Lenovo 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

148 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

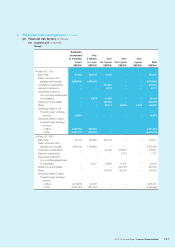

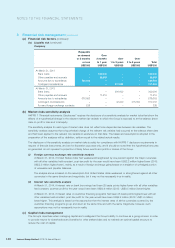

3 Financial risk management (continued)

(a) Financial risk factors (continued)

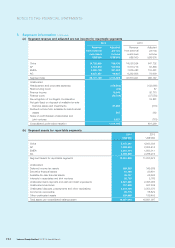

(iv) Liquidity risk (continued)

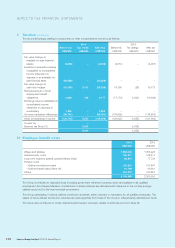

Company

Repayable

on demand

or 3 months

or less

Over

3 months

to 1 year

Over

1 to 3 years

Over

3 to 5 years Total

US$’000 US$’000 US$’000 US$’000 US$’000

At March 31, 2014

Bank loans –300,000 – – 300,000

Other payables and accruals –36,685 – – 36,685

Amounts due to subsidiaries 525,553 –––525,553

Contingent considerations – – 317,000 –317,000

At March 31, 2013

Bank loans – – 300,000 –300,000

Other payables and accruals –17,415 – – 17,415

Amounts due to subsidiaries 676,663 –––676,663

Contingent considerations – – 42,000 275,000 317,000

Forward foreign exchange contracts 238 – – – 238

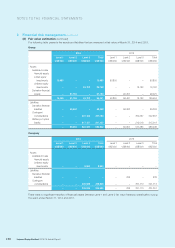

(b) Market risks sensitivity analysis

HKFRS 7 “Financial instruments: Disclosures” requires the disclosure of a sensitivity analysis for market risks that show the

effects of a hypothetical change in the relevant market risk variable to which the Group is exposed to at the balance sheet

date on profit or loss and total equity.

The sensitivity analysis for each type of market risks does not reflect inter-dependencies between risk variables. The

sensitivity analysis assumes that a hypothetical change of the relevant risk variable had occurred at the balance sheet date

and had been applied to the relevant risk variable in existence on that date. The bases and assumptions adopted in the

preparation of the analyses will by definition, seldom equal to the related actual results.

The disclosure of the sensitivity analysis on market risks is solely for compliance with HKFRS 7 disclosure requirements in

respect of financial instruments, and are for illustration purposes only; and it should be noted that the hypothetical amounts

so generated do not represent a projection of likely future events and profits or losses of the Group.

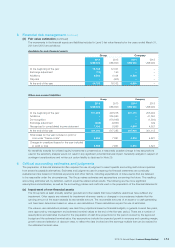

(i) Foreign currency exchange rate sensitivity analysis

At March 31, 2014, if United States dollar had weakened/strengthened by one percent against the major currencies

with all other variables held constant, post-tax profit for the year would have been US$2.2 million higher/lower (2013:

US$2.3 million higher/lower), mainly as a result of foreign exchange gains/losses on translation of unhedged portion

of receivable and payable balances.

The analysis above is based on the assumption that United States dollar weakened or strengthened against all other

currencies in the same direction and magnitude, but it may not be necessarily true in reality.

(ii) Interest rate sensitivity analysis

At March 31, 2014, if interest rate on bank borrowings had been 25 basis points higher/lower with all other variables

held constant, post-tax profit for the year would have been US$0.9 million (2013: US$0.5 million) lower/higher.

At March 31, 2014, if interest rates on customer financing programs had been 25 basis points higher/lower with all

other variables held constant, post-tax profit for the year would have been US$2.2 million (2013: US$1.6 million)

lower/higher. This analysis is based on the assumption that the interest rates of all the currencies covered by the

customer financing programs go up and down at the same time and with the same magnitude; however, such

assumptions may not be necessarily true in reality.

(c) Capital risks management

The Group’s objectives when managing capital are to safeguard the Group’s ability to continue as a going concern in order

to provide returns for shareholders and benefits for other stakeholders and to maintain an optimal capital structure to

reduce the cost of capital.