The Hartford 2010 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2010 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 57

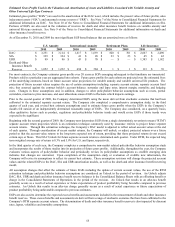

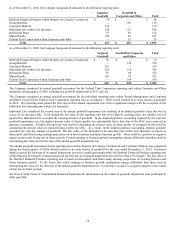

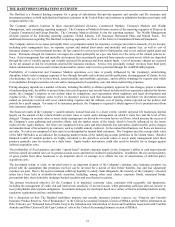

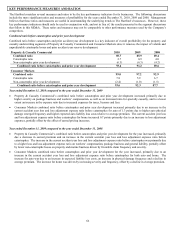

Living Benefits Required to be Fair Valued (in Other Policyholder Funds and Benefits Payable)

Fair values for GMWB and GMAB contracts are calculated using the income approach based upon internally developed models because

active, observable markets do not exist for those items. The fair value of the Company’ s guaranteed benefit liabilities, classified as

embedded derivatives, and the related reinsurance and customized freestanding derivatives is calculated as an aggregation of the

following components: Best Estimate Claims Payments; Credit Standing Adjustment; and Margins. The resulting aggregation is

reconciled or calibrated, if necessary, to market information that is, or may be, available to the Company, but may not be observable by

other market participants, including reinsurance discussions and transactions. The Company believes the aggregation of these

components, as necessary and as reconciled or calibrated to the market information available to the Company, results in an amount that

the Company would be required to transfer, or receive, for an asset, to or from market participants in an active liquid market, if one

existed, for those market participants to assume the risks associated with the guaranteed minimum benefits and the related reinsurance

and customized derivatives. The fair value is likely to materially diverge from the ultimate settlement of the liability as the Company

believes settlement will be based on our best estimate assumptions rather than those best estimate assumptions plus risk margins. In the

absence of any transfer of the guaranteed benefit liability to a third party, the release of risk margins is likely to be reflected as realized

gains in future periods’ net income. For further discussion on the impact of fair value changes from living benefits see Note 4a of the

Notes to Consolidated Financial Statements and for a discussion on the sensitivities of certain living benefits due to capital market

factors see Variable Product Equity Risk within Capital Markets Risk Management.

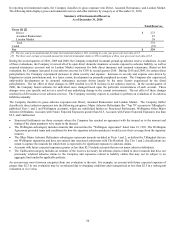

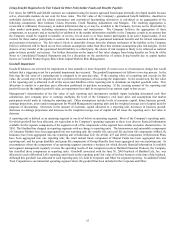

Goodwill Impairment

Goodwill balances are reviewed for impairment at least annually or more frequently if events occur or circumstances change that would

indicate that a triggering event for a potential impairment has occurred. The goodwill impairment test follows a two step process. In the

first step, the fair value of a reporting unit is compared to its carrying value. If the carrying value of a reporting unit exceeds its fair

value, the second step of the impairment test is performed for purposes of measuring the impairment. In the second step, the fair value

of the reporting unit is allocated to all of the assets and liabilities of the reporting unit to determine an implied goodwill value. This

allocation is similar to a purchase price allocation performed in purchase accounting. If the carrying amount of the reporting unit

goodwill exceeds the implied goodwill value, an impairment loss shall be recognized in an amount equal to that excess.

Management’ s determination of the fair value of each reporting unit incorporates multiple inputs including discounted cash flow

calculations, peer company price to earnings multiples, the level of the Company’ s own share price and assumptions that market

participants would make in valuing the reporting unit. Other assumptions include levels of economic capital, future business growth,

earnings projections, assets under management for Wealth Management reporting units and the weighted average cost of capital used for

purposes of discounting. Decreases in the amount of economic capital allocated to a reporting unit, decreases in business growth,

decreases in earnings projections and increases in the weighted average cost of capital will all cause the reporting unit’ s fair value to

decrease.

A reporting unit is defined as an operating segment or one level below an operating segment. Most of the Company’ s reporting units,

for which goodwill has been allocated, are equivalent to the Company’ s operating segments as there is no discrete financial information

available for the separate components of the segment or all of the components of the segment have similar economic characteristics. In

2010, The Hartford has changed its reporting segments with no change to reporting units. The homeowners and automobile components

of Consumer Markets have been aggregated into one reporting unit; the variable life, universal life and term life components within Life

Insurance have been aggregated into one reporting unit of Individual Life; the 401(k), 457 and 403(b) components of Retirement Plans

have been aggregated into one reporting unit; the retail mutual funds component of Mutual Funds has been aggregated into one

reporting unit; and the group disability and group life components of Group Benefits have been aggregated into one reporting unit. In

circumstances where the components of an operating segment constitute a business for which discrete financial information is available

and segment management regularly reviews the operating results of that component such as Hartford Financial Products, the Company

has classified those components as reporting units. Goodwill associated with the June 30, 2000 buyback of Hartford Life, Inc. was

allocated to each of Hartford Life's reporting units based on the reporting units' fair value of in-force business at the time of the buyback.

Although this goodwill was allocated to each reporting unit, it is held in Corporate and Other for segment reporting. In addition Federal

Trust Corporation is an immaterial operating segment where the goodwill has been included in the Corporate and Other.