Lenovo 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

134 Lenovo Group Limited 2013/14 Annual Report

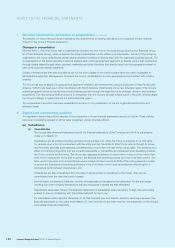

NOTES TO THE FINANCIAL STATEMENTS

2 Significant accounting policies (continued)

(a) Subsidiaries (continued)

(v) Separate financial statements

Investments in subsidiaries in the Company’s balance sheet are accounted for at cost less impairment. The results of

subsidiaries are accounted for by the Company on the basis of dividends received and receivable.

Impairment testing of the investments in subsidiaries is required upon receiving dividends from these investments

if the dividend exceeds the total comprehensive income of the subsidiary in the period the dividend is declared or

if the carrying amount of the investment in the separate financial statements exceeds the carrying amount in the

consolidated financial statements of the investee’s net assets including goodwill.

(b) Associates and joint ventures

Associates are entities over which the Group has significant influence but not control, generally accompanying a

shareholding of between 20% and 50% of the voting rights.

Investments in joint arrangements are classified as either joint operations or joint ventures depending on the contractual

rights and obligations of each investor. The Group has assessed the nature of its joint arrangements and determined them

to be joint ventures.

Interests in associates and joint ventures are accounted for using the equity method of accounting and are initially

recognized at cost. The Group’s interests in associates and joint ventures include goodwill identified on acquisition, net of

any accumulated impairment losses.

If the ownership interest in an associate or a joint venture is reduced but significant influence is retained, only a

proportionate share of the amounts previously recognized in other comprehensive income are reclassified to the

consolidated income statement where appropriate.

The Group’s share of its associates’ and joint ventures’ post-acquisition profits or losses is recognized in the consolidated

income statement, and its share of post-acquisition movements in other comprehensive income/expense is recognized as

other comprehensive income/expense with a corresponding adjustment to the carrying amount of the investment. When

the Group’s share of losses in an associate or a joint venture equals or exceeds its interest in the associate or the joint

venture including any other unsecured receivables, the Group does not recognize further losses, unless it has incurred legal

or constructive obligations or made payments on behalf of the associate or the joint venture.

The Group determines at each reporting date whether there is any objective evidence that the investment in the associate

and joint venture is impaired. If this is the case, the Group calculates the amount of impairment as the difference between

the recoverable amount of the associate or joint venture and its carrying value and recognizes the amount adjacent to

share of profit/(loss) of associates and joint ventures in the consolidated income statement.

Profits and losses resulting from upstream and downstream transactions between the Group and its associates or joint

ventures are recognized in the Group’s financial statements only to the extent of unrelated investor’s interests in the

associates or the joint ventures. Unrealized losses are eliminated unless the transaction provides evidence of an impairment

of the assets transferred.

Accounting policies of associates and joint ventures have been changed where necessary to ensure consistency with the

policies adopted by the Group.

For associates and joint ventures which adopted December 31 as their financial year end date for statutory reporting

purposes, their financial statements for the years ended March 31, 2013 and 2014 have been used for the preparation of

the Group’s consolidated financial statements.

(c) Segment reporting

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating

decision-maker. The chief operating decision-maker, who is responsible for allocating resources and assessing

performance of the operating segments, has been identified as the Lenovo Executive Committee (the “LEC”) that makes

strategic decisions.

(d) Translation of foreign currencies

(i) Items included in the financial statements of each of the Group’s entities are measured using the currency of the

primary economic environment in which the entity operates (the “functional currency”). The financial statements of

the Company and of the Group are presented in United States dollars, which is the Company’s functional and the

Group’s presentation currency.