Lenovo 2014 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

189

2013/14 Annual Report Lenovo Group Limited

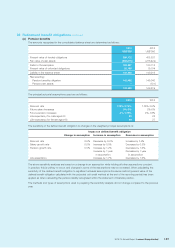

36 Retirement benefit obligations

(continued)

(c) Additional information on post-employment benefits (pension and medical)

(continued)

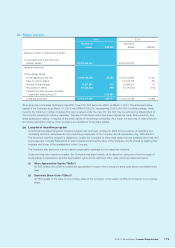

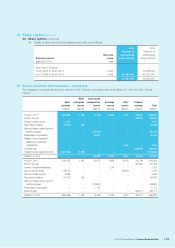

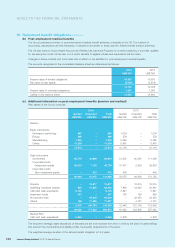

Expected maturity analysis of undiscounted pension and post-employments medical benefits:

At March 31, 2014

Less than

a year

Between

1-2 years

Between

2-5 years

Over

5 years Total

US$’000 US$’000 US$’000 US$’000 US$’000

Pension benefits 10,614 11,840 42,873 569,171 634,498

Post-employment medical benefits 3,328 3,630 2,562 22,238 31,758

Total 13,942 15,470 45,435 591,409 666,256

Pension and medical plan assets do not include any of the Company’s ordinary shares or US real estate occupied by the

Group (2013: Nil).

