Lenovo 2014 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199

|

|

174 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

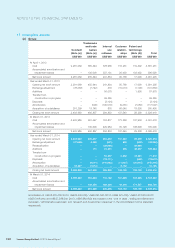

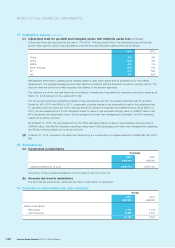

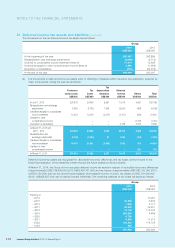

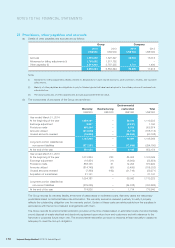

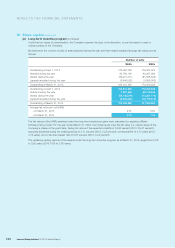

24 Receivables

(a) Customers are generally granted credit term ranging from 0 to 120 days. Ageing analysis of trade receivables of the Group

at the balance sheet date, based on invoice date, is as follows:

Group

2014 2013

US$’000 US$’000

0 – 30 days 2,206,799 1,967,312

31 – 60 days 601,499 560,180

61 – 90 days 181,916 136,543

Over 90 days 220,754 257,924

3,210,968 2,921,959

Less: provision for impairment (39,614) (36,920)

Trade receivables – net 3,171,354 2,885,039

Trade receivables that are not past due are fully performing and not considered impaired.

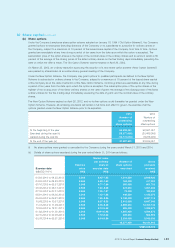

At March 31, 2014, trade receivables, net of impairment, of US$371,549,000 (2013: US$331,457,000) were past due. The

ageing of these receivables, based on due date, is as follows:

Group

2014 2013

US$’000 US$’000

Within 30 days 186,913 221,310

31 – 60 days 82,652 42,559

61 – 90 days 45,306 37,395

Over 90 days 56,678 30,193

371,549 331,457

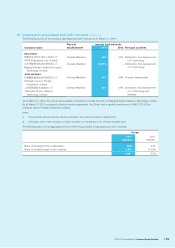

Movements in the provision for impairment of trade receivables are as follows:

Group

2014 2013

US$’000 US$’000

At beginning of the year 36,920 29,397

Exchange adjustment 342 (649)

Provisions made 22,000 23,527

Uncollectible receivables written off (244) (9,261)

Unused amounts reversed (20,675) (13,653)

Acquisition of subsidiaries 1,271 7,559

At the end of the year 39,614 36,920

(b) Notes receivable of the Group are bank accepted notes mainly with maturity dates of within six months.