Lenovo 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

132 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

1 General information and basis of preparation (continued)

The adoption of these new and revised standards and amendments to existing standards is not expected to have material

impact on the Group’s financial statements.

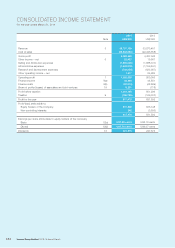

Changes in presentation

Effective April 1, 2013 the Group has re-organized its structure into two end-to-end business groups (Lenovo Business Group

and Think Business Group), which enhances the Group’s capabilities in both efficiency and innovation. As part of the Group re-

organization, the Group redistributes certain global operation functions to directly align with the respective business groups. The

re-organization of the global operation functions enables each of the geographical segments to directly control their businesses

through closely aligned supply chain, services, marketing and other functions that directly report into the geography instead of

part of the corporate global operations.

Certain overhead costs that were included as part of the cost of sales in the previous years have now been reclassified to

administrative expenses. Management considers the current reclassification is more appropriate and consistent with industry

practice.

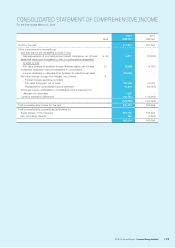

The Group has also re-aligned its geographical segments whereby Latin America that was previously part of Asia Pacific/Latin

America (“APLA”) has been spun off and combined with North America, transforming into a new Americas region. The Group’s

original geographic structure had achieved rapid business growth through the alignment of its strategic direction and business

acquisitions. The new geographical structure is in recognition that the Group’s stronger infrastructure in the Latin America aligns

the Group’s strategy to expand across the entire Americas region.

The comparative information has been reclassified to conform to the presentation of current organizational structure and

allocation basis.

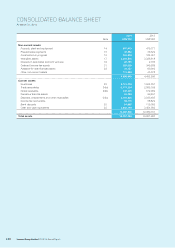

2 Significant accounting policies

The significant accounting policies adopted in the preparation of these financial statements are set out below. These policies

have been consistently applied to all the years presented, unless otherwise stated.

(a) Subsidiaries

(i) Consolidation

The consolidated financial statements include the financial statements of the Company and all of its subsidiaries

made up to March 31.

Subsidiaries are all entities (including special purpose entities) over which the Group is exposed to, or has rights

to, variable returns from its involvement with the entity and has the ability to affect those returns through its power

over the entity generally accompanying a shareholding of more than one half of the voting rights. The existence and

effect of potential voting rights that are currently exercisable or convertible are considered when assessing whether

the Group controls another entity. The Group also assesses existence of control where it does not have more than

50% of the voting power but is able to govern the financial and operating policies by virtue of de-facto control. De-

facto control may arise from circumstances where it does not have more than 50% of the voting power but is able

to govern the financial and operating policies by virtue of de-facto control such as enhanced minority rights or

contractual terms between shareholders, etc.

Subsidiaries are fully consolidated from the date on which control is transferred to the Group. They are de-

consolidated from the date that control ceases.

Inter-company transactions, balances, income and expenses on transactions are eliminated. Profits and losses

resulting from inter-company transactions that are recognized in assets are also eliminated.

Adjustments have been made to the financial statements of subsidiaries when necessary to align their accounting

policies to ensure consistency with the policies adopted by the Group.

For subsidiaries which adopted December 31 as their financial year end date for statutory reporting purposes, their

financial statements for the years ended March 31, 2013 and 2014 have been used for the preparation of the Group’s

consolidated financial statements.