Lenovo 2014 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199

|

|

157

2013/14 Annual Report Lenovo Group Limited

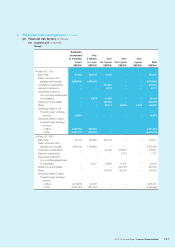

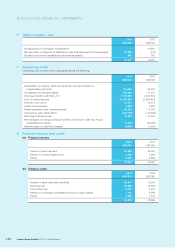

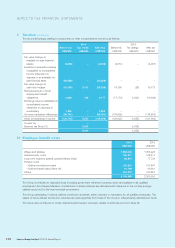

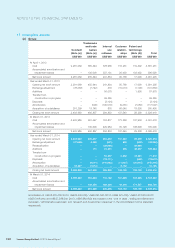

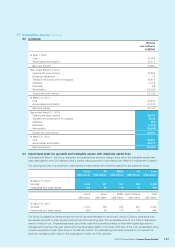

9 Taxation

The amount of taxation in the consolidated income statement represents:

2014 2013

US$’000 US$’000

Current tax

– Hong Kong profits tax 13,024 1,328

– Taxation outside Hong Kong 201,175 181,267

Deferred tax (Note 21) (17,474) (12,888)

196,725 169,707

Hong Kong profits tax has been provided at the rate of 16.5% (2013: 16.5%) on the estimated assessable profit for the year.

Taxation outside Hong Kong represents income and irrecoverable withholding taxes of subsidiaries operating in the Chinese

Mainland and overseas, calculated at rates applicable in the respective jurisdictions.

The Group has been granted certain tax concessions by tax authorities in the Chinese Mainland and overseas whereby the

subsidiaries operating in the respective jurisdictions are entitled to tax concessions.

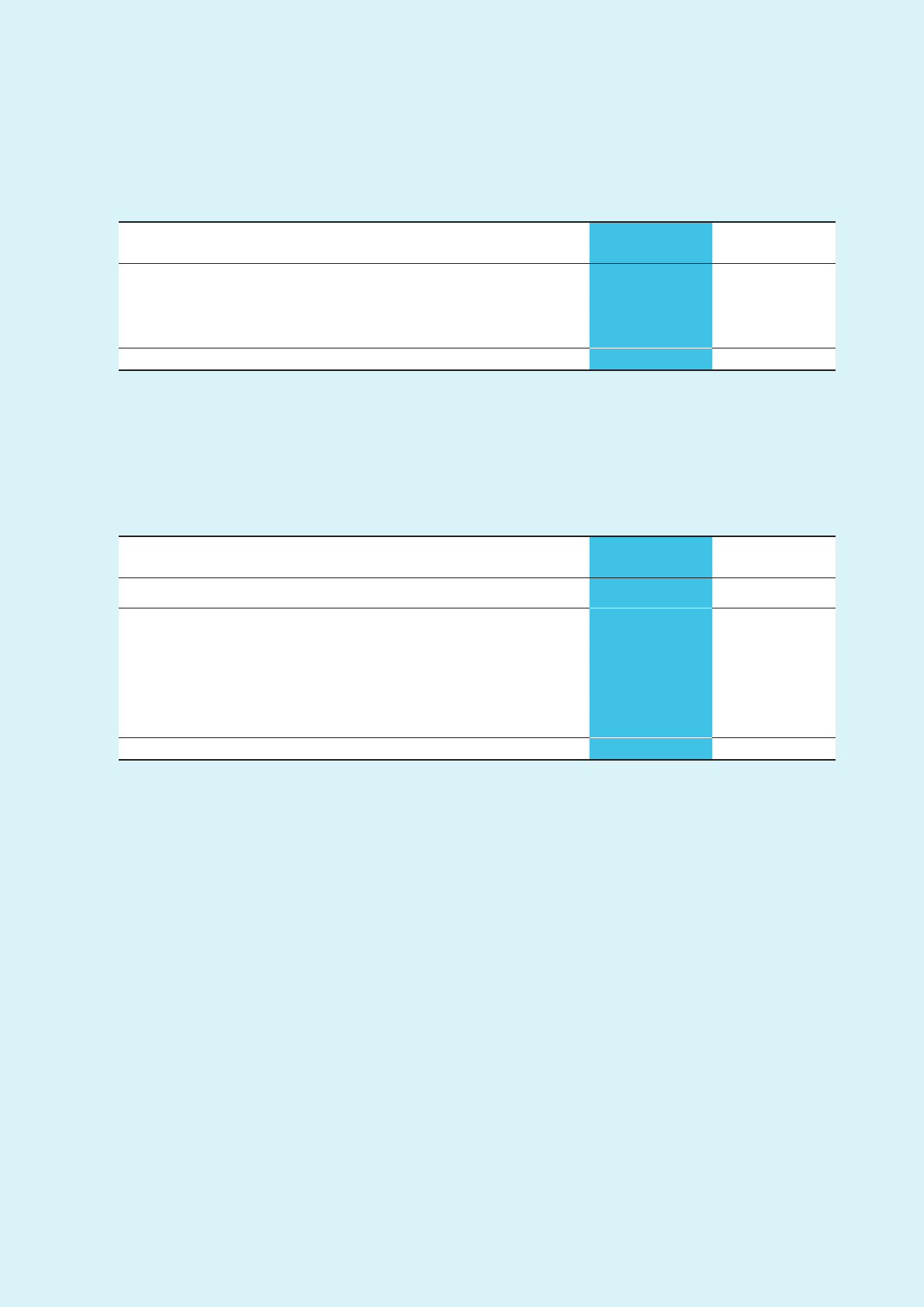

The differences between the Group’s expected tax charge, calculated at the domestic rates applicable to the countries

concerned, and the Group’s tax charge for the year are as follows:

2014 2013

US$’000 US$’000

Profit before taxation 1,014,195 801,299

Tax calculated at domestic rates applicable in countries concerned 231,160 137,345

Income not subject to taxation (427,986) (137,918)

Expenses not deductible for taxation purposes 192,706 133,750

Utilization of previously unrecognized tax losses (3,841) (69,347)

Effect on opening deferred income tax assets due to change in tax rates 359 (844)

Deferred income tax assets not recognized 151,136 76,772

Under-provision in prior years 53,191 29,949

196,725 169,707

The weighted average applicable tax rate for the year was 22.8% (2013: 17.1%).The increase is caused by changes in tax

concessions and profitability of the Group’s subsidiaries in respective countries they are operating.