The Hartford 2010 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 35

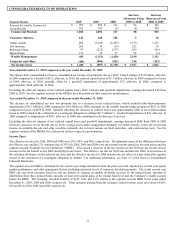

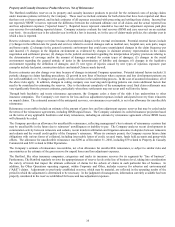

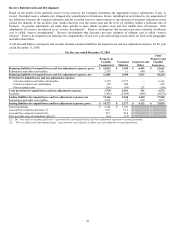

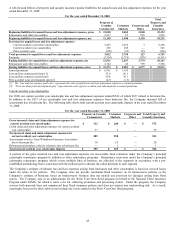

Property and Casualty Insurance Product Reserves, Net of Reinsurance

The Hartford establishes reserves on its property and casualty insurance products to provide for the estimated costs of paying claims

under insurance policies written by the Company. These reserves include estimates for both claims that have been reported and those

that have not yet been reported, and include estimates of all expenses associated with processing and settling these claims. Incurred but

not reported (“IBNR”) reserves represent the difference between the estimated ultimate cost of all claims and the actual reported loss

and loss adjustment expenses (“reported losses”). Reported losses represent cumulative loss and loss adjustment expenses paid plus

case reserves for outstanding reported claims. Company actuaries evaluate the total reserves (IBNR and case reserves) on an accident

year basis. An accident year is the calendar year in which a loss is incurred, or, in the case of claims-made policies, the calendar year in

which a loss is reported.

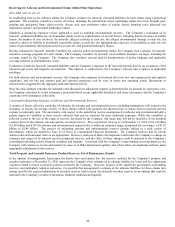

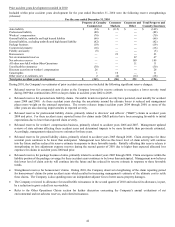

Reserve estimates can change over time because of unexpected changes in the external environment. Potential external factors include

(1) changes in the inflation rate for goods and services related to covered damages such as medical care, hospital care, auto parts, wages

and home repair; (2) changes in the general economic environment that could cause unanticipated changes in the claim frequency per

unit insured; (3) changes in the litigation environment as evidenced by changes in claimant attorney representation in the claims

negotiation and settlement process; (4) changes in the judicial environment regarding the interpretation of policy provisions relating to

the determination of coverage and/or the amount of damages awarded for certain types of damages; (5) changes in the social

environment regarding the general attitude of juries in the determination of liability and damages; (6) changes in the legislative

environment regarding the definition of damages; and (7) new types of injuries caused by new types of injurious exposure: past

examples include lead paint, construction defects and tainted Chinese-made drywall.

Reserve estimates can also change over time because of changes in internal Company operations. Potential internal factors include (1)

periodic changes in claims handling procedures; (2) growth in new lines of business where exposure and loss development patterns are

not well established; or (3) changes in the quality of risk selection in the underwriting process. In the case of assumed reinsurance, all of

the above risks apply. In addition, changes in ceding company case reserving and reporting patterns can create additional factors that

need to be considered in estimating the reserves. Due to the inherent complexity of the assumptions used, final claim settlements may

vary significantly from the present estimates, particularly when those settlements may not occur until well into the future.

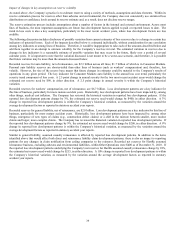

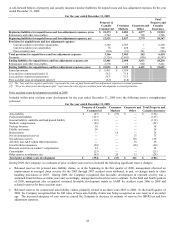

Through both facultative and treaty reinsurance agreements, the Company cedes a share of the risks it has underwritten to other

insurance companies. The Company’ s net reserves for loss and loss adjustment expenses include anticipated recovery from reinsurers

on unpaid claims. The estimated amount of the anticipated recovery, or reinsurance recoverable, is net of an allowance for uncollectible

reinsurance.

Reinsurance recoverables include an estimate of the amount of gross loss and loss adjustment expense reserves that may be ceded under

the terms of the reinsurance agreements, including IBNR unpaid losses. The Company calculates its ceded reinsurance projection based

on the terms of any applicable facultative and treaty reinsurance, including an estimate by reinsurance agreement of how IBNR losses

will ultimately be ceded.

The Company provides an allowance for uncollectible reinsurance, reflecting management’ s best estimate of reinsurance cessions that

may be uncollectible in the future due to reinsurers’ unwillingness or inability to pay. The Company analyzes recent developments in

commutation activity between reinsurers and cedants, recent trends in arbitration and litigation outcomes in disputes between reinsurers

and cedants and the overall credit quality of the Company’ s reinsurers. Where its contracts permit, the Company secures future claim

obligations with various forms of collateral, including irrevocable letters of credit, secured trusts, funds held accounts and group-wide

offsets. The allowance for uncollectible reinsurance was $290 as of December 31, 2010, including $79 related to Property & Casualty

Commercial and $211 related to Other Operations.

The Company’ s estimate of reinsurance recoverables, net of an allowance for uncollectible reinsurance, is subject to similar risks and

uncertainties as the estimate of the gross reserve for unpaid losses and loss adjustment expenses.

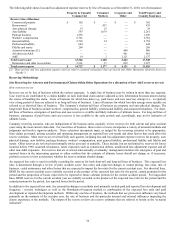

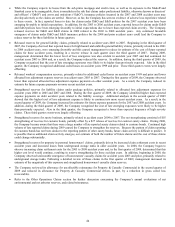

The Hartford, like other insurance companies, categorizes and tracks its insurance reserves for its segments by “line of business”.

Furthermore, The Hartford regularly reviews the appropriateness of reserve levels at the line of business level, taking into consideration

the variety of trends that impact the ultimate settlement of claims for the subsets of claims in each particular line of business. In

addition, the Other Operations operating segment, within Corporate and Other, includes reserves for asbestos and environmental

(“A&E”) claims. Adjustments to previously established reserves, which may be material, are reflected in the operating results of the

period in which the adjustment is determined to be necessary. In the judgment of management, information currently available has been

properly considered in the reserves established for losses and loss adjustment expenses.