The Hartford 2010 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

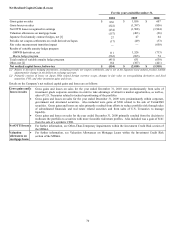

KEY PERFORMANCE MEASURES AND RATIOS

The Hartford considers several measures and ratios to be the key performance indicators for its businesses. The following discussions

include the more significant ratios and measures of profitability for the years ended December 31, 2010, 2009 and 2008. Management

believes that these ratios and measures are useful in understanding the underlying trends in The Hartford’ s businesses. However, these

key performance indicators should only be used in conjunction with, and not in lieu of, the results presented in the segment discussions

that follow in this MD&A. These ratios and measures may not be comparable to other performance measures used by the Company’ s

competitors.

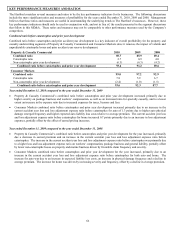

Combined ratio before catastrophes and prior year development

Combined ratio before catastrophes and prior accident year development is a key indicator of overall profitability for the property and

casualty underwriting segments of Property & Casualty Commercial and Consumer Markets since it removes the impact of volatile and

unpredictable catastrophe losses and prior accident year reserve development.

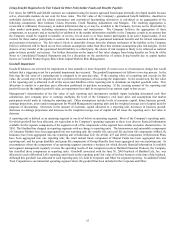

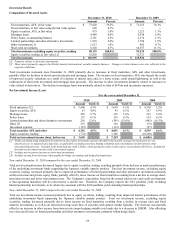

Property & Casualty Commercial 2010 2009 2008

Combined ratio 89.7 85.9 89.4

Catastrophe ratio 2.7 0.9 4.0

Non-catastrophe prior year development (6.3) (6.3) (4.2)

Combined ratio before catastrophes and prior year development 93.4 91.2 89.6

Consumer Markets

Combined ratio 99.0 97.2 92.9

Catastrophe ratio 7.8 5.9 6.7

Non-catastrophe prior year development (2.4) (1.0) (1.5)

Combined ratio before catastrophes and prior year development 93.6 92.3 87.7

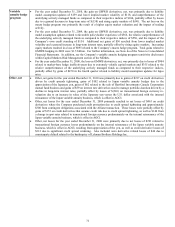

Year ended December 31, 2010 compared to the year ended December 31, 2009

• Property & Casualty Commercial’ s combined ratio before catastrophes and prior year development increased primarily due to

higher severity on package business and workers’ compensation, as well as an increased ratio for specialty casualty, and to a lesser

extent an increase in the expense ratio due to increased expenses for taxes, licenses and fees.

• Consumer Markets combined ratio before catastrophes and prior year development increased primarily due to an increase in the

current accident year loss and loss adjustment expense ratio before catastrophes for auto of 1.3 points due to higher auto physical

damage emerged frequency and higher expected auto liability loss costs relative to average premium. The current accident year loss

and loss adjustment expense ratio before catastrophes for home increased 0.7 points primarily due to an increase in loss adjustment

expenses, partially offset by the effect of earned pricing increases.

Year ended December 31, 2009 compared to the year ended December 31, 2008

• Property & Casualty Commercial’ s combined ratio before catastrophes and prior year development for the year increased, primarily

due a decrease in earned premium and an increase in the current accident year loss and loss adjustment expense ratio before

catastrophes. The increase in the current accident year loss and loss adjustment expense ratio before catastrophes was primarily due

to a higher loss and loss adjustment expense ratio on workers’ compensation, package business and general liability, partially offset

by lower non-catastrophe losses on property and marine business driven by favorable claim frequency and severity.

• Consumer Markets combined ratio before catastrophes and prior year development for the year increased, primarily due to an

increase in the current accident year loss and loss adjustment expense ratio before catastrophes for both auto and home. The

increase for auto was due to an increase in expected liability loss costs, an increase in physical damage frequency and a decline in

average premium. The increase for home was driven by increasing severity and frequency, offset by a decline in average premium.