The Hartford 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

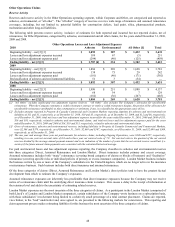

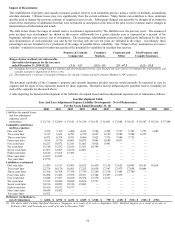

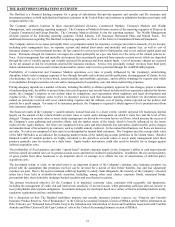

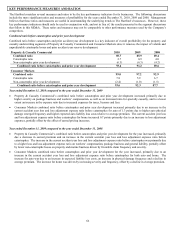

As of December 31, 2010, the Company had goodwill allocated to the following reporting units:

Segment

Goodwill

Goodwill in

Corporate and Other

Total

Hartford Financial Products within Property & Casualty Commercial $ 30 $ — $ 30

Group Benefits — 138 138

Consumer Markets 119 — 119

Individual Life within Life Insurance 224 118 342

Retirement Plans 87 69 156

Mutual Funds 159 92 251

Federal Trust Corporation within Corporate and Other — 15 15

Total $ 619 $ 432 $ 1,051

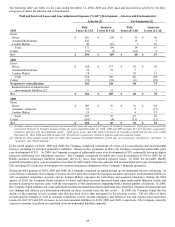

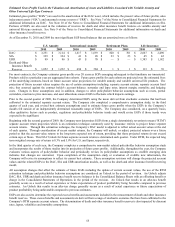

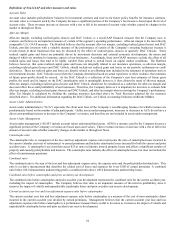

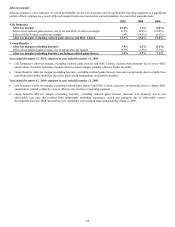

As of December 31, 2009, the Company had goodwill allocated to the following reporting units:

Segment

Goodwill

Goodwill in Corporate

and Other

Total

Hartford Financial Products within Property & Casualty Commercial $ 30 $ — $ 30

Group Benefits — 138 138

Consumer Markets 119 — 119

Individual Life within Life Insurance 224 118 342

Retirement Plans 87 69 156

Mutual Funds 159 92 251

Federal Trust Corporation within Corporate and Other — 168 168

Total $ 619 $ 585 $ 1,204

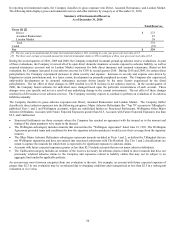

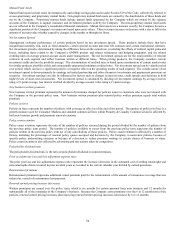

The Company completed its annual goodwill assessment for the Federal Trust Corporation reporting unit within Corporate and Other

during the second quarter of 2010, resulting in a goodwill impairment of $153, pre-tax.

The Company completed its annual goodwill assessment for the individual reporting units within Wealth Management and Corporate

and Other, except for the Federal Trust Corporation reporting unit, as of January 1, 2010, which resulted in no write-downs of goodwill

in 2010. The reporting units passed the first step of their annual impairment tests with a significant margin with the exception of the

Individual Life reporting unit within Life Insurance.

Individual Life completed the second step of the annual goodwill impairment test resulting in an implied goodwill value that was in

excess of its carrying value. Even though the fair value of the reporting unit was lower than its carrying value, the implied level of

goodwill in Individual Life exceeded the carrying amount of goodwill. In the implied purchase accounting required by the step two

goodwill impairment test, the implied present value of future profits was substantially lower than that of the DAC asset removed in

purchase accounting. A higher discount rate was used for calculating the present value of future profits as compared to that used for

calculating the present value of estimated gross profits for DAC. As a result, in the implied purchase accounting, implied goodwill

exceeded the carrying amount of goodwill. The fair value of the Individual Life reporting unit within Life Insurance is based on

discounted cash flows using earnings projections on in force business and future business growth. There could be a positive or negative

impact on the result of step one in future periods if actual earnings or business growth assumptions emerge differently than those used in

determining fair value for the first step of the annual goodwill impairment test.

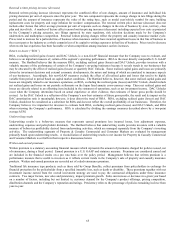

The annual goodwill assessment for the reporting units within Property & Casualty Commercial and Consumer Markets was completed

during the fourth quarter of 2010, which resulted in no write-downs of goodwill for the year ended December 31, 2010. Consumer

Markets passed the first step of its annual impairment test with a significant margin while the Hartford Financial Products reporting unit

within Property & Casualty Commercial passed the first step of its annual impairment test with less than a 5% margin. The fair value of

the Hartford Financial Products reporting unit is based on discounted cash flows using earnings projections on existing business and

future business growth. To the extent that actual earnings or business growth assumptions emerge differently than those used in

determining fair value for the first step of the annual goodwill impairment test, it could have a positive or negative impact on the results

of step one in future periods.

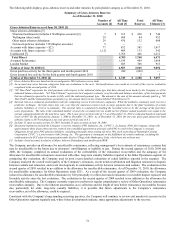

See Note 8 of the Notes to Consolidated Financial Statements for information on the results of goodwill impairment tests performed in

2009 and 2008.