The Hartford 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 110

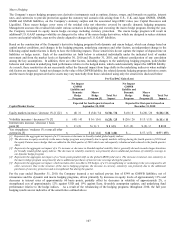

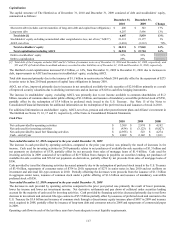

Liabilities

The Company’ s Wealth Management operations issued non-U.S. dollar denominated funding agreement liability contracts. The

Company hedges the foreign currency risk associated with these liability contracts with currency rate swaps. At December 31, 2010 and

2009, the derivatives used to hedge foreign currency exchange risk related to foreign denominated liability contracts had a total notional

amount of $771 and $814, respectively, and a total fair value of $(17) and $(2), respectively.

The yen based fixed annuity product was written by Hartford Life Insurance K.K. (“HLIKK”), a wholly-owned Japanese subsidiary of

Hartford Life, Inc. (“HLI”), and subsequently reinsured to Hartford Life Insurance Company, a U.S. dollar based wholly-owned indirect

subsidiary of HLI. During 2009, the Company has since suspended new sales of the Japan business. The underlying investment

involves investing in U.S. securities markets, which offer favorable credit spreads. The yen denominated fixed annuity product (“yen

fixed annuities”) is recorded in the consolidated balance sheets with invested assets denominated in dollars while policyholder liabilities

are denominated in yen and converted to U.S. dollars based upon the December 31, yen to U.S. dollar spot rate. The difference between

U.S. dollar denominated investments and yen denominated liabilities exposes the Company to currency risk. The Company manages

this currency risk associated with the yen fixed annuities primarily with pay variable U.S. dollar and receive fixed yen currency swaps.

As of December 31, 2010 and 2009, the notional value of the currency swaps was $2.1 billion and $2.3 billion and the fair value was

$608 and $316, respectively. Although economically an effective hedge, a divergence between the yen denominated fixed annuity

product liability and the currency swaps exists primarily due to the difference in the basis of accounting between the liability and the

derivative instruments (i.e. historical cost versus fair value). The yen denominated fixed annuity product liabilities are recorded on a

historical cost basis and are only adjusted for changes in foreign spot rates and accrued income. The currency swaps are recorded at fair

value, incorporating changes in value due to changes in forward foreign exchange rates, interest rates and accrued income. A before-tax

net gain of $27 and $47 for the years ended December 31, 2010 and 2009, respectively, which includes the changes in value of the

currency swaps, excluding net periodic coupon settlements, and the yen fixed annuity contract remeasurement, was recorded in net

realized capital gains and losses.

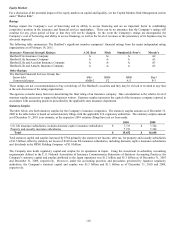

Prior to 2010, the Company had also issued guaranteed benefits (GMDB and GMIB) that were reinsured from HLIKK to the U.S.

insurance subsidiaries. During 2010, the Company entered into foreign currency forward contracts that convert U.S. dollars to yen in

order to hedge the foreign currency risk due to U.S. dollar denominated assets backing the yen denominated liabilities. The Company

also enters into foreign currency forward contracts that convert euros to yen in order to economically hedge the risk arising when the

Japan policyholders’ variable annuity sub-accounts are invested in non-Japanese yen denominated securities while the related GMDB

and GMIB guarantees are effectively yen-denominated. As of December 31, 2010 and 2009, the derivatives used to hedge foreign

currency risk associated with Japanese variable annuity products had a total notional amount of $1.7 billion and $257, respectively, and

a total fair value of $73 and $(8), respectively.