The Hartford 2010 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-75

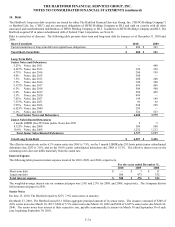

14. Debt (continued)

Junior Subordinated Debentures

On June 6, 2008, the Company issued $500 aggregate principal amount of 8.125% fixed-to-floating rate junior subordinated debentures

(the “debentures”) due June 15, 2068 for net proceeds of approximately $493, after deducting underwriting discounts and expenses from

the offering. The debentures bear interest at an annual fixed rate of 8.125% from the date of issuance to, but excluding, June 15, 2018,

payable semi-annually in arrears on June 15 and December 15. From and including June 15, 2018, the debentures will bear interest at an

annual rate, reset quarterly, equal to three-month LIBOR plus 4.6025%, payable quarterly in arrears on March 15, June 15, September

15 and December 15 of each year. The Company has the right, on one or more occasions, to defer the payment of interest on the

debentures. The Company may defer interest for up to ten consecutive years without giving rise to an event of default. Deferred interest

will accumulate additional interest at an annual rate equal to the annual interest rate then applicable to the debentures. If the Company

defers interest for five consecutive years or, if earlier, pays current interest during a deferral period, which may be paid from any source

of funds, the Company will be required to pay deferred interest from proceeds from the sale of certain qualifying securities.

The debentures carry a scheduled maturity date of June 15, 2038 and a final maturity date of June 15, 2068. During the 180-day period

ending on a notice date not more than fifteen and not less than ten business days prior to the scheduled maturity date, the Company is

required to use commercially reasonable efforts to sell certain qualifying replacement securities sufficient to permit repayment of the

debentures at the scheduled maturity date. If any debentures remain outstanding after the scheduled maturity date, the unpaid amount

will remain outstanding until the Company has raised sufficient proceeds from the sale of qualifying replacement securities to permit the

repayment in full of the debentures. If there are remaining debentures at the final maturity date, the Company is required to redeem the

debentures using any source of funds.

Subject to the replacement capital covenant described below, the Company can redeem the debentures at its option, in whole or in part,

at any time on or after June 15, 2018 at a redemption price of 100% of the principal amount being redeemed plus accrued but unpaid

interest. The Company can redeem the debentures at its option prior to June 15, 2018 (a) in whole at any time or in part from time to

time or (b) in whole, but not in part, in the event of certain tax or rating agency events relating to the debentures, at a redemption price

equal to the greater of 100% of the principal amount being redeemed and the applicable make-whole amount, in each case plus any

accrued and unpaid interest.

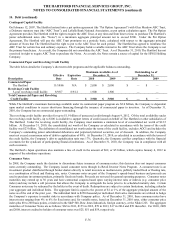

In connection with the offering of the debentures, the Company entered into a "replacement capital covenant" for the benefit of holders

of one or more designated series of the Company's indebtedness, initially the Company’ s 6.1% notes due 2041. Under the terms of the

replacement capital covenant, if the Company redeems the debentures at any time prior to June 15, 2048 it can only do so with the

proceeds from the sale of certain qualifying replacement securities.

For a discussion of the 10.0% junior subordinated debentures due 2068, see Note 21.

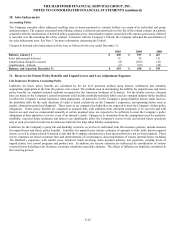

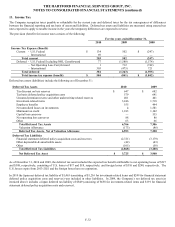

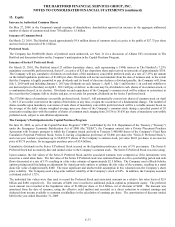

Long-Term Debt Maturities

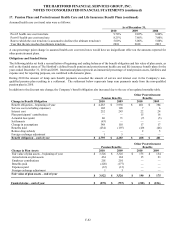

The following table reflects the Company’ s long-term debt maturities.

2011 $ 400

2012 —

2013 320

2014 200

2015 500

Thereafter 5,805

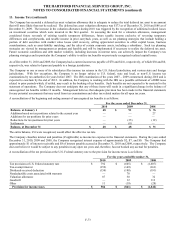

Capital Lease Obligations

The Company recorded capital leases of $0 and $68 in 2010 and 2009, respectively. Capital lease obligations are included in long-term

debt, except for the current maturities, which are included in short-term debt, in the Consolidated Balance Sheet as of December 31,

2010 and 2009, respectively. In May 2007, the Company entered into a firm commitment to purchase office buildings and recorded a

capital lease of $114. This purchase was completed in January 2010.

Shelf Registrations

On August 4, 2010, The Hartford filed with the Securities and Exchange Commission (the “SEC”) an automatic shelf registration

statement (Registration No. 333-168532) for the potential offering and sale of debt and equity securities. The registration statement

allows for the following types of securities to be offered: debt securities, junior subordinated debt securities, preferred stock, common

stock, depositary shares, warrants, stock purchase contracts, and stock purchase units. In that The Hartford is a well-known seasoned

issuer, as defined in Rule 405 under the Securities Act of 1933, the registration statement went effective immediately upon filing and

The Hartford may offer and sell an unlimited amount of securities under the registration statement during the three-year life of the shelf.