Lenovo 2014 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

2013/14 Annual Report Lenovo Group Limited

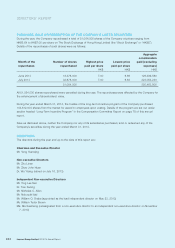

DIRECTORS’ RIGHTS TO ACQUIRE SHARES OR DEBENTURES (continued)

Share Option Scheme (continued)

2. Valuation of share options

The share options granted are not recognized in the financial statements until they are exercised. The directors

consider that it is not appropriate to value the share options on the ground that certain crucial factors for such

valuation are variables which cannot be reasonably determined at this stage. Any valuation of the share options

based on speculative assumptions in respect of such variables would not be meaningful and the results thereof

may be misleading to the shareholders. Thus, it is more appropriate to disclose only the market price and exercise

price.

Long-Term Incentive Program

The Company adopted the long-term incentive program on May 26, 2005, under which the Board or the trustee of

the program shall select the employees (including but not limited to the directors) of the Group for participation in the

program, and determine the number of shares to be awarded.

Details of the movements in the share options and the share awards for the year ended March 31, 2014 are set out

under the section headed “Long-Term Incentive Schemes” in the Compensation Committee Report.

Save as disclosed in the sections headed “Directors’ Interests”, “Share Option Scheme and “Long-Term Incentive

Program” of this report, and “Long-Term Incentive Program” of the Compensation Committee Report, at no time during

the year ended March 31, 2014 was the Company or any of its subsidiaries a party to any arrangements to enable the

directors of the Company to acquire benefits by means of acquisitions of shares in, or debentures of, the Company or

any body corporate.

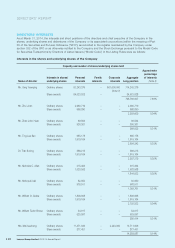

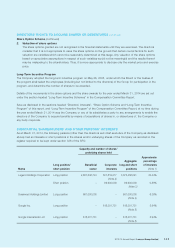

SUBSTANTIAL SHAREHOLDERS’ AND OTHER PERSONS’ INTERESTS

As at March 31, 2014, the following persons (other than the directors and chief executive of the Company as disclosed

above) had an interests or short positions in the shares and/or underlying shares of the Company as recorded in the

register required to be kept under section 336 of the SFO:

Capacity and number of shares/

underlying shares held

Name

Long position/

short position

Beneficial

owner

Corporate

interests

Aggregate

long and short

positions

Approximate

percentage

of interests

(Note 1)

Legend Holdings Corporation Long position 2,867,636,724 507,819,317 3,375,456,041 32.44%

(Note 2)

Short position –89,900,000 89,900,000 0.86%

(Note 3)

Sureinvest Holdings Limited Long position 661,000,000 –661,000,000 6.36%

(Note 4)

Google Inc. Long position –618,301,731 618,301,731 5.94%

(Note 5)

Google International LLC Long position 618,301,731 –618,301,731 5.94%

(Note 5)