Lenovo 2014 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199

|

|

150 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

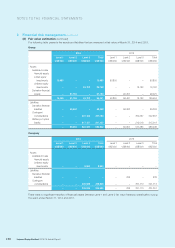

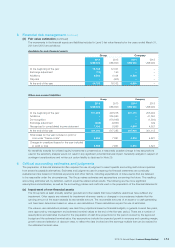

3 Financial risk management (continued)

(d) Fair value estimation (continued)

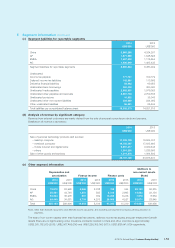

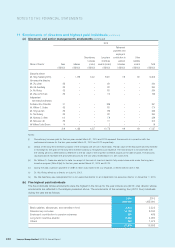

The following table presents the assets and liabilities that are measured at fair value at March 31, 2014 and 2013.

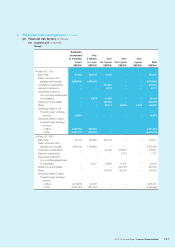

Group

2014 2013

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Assets

Available-for-sale

financial assets

Listed equity

investments 10,455 – – 10,455 53,800 – – 53,800

Unlisted equity

investments – – 24,702 24,702 – – 16,162 16,162

Derivative financial

assets –61,184 –61,184 –99,491 –99,491

10,455 61,184 24,702 96,341 53,800 99,491 16,162 169,453

Liabilities

Derivative financial

liabilities –58,462 –58,462 –69,053 –69,053

Contingent

considerations – – 307,183 307,183 – – 302,367 302,367

Written put option

liability – – 217,157 217,157 – – 215,018 215,018

–58,462 524,340 582,802 –69,053 517,385 586,438

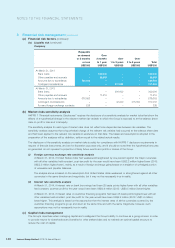

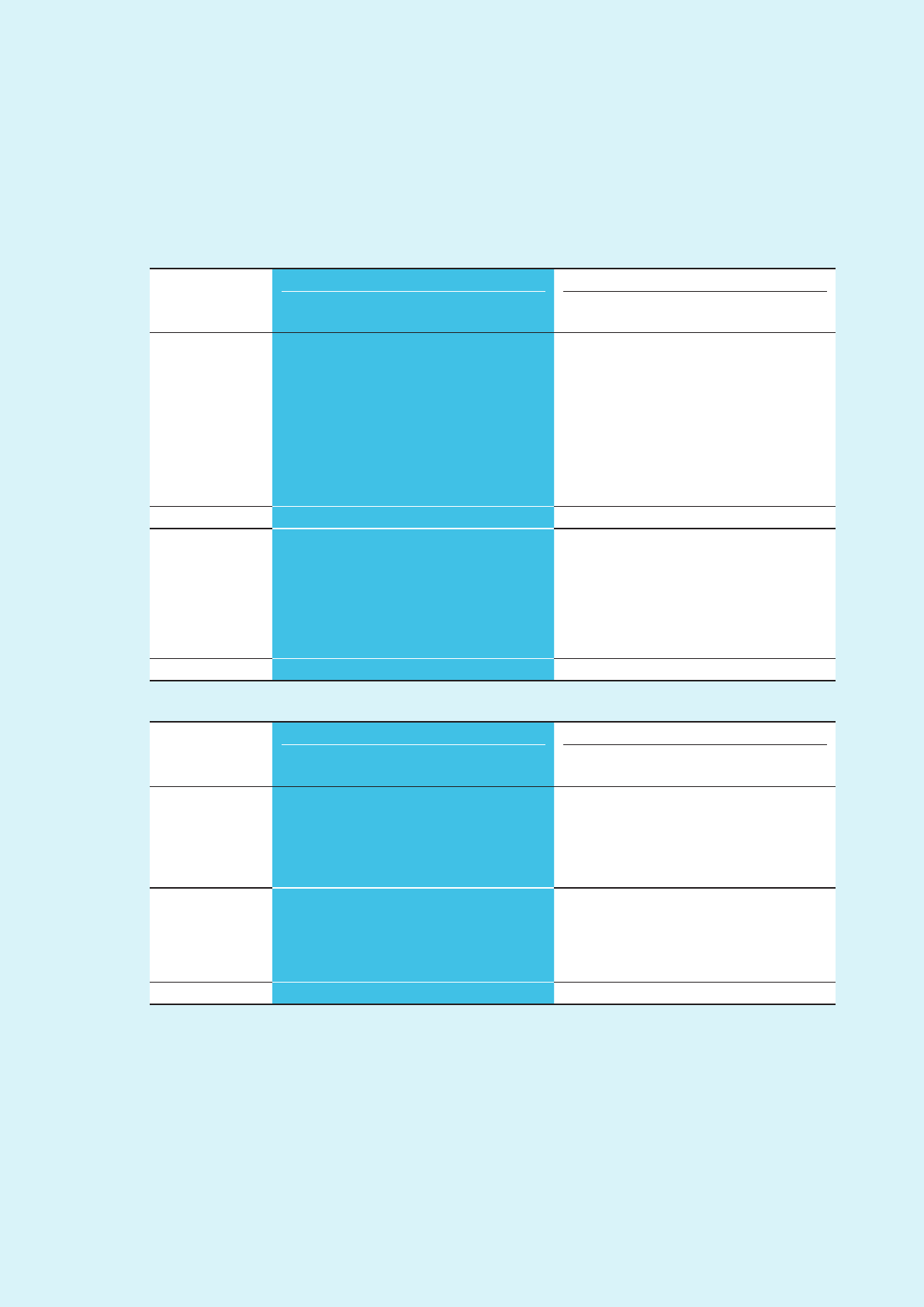

Company

2014 2013

Level 1 Level 2 Level 3 Total Level 1 Level 2 Level 3 Total

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000

Assets

Available-for-sale

financial assets

Unlisted equity

investments – – 8,500 8,500 ––––

Liabilities

Derivative financial

liabilities – – – – –238 –238

Contingent

considerations – – 305,929 305,929 – – 301,113 301,113

– – 305,929 305,929 –238 301,113 301,351

There were no significant transfers of financial assets between Level 1 and Level 2 fair value hierarchy classification during

the years ended March 31, 2014 and 2013.