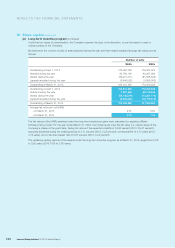

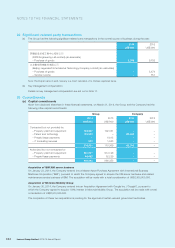

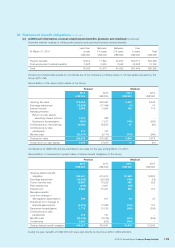

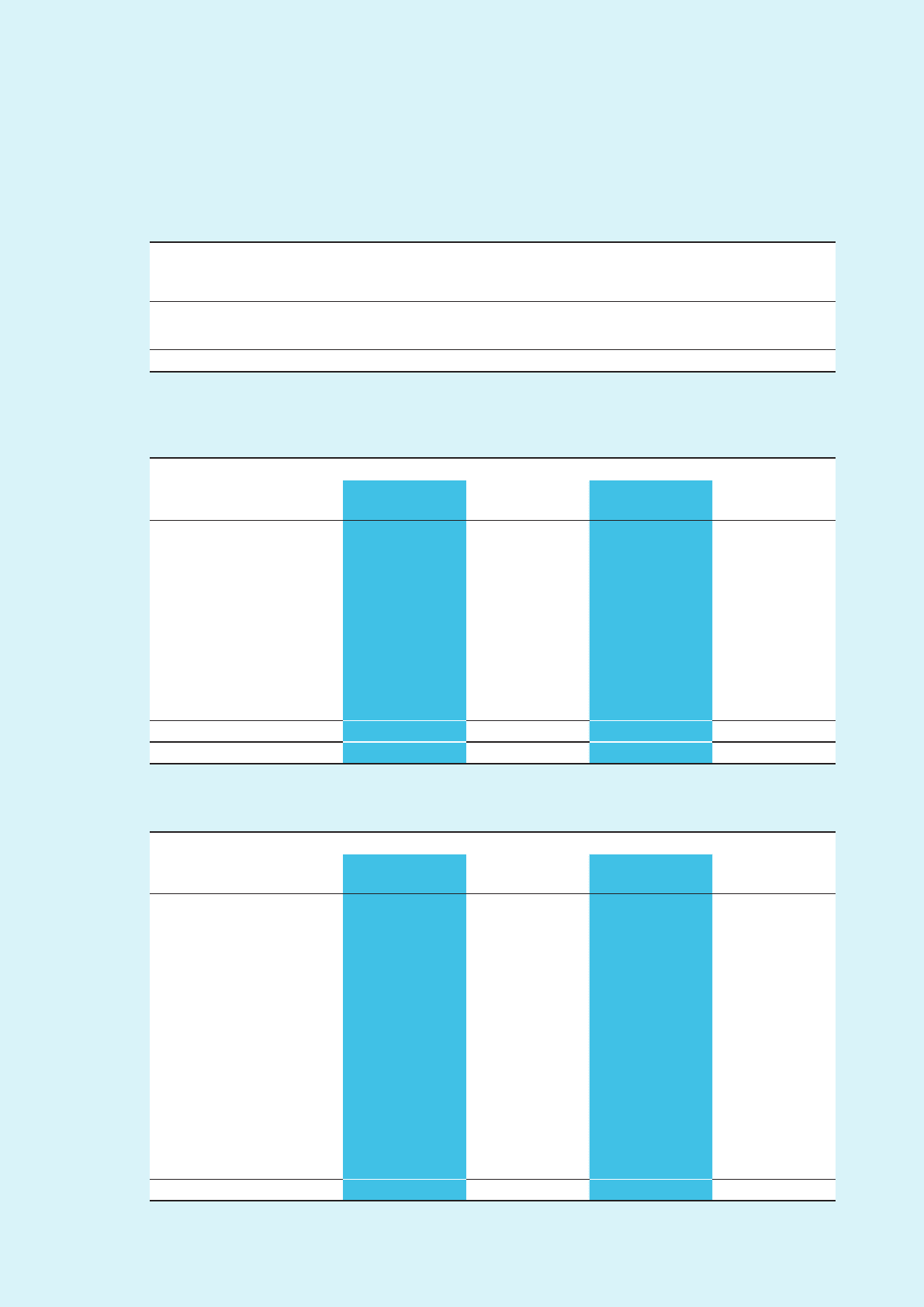

Reconciliation of fair value of plan assets of the Group:

Pension Medical

2014 2013 2014 2013

US$’000 US$’000 US$’000 US$’000

Opening fair value 275,422 224,497 5,878 6,445

Exchange adjustment (12,285) (17,494) (1) 10

Interest income 5,965 5,904 160 174

Remeasurements:

Return on plan assets

excluding interest income 1,015 888 ––

Experience (losses)/gains (281) 7,217 (146) (265)

Contributions by the employer 19,698 59,953 27 (90)

Contributions by plan

participants 415 167 –

Benefits paid (23,074) (5,710) (373) (396)

Closing fair value 266,875 275,422 5,545 5,878

Actual return on plan assets 6,699 14,009 14 (91)

Contributions of US$8,295,000 are estimated to be made for the year ending March 31, 2015.

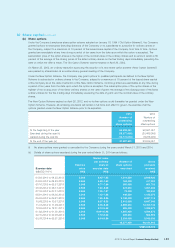

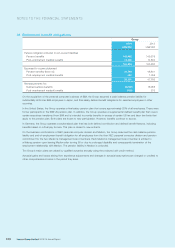

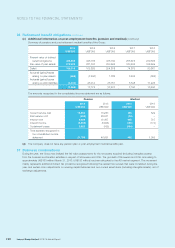

Reconciliation of movements in present value of defined benefit obligations of the Group:

Pension Medical

2014 2013 2014 2013

US$’000 US$’000 US$’000 US$’000

Opening defined benefit

obligation 424,641 415,910 20,542 19,850

Exchange adjustment (16,002) (36,259) (169) (79)

Current service cost 15,850 16,233 495 522

Past service cost (695) 2,031 (34) –

Interest cost 9,689 10,407 685 707

Remeasurements:

Loss from change in

demographic assumptions 509 911 69 33

(Gain)/loss from changes in

financial assumptions (4,614) 13,389 (678) 127

Experience losses/(gains) 1,779 10,763 (465) (209)

Contributions by plan

participants 415 167 ––

Benefits paid (25,135) (8,709) (373) (409)

Curtailments 2,920 (202) (494) –

Closing defined benefit obligation 409,357 424,641 19,578 20,542

During the year, benefits of US$2,061,000 were paid directly by the Group (2013: US$2,999,000).