The Hartford 2010 Annual Report Download - page 158

Download and view the complete annual report

Please find page 158 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-30

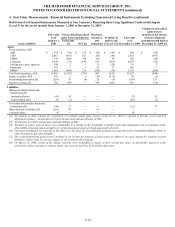

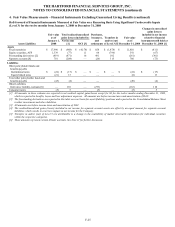

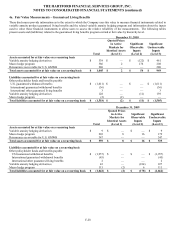

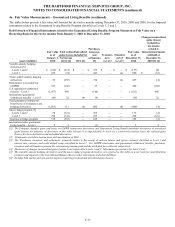

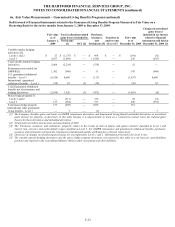

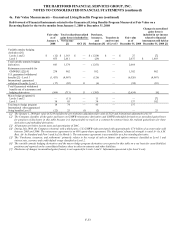

4a. Fair Value Measurements – Guaranteed Living Benefits (continued)

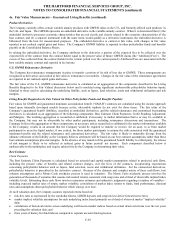

As many guaranteed benefit obligations are relatively new in the marketplace, actual policyholder behavior experience is limited. As a

result, estimates of future policyholder behavior are subjective and based on analogous internal and external data. As markets change,

mature and evolve and actual policyholder behavior emerges, management continually evaluates the appropriateness of its assumptions

for this component of the fair value model.

On a daily basis, the Company updates capital market assumptions used in the GMWB liability model such as interest rates and equity

indices. On a weekly basis, the blend of implied equity index volatilities is updated. The Company continually monitors various aspects

of policyholder behavior and may modify certain of its assumptions, including living benefit lapses and withdrawal rates, if credible

emerging data indicates that changes are warranted. At a minimum, all policyholder behavior assumptions are reviewed and updated, as

appropriate, in conjunction with the completion of the Company’ s comprehensive study to refine its estimate of future gross profits

during the third quarter of each year.

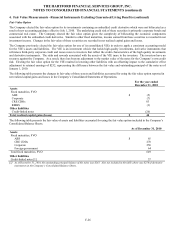

Credit Standing Adjustment

This assumption makes an adjustment that market participants would make, in determining fair value, to reflect the risk that guaranteed

benefit obligations or the GMWB reinsurance recoverables will not be fulfilled (“nonperformance risk”). As a result of sustained

volatility in the Company’ s credit default spreads, during 2009 the Company changed its estimate of the Credit Standing Adjustment to

incorporate a blend of observable Company and reinsurer credit default spreads from capital markets, adjusted for market recoverability.

Prior to the first quarter of 2009, the Company calculated the Credit Standing Adjustment by using default rates published by rating

agencies, adjusted for market recoverability. The credit standing adjustment assumption, net of reinsurance, and exclusive of the impact

of the credit standing adjustment on other market inputs, resulted in pre-tax realized gains/(losses) of $(10), $26 and $10, for the years

ended December 31, 2010, 2009 and 2008, respectively. As of December 31, 2010 the credit standing adjustment was $26.

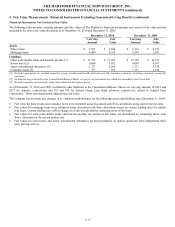

Margins

The behavior risk margin adds a margin that market participants would require, in determining fair value, for the risk that the

Company’ s assumptions about policyholder behavior could differ from actual experience. The behavior risk margin is calculated by

taking the difference between adverse policyholder behavior assumptions and best estimate assumptions.

Assumption updates, including policyholder behavior assumptions, affected best estimates and margins for a total pre-tax realized gain

of $159, $566 and $470 for the years ended December 31, 2010, 2009 and 2008, respectively. As of December 31, 2010 the behavior

risk margin was $565.

In addition to the non-market-based updates described above, the Company recognized non-market-based updates driven by the relative

outperformance (underperformance) of the underlying actively managed funds as compared to their respective indices resulting in pre-

tax realized gain (loss) of approximately $104, $550 and $(355) for the years ended December 31, 2010, 2009 and 2008, respectively.