The Hartford 2010 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-93

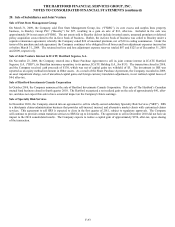

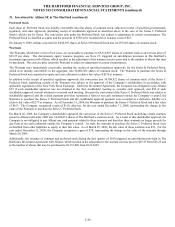

20. Sale of Subsidiaries and Joint Venture

Sale of First State Management Group

On March 31, 2009, the Company sold First State Management Group, Inc. (“FSMG”), its core excess and surplus lines property

business, to Beazley Group PLC (“Beazley”) for $27, resulting in a gain on sale of $12, after-tax. Included in the sale was

approximately $4 in net assets of FSMG. The net assets sold to Beazley did not include invested assets, unearned premium or deferred

policy acquisition costs related to the in-force book of business. Rather, the in-force book of business was ceded to Beazley under a

separate reinsurance agreement, whereby the Company ceded $26 of unearned premium, net of $10 in ceding commission. Under the

terms of the purchase and sale agreement, the Company continues to be obligated for all losses and loss adjustment expenses incurred on

or before March 31, 2009. The retained net loss and loss adjustment expense reserves totaled $87 and $125 as of December 31, 2010

and 2009, respectively.

Sale of Joint Venture Interest in ICATU Hartford Seguros, S.A.

On November 23, 2009, the Company entered into a Share Purchase Agreement to sell its joint venture interest in ICATU Hartford

Seguros, S.A. ("IHS"), its Brazilian insurance operation, to its partner, ICATU Holding S.A., for $135. The transaction closed in 2010,

and the Company received cash proceeds of $130, which was net of capital gains tax withheld of $5. The investment in IHS was

reported as an equity method investment in Other assets. As a result of the Share Purchase Agreement, the Company recorded in 2009,

an asset impairment charge, net of unrealized capital gains and foreign currency translation adjustments, in net realized capital losses of

$44, after-tax.

Sale of Hartford Investments Canada Corporation

In October 2010, the Company announced the sale of Hartford Investments Canada Corporation. This sale of The Hartford’ s Canadian

mutual fund business closed in fourth quarter 2010. The Hartford recognized a net realized gain on the sale of approximately $41, after-

tax, and does not expect this sale to have a material impact on the Company's future earnings.

Sale of Specialty Risk Services

In December 2010, the Company entered into an agreement to sell its wholly-owned subsidiary Specialty Risk Services ("SRS"). SRS

is a third-party claims administration business that provides self-insured, insured, and alternative market clients with customized claims

services. This agreement to sell SRS is expected to close in the first quarter of 2011, subject to regulatory approvals. The Company

will continue to provide certain transition services to SRS for up to 24 months. The agreement to sell in December 2010 did not have an

impact to the 2010 consolidated results. The Company expects to realize a capital gain of approximately $150, after-tax, upon closing

of the transaction.