The Hartford 2010 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 44

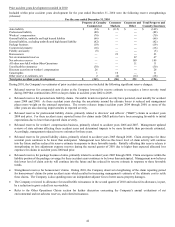

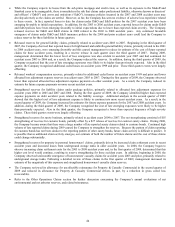

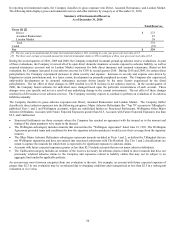

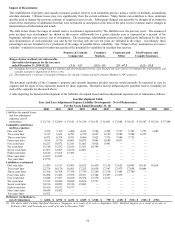

• While the Company expects its losses from the sub-prime mortgage and credit crisis, as well as its exposure to the Madoff and

Stanford cases to be manageable, there is nonetheless the risk that claims under professional liability, otherwise known as directors’

and officers’ (“D&O”) and errors and omissions (“E&O”), insurance policies incurred in the 2007 and 2008 accident years may

develop adversely as the claims are settled. However, so far, the Company has seen no evidence of adverse loss experience related

to these events. In fact, reported losses to date for claims under D&O and E&O policies for the 2007 accident year have been

emerging favorably to initial expectations. In addition, for the 2003 to 2006 accident years, reported losses for claims under D&O

and E&O policies have been emerging favorably to initial expectations due to lower than expected claim severity. The Company

released reserves for D&O and E&O claims in 2009 related to the 2003 to 2008 accident years. Any continued favorable

emergence of claims under D&O and E&O insurance policies for the 2008 and prior accident years could lead the Company to

reduce reserves for these liabilities in future quarters.

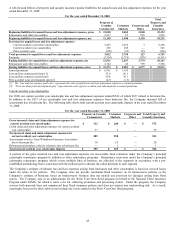

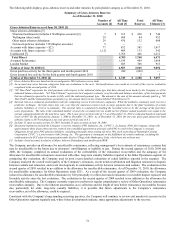

• Released reserves for general liability claims, primarily related to accident years 2003 to 2007. Beginning in the third quarter of

2007, the Company observed that reported losses for high hazard and umbrella general liability claims, primarily related to the 2001

to 2006 accident years, were emerging favorably and this caused management to reduce its estimate of the cost of future reported

claims for these accident years, resulting in a reserve release in each quarter since the third quarter of 2007. During 2009,

management determined that the lower level of loss emergence was also evident in accident year 2007 and had continued for

accident years 2003 to 2006 and, as a result, the Company reduced the reserves. In addition, during the third quarter of 2009, the

Company recognized that the cost of late emerging exposures were likely to be higher than previously expected. Also in the third

quarter, the Company recognized additional ceded losses on accident years 1999 and prior. These third quarter events were largely

offsetting.

• Released workers' compensation reserves, primarily related to additional ceded losses on accident years 1999 and prior and lower

allocated loss adjustment expense reserves in accident years 2003 to 2007. During the first quarter of 2009, the Company observed

lower than expected allocated loss adjustment expense payments on older accident years. As a result, the Company reduced its

estimate for future expense payments on more recent accident years.

• Strengthened reserves for liability claims under package policies, primarily related to allocated loss adjustment expenses for

accident years 2000 to 2005 and 2007 and 2008. During the first quarter of 2009, the Company identified higher than expected

expense payments on older accident years related to the liability coverage. Additional analysis in the second quarter of 2009

showed that this higher level of loss adjustment expense is likely to continue into more recent accident years. As a result, in the

second quarter of 2009, the Company increased its estimates for future expense payments for the 2007 and 2008 accident years. In

addition, during the third quarter of 2009, the Company recognized the cost of late emerging exposures were likely to be higher

than previously expected. Also in the third quarter, the Company recognized a lower than expected frequency of high severity

claims. These third quarter events were largely offsetting.

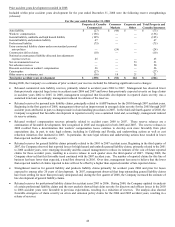

• Strengthened reserves for surety business, primarily related to accident years 2004 to 2007. The net strengthening consisted of $55

strengthening of reserves for customs bonds, partially offset by a $27 release of reserves for contract surety claims. During 2008,

the Company became aware that there were a large number of late reported surety claims related to customs bonds. Continued high

volume of late reported claims during 2009 caused the Company to strengthen the reserves. Because the pattern of claim reporting

for customs bonds has not been similar to the reporting pattern of other surety bonds, future claim activity is difficult to predict. It

is possible that as additional claim activity emerges, our estimate of both the number of future claims and the cost of those claims

could change substantially.

• Strengthened reserves for property in personal homeowners’ claims, primarily driven by increased claim settlement costs in recent

accident years and increased losses from underground storage tanks in older accident years. In 2008, the Company began to

observe increasing claim settlement costs for the 2005 to 2008 accident years and, in the first quarter of 2009, determined that this

higher cost level would continue, resulting in reserve strengthening for these accident years. In addition, beginning in 2008, the

Company observed unfavorable emergence of homeowners' casualty claims for accident years 2003 and prior, primarily related to

underground storage tanks. Following a detailed review of these claims in the first quarter of 2009, management increased its

estimate of the magnitude of this exposure and strengthened homeowners' casualty claim reserves.

• The Company reviewed its allowance for uncollectible reinsurance for Property & Casualty Commercial in the second quarter of

2009 and reduced its allowance for Property & Casualty Commercial driven, in part, by a reduction in gross ceded loss

recoverables.

• Refer to the Other Operations Claims section for further discussion concerning the Company’ s annual evaluations of net

environmental and net asbestos reserves, and related reinsurance.