Lenovo 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

2013/14 Annual Report Lenovo Group Limited

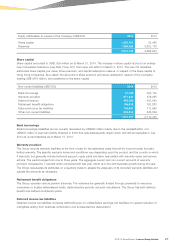

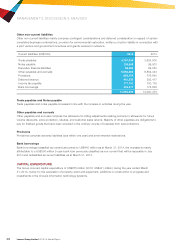

Equity attributable to owners of the Company (US$’000) 2014 2013

Share capital 1,650,101 33,465

Reserves 1,360,029 2,633,178

3,010,130 2,666,643

Share capital

Share capital amounted to US$1,650 million as at March 31, 2014. The increase in share capital is due to an entirely

new Companies Ordinance (Cap.622) (“new CO”) that came into effect on March 3, 2014. The new CO abolishes

authorized share capital, par value, share premium, and capital redemption reserve, in respect of the share capital of

Hong Kong companies. As a result, the amounts of share premium and share redemption reserve of the Company,

totaling US$1,616 million, are transferred to the share capital.

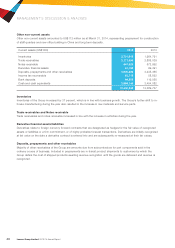

Non-current liabilities (US$’000) 2014 2013

Bank borrowings 10,125 303,133

Warranty provision 277,231 279,255

Deferred revenue 438,385 403,540

Retirement benefit obligations 156,515 163,883

Deferred income tax liabilities 142,881 113,992

Other non-current liabilities 844,914 846,539

1,870,051 2,110,342

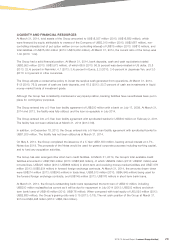

Bank borrowings

Bank borrowings (classified as non-current) decreased by US$293 million mainly due to the reclassification of a

US$300 million 5-year loan facility obtained in 2009 that was subsequently drawn down and will be repayable in July

2014 as current liabilities as at March 31, 2014.

Warranty provision

The Group records warranty liabilities at the time of sale for the estimated costs that will be incurred under its basic

limited warranty. The specific warranty terms and conditions vary depending upon the product and the country in which

it was sold, but generally include technical support, repair parts and labor associated with warranty repair and service

actions. The period ranges from one to three years. The aggregate current and non-current amounts of warranty

provision increased by 7 percent when compared with last year, which is in line with business growth during the year.

The Group reevaluates its estimates on a quarterly basis to assess the adequacy of its recorded warranty liabilities and

adjusts the amounts as necessary.

Retirement benefit obligations

The Group operates various pension schemes. The schemes are generally funded through payments to insurance

companies or trustee-administered funds, determined by periodic actuarial calculations. The Group has both defined

benefit and defined contribution plans.

Deferred income tax liabilities

Deferred income tax liabilities comprise withholding tax on undistributed earnings, tax liabilities on upward valuation of

intangibles arising from business combination and accelerated tax depreciation.