The Hartford 2010 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

112

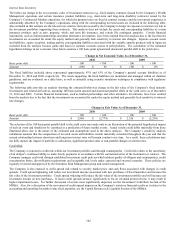

upon certain economic and business assumptions. These assumptions include, but are not limited to, equity market performance,

changes in interest rates and the Company’ s other capital requirements. The Company does not have a required minimum funding

contribution for the U.S. qualified defined benefit pension plan for 2011 and the funding requirements for all of the pension plans is

expected to be immaterial.

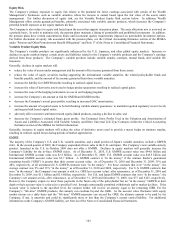

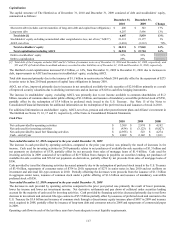

Dividends from Insurance Subsidiaries

Dividends to the HFSG Holding Company from its insurance subsidiaries are restricted. The payment of dividends by Connecticut-

domiciled insurers is limited under the insurance holding company laws of Connecticut. These laws require notice to and approval by

the state insurance commissioner for the declaration or payment of any dividend, which, together with other dividends or distributions

made within the preceding twelve months, exceeds the greater of (i) 10% of the insurer’ s policyholder surplus as of December 31 of the

preceding year or (ii) net income (or net gain from operations, if such company is a life insurance company) for the twelve-month period

ending on the thirty-first day of December last preceding, in each case determined under statutory insurance accounting principles. In

addition, if any dividend of a Connecticut-domiciled insurer exceeds the insurer’ s earned surplus, it requires the prior approval of the

Connecticut Insurance Commissioner. The insurance holding company laws of the other jurisdictions in which The Hartford’ s

insurance subsidiaries are incorporated (or deemed commercially domiciled) generally contain similar (although in certain instances

somewhat more restrictive) limitations on the payment of dividends. Dividends paid to HFSG Holding Company by its insurance

subsidiaries are further dependent on cash requirements of HLI and other factors. The Company’ s property-casualty insurance

subsidiaries are permitted to pay up to a maximum of approximately $1.5 billion in dividends to HFSG Holding Company in 2011

without prior approval from the applicable insurance commissioner. The Company’ s life insurance subsidiaries are permitted to pay up

to a maximum of approximately $83 in dividends to HLI in 2011 without prior approval from the applicable insurance commissioner.

The aggregate of these amounts, net of amounts required by HLI, is the maximum the insurance subsidiaries could pay to HFSG

Holding Company in 2011. In 2010, HFSG Holding Company and HLI received no dividends from the life insurance subsidiaries, and

HFSG Holding Company received $1.0 billion in dividends from its property-casualty insurance subsidiaries.

Other Sources of Capital for the HFSG Holding Company

The Hartford endeavors to maintain a capital structure that provides financial and operational flexibility to its insurance subsidiaries,

ratings that support its competitive position in the financial services marketplace (see the “Ratings” section below for further

discussion), and shareholder returns. As a result, the Company may from time to time raise capital from the issuance of stock, debt or

other capital securities and is continuously evaluating strategic opportunities. The issuance of common stock, debt or other capital

securities could result in the dilution of shareholder interests or reduced net income due to additional interest expense.

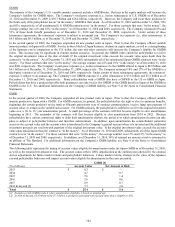

Capital Purchase Program

On March 31, 2010, the Company repurchased all 3.4 million shares of Series E Preferred Stock issued to the U.S. Department of the

Treasury (the “Treasury”) for an aggregate purchase price of $3.4 billion. The Hartford used approximately $425 of the net proceeds

from the debt issuance, $1.6 billion from the common stock issuance, $556 from the preferred stock issuance together with available

funds at the HFSG Holding Company to repurchase the Series E Preferred Stock. The Company recorded a $440 charge to retained

earnings representing the acceleration of the accretion of the remaining discount on the preferred stock.

On September 27, 2010, the Treasury sold its warrants to purchase approximately 52 million shares of The Hartford’ s common stock in

a secondary public offering for net proceeds of approximately $706. The Hartford did not receive any proceeds from this sale. The

warrants are exercisable, in whole or in part, at any time and from time to time until June 26, 2019 at an initial exercise price of $9.79.

The exercise price will be paid by the withholding by The Hartford of a number of shares of common stock issuable upon exercise of the

warrants equal to the value of the aggregate exercise price of the warrants so exercised determined by reference to the closing price of

The Hartford's common stock on the trading day on which the warrants are exercised and notice is delivered to the warrant agent. The

Hartford did not purchase any of the warrants sold by the Treasury.

During the Company’ s participation in the Capital Purchase Program (“CPP”), the Company was subject to numerous additional

regulations, including restrictions on the ability to increase the common stock dividend, limitations on the compensation arrangements

for senior executives and additional corporate governance standards. As a result of the redemption of Series E Preferred Stock, the

Company is no longer subject to these regulations other than certain reporting and certification obligations to U.S. regulatory agencies.

To satisfy a key eligibility requirement for participation in the CPP, The Hartford acquired Federal Trust Corporation and has agreed

with the OTS to serve as a source of strength to its wholly-owned subsidiary Federal Trust Bank (“FTB”), which included capital

contributions of $5 and $195 in 2010 and 2009, respectively, and could require further contributions of capital to FTB in the future. At

December 31, 2010 and 2009, FTB’ s Tier 1 capital ratio was 11.4% and 8.3%, respectively. FTB was designated as a “well capitalized”

institution at December 31, 2010 and 2009.

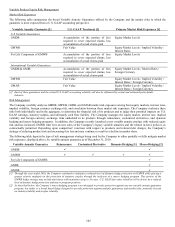

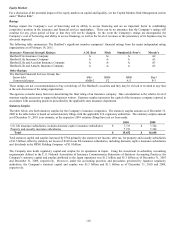

Shelf Registrations

On August 4, 2010, The Hartford filed with the Securities and Exchange Commission (the “SEC”) an automatic shelf registration

statement (Registration No. 333-168532) for the potential offering and sale of debt and equity securities. The registration statement

allows for the following types of securities to be offered: debt securities, junior subordinated debt securities, preferred stock, common

stock, depositary shares, warrants, stock purchase contracts, and stock purchase units. In that The Hartford is a well-known seasoned

issuer, as defined in Rule 405 under the Securities Act of 1933, the registration statement went effective immediately upon filing and

The Hartford may offer and sell an unlimited amount of securities under the registration statement during the three-year life of the shelf.