities in the Company’s Consolidated Balance Sheets.

[2] The maximum exposure to loss represents the maximum loss amount that the Company could recognize as a reduction in net investment income or

as a realized capital loss and is the cost basis of the Company’s investment.

[3] Total assets included in fixed maturities, AFS, and fixed maturities, FVO, in the Company’s Consolidated Balance Sheets.

CDOs represent structured investment vehicles for which the Company has a controlling financial interest as it provides collateral

management services, earns a fee for those services and also holds investments in the securities issued by these vehicles. Limited

partnerships represent a hedge fund for which the Company holds a majority interest in the fund as an investment. Other investments

represent an investment trust for which the Company has a controlling financial interest as it provides investment management services,

earns a fee for those services and also holds investments in the securities issued by the trusts. During 2010, the Company liquidated this

investment trust.

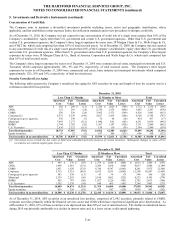

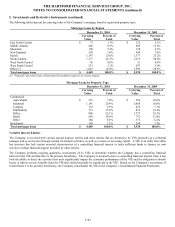

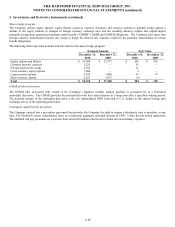

Non-Consolidated VIEs

The following table presents the carrying value of assets and liabilities, and the maximum exposure to loss relating to significant VIEs

for which the Company is not the primary beneficiary. The Company has no implied or unfunded commitments to these VIEs.

December 31, 2010 December 31, 2009

Assets Liabilities

Maximum

Exposure

to Loss Assets Liabilities

Maximum

Exposure

to Loss

CDOs [1] $ — $ — $ — $ 262 $ — $ 273

Other [2] 32 32 4 36 36 5

Total $ 32 $ 32 $ 4 $ 298 $ 36 $ 278

[1] Maximum exposure to loss represents the Company’s investment in securities issued by CDOs at cost.

[2] Maximum exposure to loss represents issuance costs that were incurred to establish a contingent capital facility.

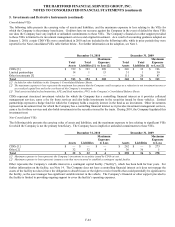

Other represents the Company’ s variable interest in a contingent capital facility (“facility”), which has been held for four years. For

further information on the facility, see Note 14. The Company does not have a controlling financial interest as it does not manage the

assets of the facility nor does it have the obligation to absorb losses or the right to receive benefits that could potentially be significant to

the facility, as the asset manager has significant variable interest in the vehicle. The Company’ s financial or other support provided to

the facility is limited to providing ongoing support to cover the facility’ s operating expenses.