Lenovo 2014 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

178 Lenovo Group Limited 2013/14 Annual Report

NOTES TO THE FINANCIAL STATEMENTS

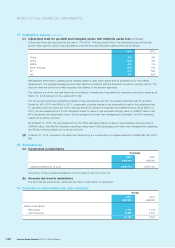

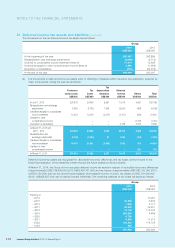

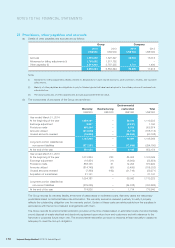

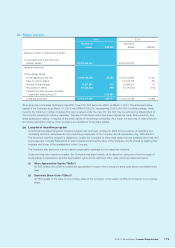

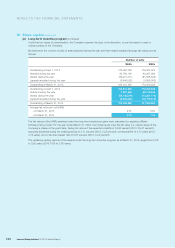

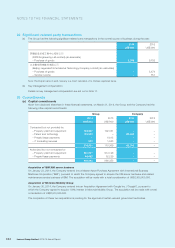

29 Other non-current liabilities

Group Company

2014 2013 2014 2013

US$’000 US$’000 US$’000 US$’000

Contingent considerations (i) 307,183 302,367 305,929 301,113

Deferred consideration (i) 2,151 2,151 ––

Guaranteed dividend to non-controlling

shareholders of a subsidiary (ii) 18,922 23,699 ––

Environmental restoration (Note 27(b)) 17,559 54,328 ––

Written put option liability (iii) 217,157 215,018 ––

Government incentives and grants received

in advance (iv) 143,778 122,841 ––

Others 138,164 126,135 307 597

844,914 846,539 306,236 301,710

Notes:

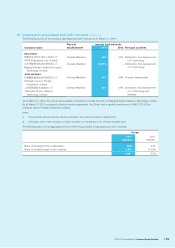

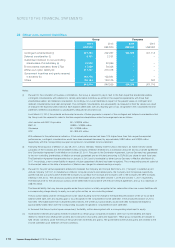

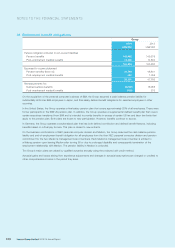

(i) Pursuant to the completion of business combinations, the Group is required to pay in cash to the then respective shareholders/sellers

contingent considerations with reference to certain performance indicators as written in the respective agreements with those then

shareholders/sellers; and deferred consideration. Accordingly, non-current liabilities in respect of the present values of contingent and

deferred considerations have been recognized. The contingent considerations are subsequently re-measured at their fair values as a result

of change in the expected performance at each balance sheet date, with any resulting gain or loss recognized in the consolidated income

statement. Deferred consideration is subsequently measured at amortized cost.

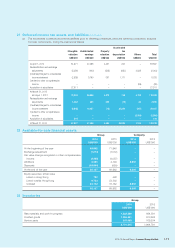

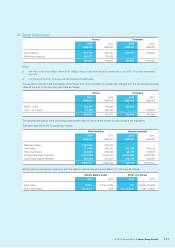

As at March 31, 2014, the potential undiscounted amounts of future payments in respect of the contingent and deferred considerations that

the Group could be required to make to the then respective shareholders under the arrangements are as follows:

Joint venture with NEC Corporation Nil – US$325 million

EMC JV US$39 – US$59 million

Stoneware Nil – US$48 million

CCE Nil – BRL400 million

With reference to the performance indicators, if their actual performances had been 10% higher/lower than their respective expected

performances, contingent considerations would have been increased/decreased by approximately US$4 million and US$30 million

respectively with the corresponding loss/gain recognized in consolidated income statement.

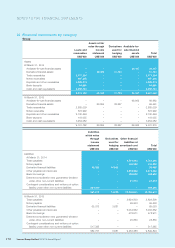

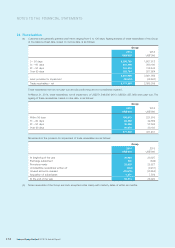

(ii) Following the acquisition of Medion on July 29, 2011, Lenovo Germany Holding GmbH (“Lenovo Germany”), an indirect wholly-owned

subsidiary of the Company and the immediate holding company of Medion entered into a domination and profit and loss transfer agreement

(the “Domination Agreement”) with Medion on October 25, 2011. Pursuant to the Domination Agreement, Lenovo Germany has guaranteed

to the non-controlling shareholders of Medion an annual guaranteed pre-tax dividend amounting to EUR0.82 per share for each fiscal year.

The Domination Agreement became effective on January 3, 2012 and is terminable by either Lenovo Germany or Medion after March 31,

2017. Accordingly, a non-current liability in respect of future guaranteed dividend has been recognized. The corresponding amount stated at

its discounted value on the date of acquisition of Medion was charged to retained earnings in equity.

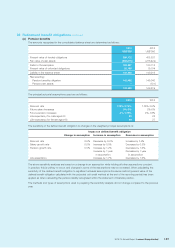

(iii) Pursuant to the joint venture agreement entered into between the Company and Compal Electronics, Inc. (“Compal”) to establish a joint

venture company (“JV Co”) to manufacture notebook computer products and related parts, the Company and Compal are respectively

granted call and put options which entitle the Company to purchase from Compal and Compal to sell to the Company the 49% Compal’s

interests in the JV Co. The call and put options will be exercisable at any time after October 1, 2019 and October 1, 2017 respectively.

The exercise price for the call and put options will be determined in accordance with the joint venture agreement, and up to a maximum of

US$750 million.

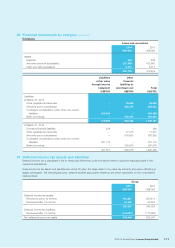

The financial liability that may become payable under the put option is initially recognized at fair value within other non-current liabilities with

a corresponding charge directly to equity, as a put option written on non-controlling interest.

The put option liability shall be re-measured at its fair value resulting from the change in the expected performance of the JV Co at each

balance sheet date, with any resulting gain or loss recognized in the consolidated income statement. If the actual performance of JV Co

had been 10% higher/lower than its expected performances, the written put option liability would have been increased/decreased by

approximately US$4 million with the corresponding loss/gain recognized in consolidated income statement.

In the event that the put option lapses unexercised, the liability will be derecognized with a corresponding adjustment to equity.

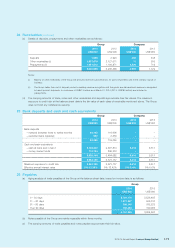

(iv) Government incentives and grants received in advance by certain group companies included in other non-current liabilities are mainly

related to research and development projects and construction of property, plant and equipment. These group companies are obliged to

fulfill certain conditions under the terms of the government incentives and grants. The government incentive and grants are credited to the

income statement upon fulfillment of those conditions.