The Hartford 2010 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

Variable

annuity hedge

program

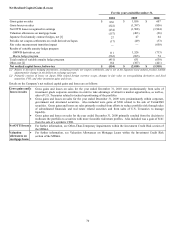

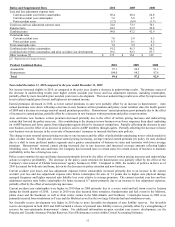

• For the year ended December 31, 2010, the gain on GMWB derivatives, net, was primarily due to liability

model assumption updates of $159 and lower implied market volatility of $118, and outperformance of the

underlying actively managed funds as compared to their respective indices of $104, partially offset by losses

due to a general decrease in long-term rates of $(158) and rising equity markets of $(90). The net loss on the

macro hedge program was primarily the result of a higher equity market valuation and the impact of trading

activity.

• For the year ended December 31, 2009, the gain on GMWB derivatives, net, was primarily due to liability

model assumption updates related to favorable policyholder experience of $566, the relative outperformance of

the underlying actively managed funds as compared to their respective indices of $550, and the impact of the

Company’ s own credit standing of $154. Additional net gains of $56 resulted from lower implied market

volatility and a general increase in long-term interest rates, partially offset by rising equity markets. Increasing

equity markets resulted in a loss of $895 related to the Company’ s macro hedge program. Total gains related to

GMWB hedging in 2009 were $1.5 billion. For further information, see Note 4a of the Notes to Consolidated

Financial Statements. In addition, see the Company’ s variable annuity hedging program sensitivity disclosures

within Capital Markets Risk Management section of the MD&A.

• For the year ended December 31, 2008, the loss on GMWB derivatives, net, was primarily due to losses of $904

related to market-base hedge ineffectiveness due to extremely volatile capital markets and $355 related to the

relative outperformance of the underlying actively managed funds as compared to their respective indices,

partially offset by gains of $470 in the fourth quarter related to liability model assumption updates for lapse

rates.

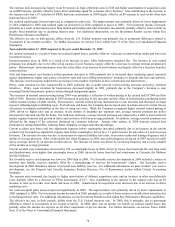

Other, net • Other, net gains for the year ended December 31, 2010 was primarily due to gains of $217 on credit derivatives

driven by credit spreads tightening, gains of $102 related to Japan variable annuity hedges due to the

appreciation of the Japanese yen, gains of $62 related to the sale of Hartford Investments Canada Corporation

mutual fund business and gains of $59 on interest rate derivatives used to manage portfolio duration driven by a

decline in long-term interest rates, partially offset by losses of $(326) on transactional foreign currency re-

valuation due to an increase in value of the Japanese yen versus the U.S. dollar associated with the internal

reinsurance of the Japan variable annuity business, which is offset in AOCI.

• Other, net losses for the year ended December 31, 2009 primarily resulted in net losses of $463 on credit

derivatives where the Company purchased credit protection due to credit spread tightening and approximately

$300 from contingent obligations associated with the Allianz transaction. These losses were partially offset by

gains of $155 on credit derivatives that assume credit risk due to credit spread tightening, as well as $140 from

a change in spot rates related to transactional foreign currency predominately on the internal reinsurance of the

Japan variable annuity business, which is offset in AOCI.

• Other, net losses for the year ended December 31, 2008 were primarily due to net losses of $291 related to

transactional foreign currency losses predominately on the internal reinsurance of the Japan variable annuity

business, which is offset in AOCI, resulting from appreciation of the yen, as well as credit derivative losses of

$312 due to significant credit spread widening. Also included were derivative related losses of $46 due to

counterparty default related to the bankruptcy of Lehman Brothers Holdings Inc.