The Hartford 2010 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-96

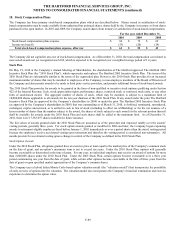

22. Restructuring, Severance and Other Costs

During the year ended December 31, 2009, the Company completed a review of several strategic alternatives with a goal of preserving

capital, reducing risk and stabilizing its ratings. These alternatives included the potential restructuring, discontinuation or disposition of

various business lines. Following that review, the Company announced that it would suspend all new sales in International’ s Japan and

European operations. The Company has also executed on plans to change the management structure of the organization and reorganized

the nature and focus of certain of the Company’ s operations. These plans resulted in termination benefits to current employees, costs to

terminate leases and other contracts and asset impairment charges. The Company completed these restructuring activities and executed

final payment during the year ended December 31, 2010.

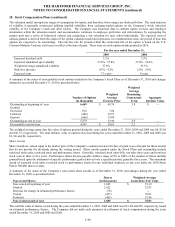

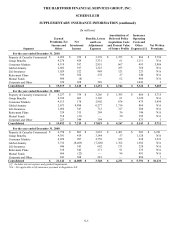

The following pre-tax charges were incurred during the years ended December 31, 2010 and 2009 in connection with these restructuring

activities:

2010 2009

Severance benefits $ 25 $ 52

Asset impairment charges 1 53

Other contract termination charges — 34

Total severance and other costs $ 26 $ 139

The amounts incurred during the year ended December 31, 2010 and 2009 were recorded in Insurance operating costs and other

expenses within Corporate and Other.

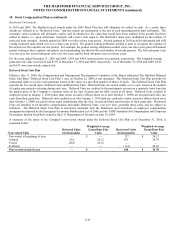

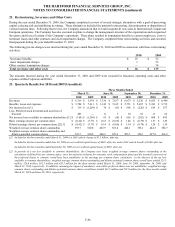

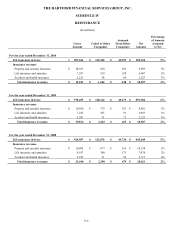

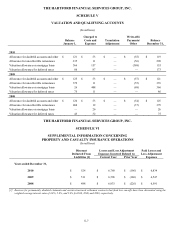

23. Quarterly Results For 2010 and 2009 (Unaudited)

Three Months Ended

March 31, June 30, September 30, December 31,

2010 2009 2010 2009 2010 2009 2010 2009

Revenues $6,319 $5,394 $3,336 $7,637 $6,673 $ 5,230 $6,055 $6,440

Benefits, losses and expenses $5,784 $7,411 $3,343 $7,619 $5,751 $ 5,687 $5,241 $5,712

Net income (loss) [1] $ 319 $ (1,209) $ 76 $ (15) $ 666 $ (220) $ 619 $ 557

Less: Preferred stock dividends and accretion of

discount 483 — 11 3 10 62 11 62

Net income (loss) available to common shareholders [1] $(164) $(1,209) $ 65 $ (18) $ 656 $ (282) $ 608 $ 495

Basic earnings (losses) per common share $(0.42) $(3.77) $0.15 $(0.06) $1.48 $ (0.79) $1.37 $1.29

Diluted earnings (losses) per common share [2] [3] $(0.42) $(3.77) $0.14 $(0.06) $1.34 $ (0.79) $1.24 $1.19

Weighted average common shares outstanding 393.7 320.8 443.9 325.4 444.1 356.1 444.3 382.7

Weighted average common shares outstanding and

dilutive potential common shares 393.7 320.8 480.2 325.4 495.3 356.1 497.8 416.2

[1] Included in the three months ended March 31, 2009 is a DAC unlock charge of $1.5 billion, after-tax.

Included in the three months ended June 30, 2009 are net realized capital losses of $649, after-tax, and a DAC unlock benefit of $360, after-tax.

Included in the three months ended September 30, 2009 are net realized capital losses of $885, after-tax.

[2] In periods of a net loss available to common shareholders, the Company uses basic weighted average common shares outstanding in the

calculation of diluted loss per common share, since the inclusion of shares for warrants, stock compensation plans and the assumed conversion of

the preferred shares to common would have been antidilutive to the earnings per common share calculation. In the absence of the net loss

available to common shareholders, weighted average common shares outstanding and dilutive potential common shares would have totaled 321.5

million, 326.6 million, 382.5 million and 428.5 million for the three months ended March 31, 2009, June 30, 2009, September 30, 2009, and

March 31, 2010 respectively. In addition, assuming the impact of mandatory convertible preferred shares was not antidilutive, weighted average

common shares outstanding and dilutive potential common shares would have totaled 431.9 million and 501.0 million for the three months ended

March 31, 2010 and June 30, 2010, respectively.