The Hartford 2010 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

INSURANCE RISK MANAGEMENT

The Hartford has a robust set of enterprise risk management processes and controls around the management of insurance risks that are

integrated into such core activities as underwriting, pricing, reinsurance, claims management, and capital management. In addition, to

manage aggregations of insurance risk across the portfolio, The Hartford has policies and processes to manage risk related to natural

catastrophes, such as hurricanes and earthquakes and pandemics, as well as man-made disasters such as terrorism. The Hartford’ s risk

management processes include, but are not limited to, disciplined underwriting protocols, exposure controls, sophisticated risk

modeling, risk transfer, and capital management strategies. In managing risk, The Hartford’ s management processes involve establishing

underwriting guidelines for both individual risks, including individual policy limits, and in aggregate, including aggregate exposure

limits by geographic zone and peril. The Company establishes risk limits and actively monitors risk exposures as a percent of statutory

surplus.

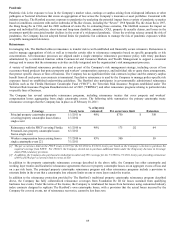

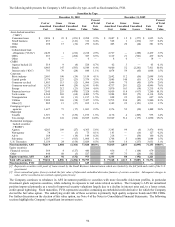

Natural Catastrophes

For natural catastrophe perils, the Company generally limits its estimated loss to natural catastrophes from a single 250-year event prior

to reinsurance to less than 30% of statutory surplus of the property and casualty operations and its estimated loss to natural catastrophes

from a single 250-year event after reinsurance to less than 15% of statutory surplus of the property and casualty operations. The

Company uses third-party models to estimate the potential loss resulting from various catastrophe events and the potential financial

impact those events would have on the Company’ s financial position and results of operations. The Company’ s modeled loss estimates

are derived by averaging 21 modeled loss events representing a 250-year return period loss. For the peril of earthquake, the 21 events

averaged to determine the modeled loss estimate include events occurring in California as well as the Northwestern, Northeastern,

Southeastern and Midwestern regions of the United States with associated magnitudes ranging from 6.1 to 7.9 on the Moment

Magnitude scale. For the peril of hurricane, the 21 events averaged to determine the modeled loss estimate include category 3, 4 and 5

events in Florida, as well as other Southeastern and Northeastern region landfalls.

While Enterprise Risk Management has a process to track and manage these limits, from time to time, the estimated loss to natural

catastrophes from a single 250-year event prior to reinsurance may fluctuate above or below these limits due to changes in modeled loss

estimates, exposures, or statutory surplus. Currently, the Company's estimated pre-tax loss to a single 250-year natural catastrophe

event prior to reinsurance is less than 30% of the statutory surplus of the property and casualty insurance subsidiaries and the

Company’ s estimated pre-tax loss net of reinsurance is less than 15% of statutory surplus of the property and casualty operations. The

estimated 250 year pre-tax probable maximum losses from hurricane events are estimated to be $1.5 billion and $582 before and after

reinsurance, respectively. The estimated 250 year pre-tax probable maximum loss from earthquake events are estimated to be $666

before reinsurance and $434 net of reinsurance. The loss estimates represent total property losses for hurricane events and property and

workers’ compensation losses for earthquake events resulting from a single event. The estimates provided are based on 250-year return

period loss estimates, which have a 0.4% likelihood of being exceeded in any single year.

The net loss estimates provided above assume that the Company is able to recover all losses ceded to reinsurers under its reinsurance

programs. There are various methodologies used in the industry to estimate the potential property and workers’ compensation losses that

would arise from various catastrophe events and companies may use different models and assumptions in their estimates. Therefore, the

Company’ s estimates of gross and net losses arising from a 250-year hurricane or earthquake event may not be comparable to estimates

provided by other companies. Furthermore, the Company’ s estimates are subject to significant uncertainty and could vary materially

from the actual losses that would arise from these events and the loss estimates provided by other Companies. The company also

manages natural catastrophe risk for group life, group disability, and individual life insurance, which in combination with property and

workers compensation loss estimates, are subject to separate enterprise risk management net aggregate loss limits as a percent of

enterprise surplus.

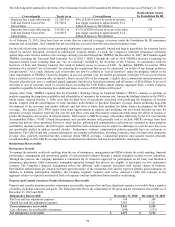

Terrorism

The Company is exposed to losses from terrorist attacks, including losses caused by single-site and multi-site conventional attacks, as

well as the potential for attacks using nuclear, biological, chemical or radiological weapons (“NBCR”) attacks. For terrorism, the

Company monitors aggregations of exposure around key landmarks primarily in major metropolitan areas that span the Company’ s

insurance portfolio. Enterprise limits for terrorism apply to aggregations of risk across property-casualty, group benefits, life insurance

and specific asset portfolios and are defined based on a deterministic, single-site conventional terrorism attack scenario. The Company

manages its potential estimated loss from this terrorism loss scenario to less than $1.3 billion. Among the landmark locations

specifically monitored by the Company as of December 31, 2010, the largest estimated modeled loss arising from a single event is

approximately $1.1 billion. The Company monitors exposures monthly and employs both internally developed and vendor-licensed loss

modeling tools as part of its risk management discipline. The risk of terrorism presents unique challenges to any insurance company

given the fact that the frequency and severity of terrorist attacks are highly uncertain and potentially unknowable. As such, modeled

terrorism losses could differ materially from scenarios employed to manage the Company’ s overall terrorism risk loss exposure.