The Hartford 2010 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

F-64

9. Separate Accounts, Death Benefits and Other Insurance Benefit Features (continued)

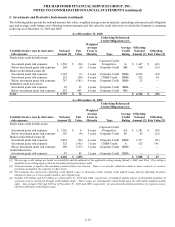

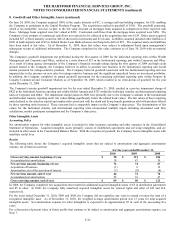

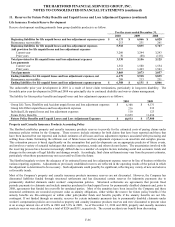

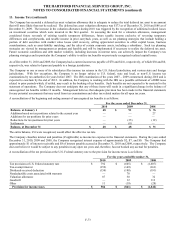

The following table provides details concerning GMDB and GMIB exposure as of December 31, 2010:

Individual Variable and Group Annuity Account Value by GMDB/GMIB Type

Maximum anniversary value (“MAV”) [1]

Account

Value

(“AV”)

Net Amount

at Risk

(“NAR”) [10]

Retained Net

Amount

at Risk

(“RNAR”) [10]

Weighted Avera

g

e

Attained Age of

Annuitant

MAV only $ 25,546 $ 5,526

$

1,327 68

With 5% rollup [2] 1,752 472 160 68

With Earnings Protection Benefit Rider (EPB) [3] 6,524 883 99 64

With 5% rollup & EPB 724 157 33 67

Total MAV 34,546 7,038 1,619

Asset Protection Benefit (APB) [4] 27,840 2,703 1,736 65

Lifetime Income Benefit (LIB) - Death Benefit [5] 1,319 88 88 63

Reset [6] (5-7 years) 3,699 243 241 68

Return of Premium (“ROP”) [7] /Other 23,427 674 647 65

Subtotal U.S. GMDB [8] $ 90,831 $ 10,746

$

4,331 66

Less: General Account Value with U.S. GMDB 6,865

Subtotal Separate Account Liabilities with GMDB 83,966

Separate Account Liabilities without U.S. GMDB 75,776

Total Separate Account Liabilities $ 159,742

Japan GMDB [9], [11] $ 31,249 $ 8,847

$

7,593 69

Japan GMIB [9], [11] $ 28,835 5,777 5,777 69

[1] MAV GMDB is the greatest of current AV, net premiums paid and the highest AV on any anniversary before age 80 (adjusted for withdrawals).

[2] Rollup GMDB is the greatest of the MAV, current AV, net premium paid and premiums (adjusted for withdrawals) accumulated at generally 5%

simple interest up to the earlier of age 80 or 100% of adjusted premiums.

[3] EPB GMDB is the greatest of the MAV, current AV, or contract value plus a percentage of the contract’s growth. The contract’s growth is AV

less premiums net of withdrawals, subject to a cap of 200% of premiums net of withdrawals.

[4] APB GMDB is the greater of current AV or MAV, not to exceed current AV plus 25% times the greater of net premiums and MAV (each adjusted

for premiums in the past 12 months).

[5] LIB GMDB is the greatest of current AV, net premiums paid, or for certain contracts a benefit amount that ratchets over time, generally based

on market performance.

[6] Reset GMDB is the greatest of current AV, net premiums paid and the most recent five to seven year anniversary AV before age 80 (adjusted for

withdrawals).

[7] ROP GMDB is the greater of current AV and net premiums paid.

[8] AV includes the contract holder’s investment in the separate account and the general account.

[9] GMDB includes a ROP and MAV (before age 80) paid in a single lump sum. GMIB is a guarantee to return initial investment, adjusted for

earnings liquidity, which allows for free withdrawal of earnings, paid through a fixed payout annuity, after a minimum deferral period of 10, 15

or 20 years. The GRB related to the Japan GMIB was $33.9 billion and $28.6 billion as of December 31, 2010 and December 31, 2009,

respectively. The GRB related to the Japan GMAB and GMWB was $707 and $648 as of December 31, 2010 and December 31, 2009,

respectively. These liabilities are not included in the Separate Account as they are not legally insulated from the general account liabilities of the

insurance enterprise. As of December 31, 2010, 54% of RNAR is reinsured to a Hartford affiliate.

[10] NAR is defined as the guaranteed benefit in excess of the current AV for all accounts that are in the money. RNAR represents NAR reduced for

reinsurances. NAR and RNAR are highly sensitive to equity markets movements and increase when equity markets declines.

[11] Policies with a guaranteed living benefit (GMIB in Japan) also have a guaranteed death benefit. The NAR for each benefit is shown in the table

above, however these benefits are not additive. When a policy terminates due to death, any NAR related to GMWB or GMIB is released.

Similarly, when a policy goes into benefit status on a GMWB or GMIB, its GMDB NAR is released.

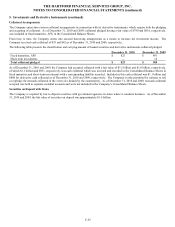

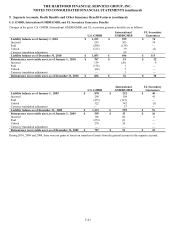

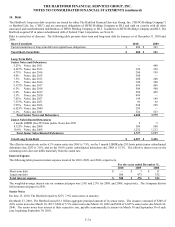

In the U.S. , account balances of contracts with guarantees were invested in variable separate accounts as follows:

Asset type As of December 31, 2010 As of December 31, 2009

Equity securities (including mutual funds) [1] $ 75,601 $ 75,720

Cash and cash equivalents 8,365 9,298

Total $ 83,966 $ 85,018

[1} As of December 31, 2010 and December 31, 2009, approximately 15% and 16%, respectively, of the equity securities above were invested in

fixed income securities through these funds and approximately 85% and 84%, respectively, were invested in equity securities.

See Note 4a for further information on guaranteed living benefits that are accounted for at fair value, such as GMWB.