Lenovo 2014 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199

|

|

180 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

30 Share capital (continued)

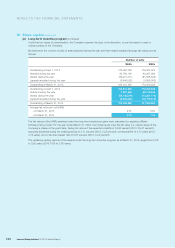

(a) Long-term incentive program

(continued)

Under the two types of compensation, the Company reserves the right, at its discretion, to pay the award in cash or

ordinary shares of the Company.

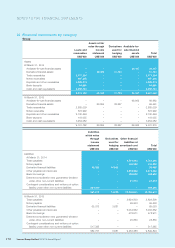

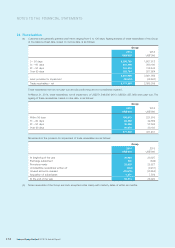

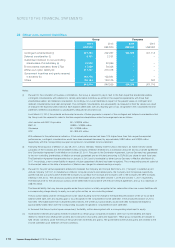

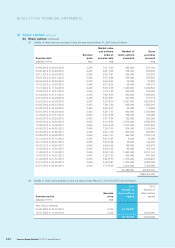

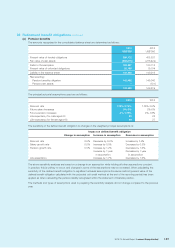

Movements in the number of units of award granted during the year and their related weighted average fair values are as

follows:

Number of units

SARs RSUs

Outstanding at April 1, 2012 172,094,158 176,064,076

Granted during the year 82,786,156 80,087,089

Vested during the year (82,021,317) (81,848,623)

Lapsed/cancelled during the year (8,446,562) (3,896,006)

Outstanding at March 31, 2013 164,412,435 170,406,536

Outstanding at April 1, 2013 164,412,435 170,406,536

Granted during the year 7,057,800 55,119,546

Vested during the year (59,706,679) (71,231,773)

Lapsed/cancelled during the year (8,535,288) (16,790,916)

Outstanding at March 31, 2014 103,228,268 137,503,393

Average fair value per unit (HK$)

– At March 31, 2013 2.37 6.50

– At March 31, 2014 2.15 7.34

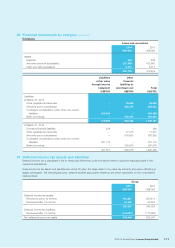

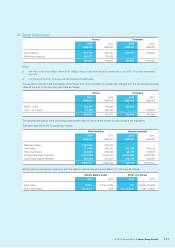

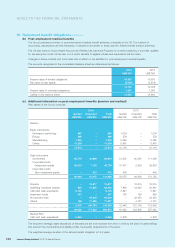

The fair values of the SARs awarded under the long-term incentive program were calculated by applying a Black-

Scholes pricing model. For the year ended March 31, 2014, the model inputs were the fair value (i.e. market value) of the

Company’s shares at the grant date, taking into account the expected volatility of 36.62 percent (2013: 39.47 percent),

expected dividends during the vesting periods of 2.71 percent (2013: 2.25 percent), contractual life of 4.75 years (2013:

4.75 years), and a risk-free interest rate of 0.67 percent (2013: 0.24 percent).

The remaining vesting periods of the awards under the long-term incentive program as at March 31, 2014 ranged from 0.08

to 3.92 years (2013: 0.08 to 3.92 years).