Lenovo 2014 Annual Report Download - page 190

Download and view the complete annual report

Please find page 190 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

188 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

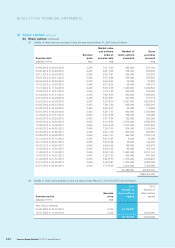

36 Retirement benefit obligations

(continued)

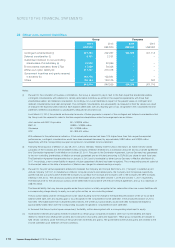

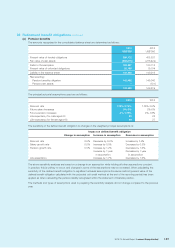

(b) Post-employment medical benefits

The Group operates a number of post-employment medical benefit schemes, principally in the US. The method of

accounting, assumptions and the frequency of valuations are similar to those used for defined benefit pension schemes.

The US plan (Lenovo Future Health Account and Retiree Life Insurance Program) is currently funded by a trust that qualifies

for tax exemption under US tax law, out of which benefits to eligible retirees and dependents will be made.

Changes in future medical cost trend rates has no effect on the liabilities for post-employment medical benefits.

The amounts recognized in the consolidated balance sheet are determined as follows:

2014 2013

US$’000 US$’000

Present value of funded obligations 18,287 18,676

Fair value of plan assets (5,545) (5,878)

12,742 12,798

Present value of unfunded obligations 1,291 1,866

Liability in the balance sheet 14,033 14,664

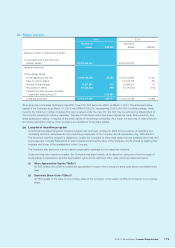

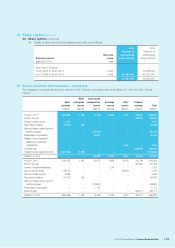

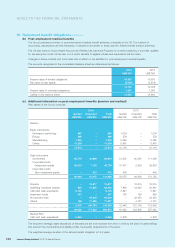

(c) Additional information on post-employment benefits (pension and medical)

Plan assets of the Group comprise:

2014 2013

Quoted Unquoted Total Quoted Unquoted Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Pension

Equity instruments

Information technology 860 –860 1,004 –1,004

Energy 298 –298 279 –279

Manufacturing 1,216 –1,216 2,360 –2,360

Others 11,239 –11,239 6,461 –6,461

13,613 –13,613 10,104 –10,104

Debt instruments

Government 26,775 42,898 69,673 21,207 90,291 111,498

Corporate bonds

(investment grade) 39,673 7,105 46,778 37,471 2,359 39,830

Corporate bonds

(Non-investment grade) –472 472 400 –400

66,448 50,475 116,923 59,078 92,650 151,728

Property –18,877 18,877 –19,215 19,215

Qualifying insurance policies 845 41,555 42,400 7,836 34,645 42,481

Cash and cash equivalents 8,135 –8,135 3,841 –3,841

Investment funds 437 –437 763 126 889

Structured bonds –48,503 48,503 –42,433 42,433

Others 158 17,829 17,987 –4,731 4,731

9,575 126,764 136,339 12,440 101,150 113,590

89,636 177,239 266,875 81,622 193,800 275,422

Medical Plan

Cash and cash equivalents 5,545 –5,545 5,878 –5,878

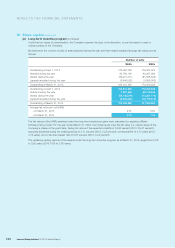

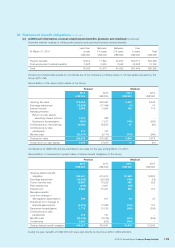

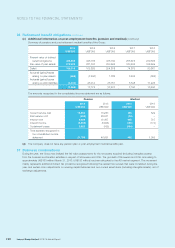

The long term strategic asset allocations of the plans are set and reviewed from time to time by the plans’ trustees taking

into account the membership and liability profile, the liquidity requirements of the plans.

The weighted average duration of the defined benefit obligation is 14.5 years.