Lenovo 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 Lenovo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

179

2013/14 Annual Report Lenovo Group Limited

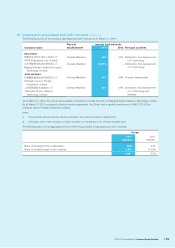

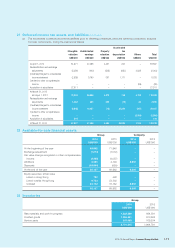

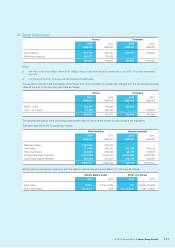

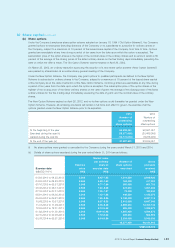

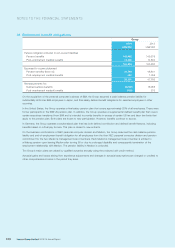

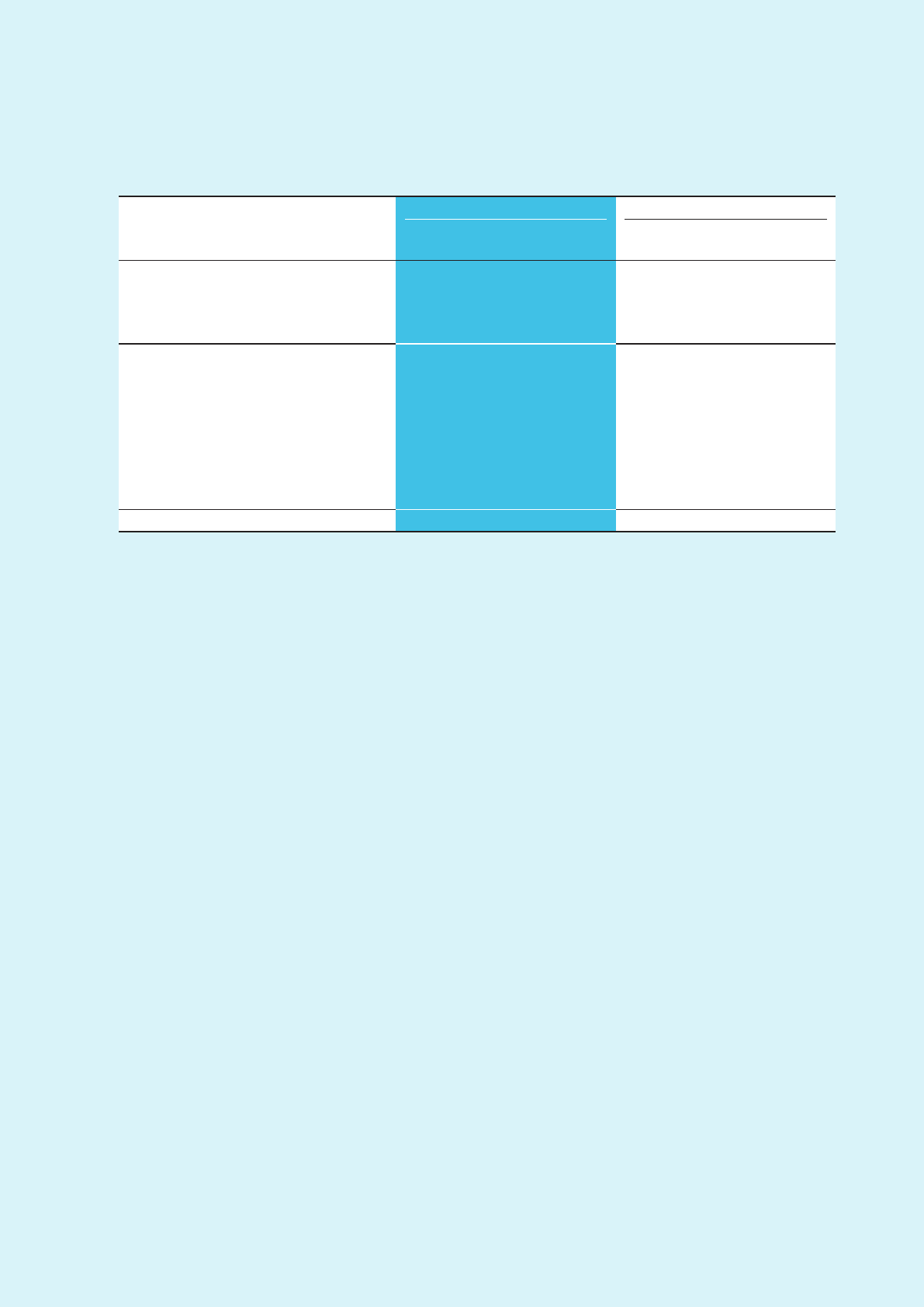

30 Share capital

2014 2013

Number of

shares US$’000

Number of

shares US$’000

Maximum number of shares can be issued:

At the beginning and end of the year

Ordinary shares 20,000,000,000 20,000,000,000

Issued and fully paid:

Voting ordinary shares:

At the beginning of the year 10,439,152,059 33,465 10,335,612,596 33,131

Issue of ordinary shares – – 140,299,463 452

Exercise of share options 18,277,450 816 20,486,000 67

Repurchase of shares (51,054,000) (164) (57,246,000) (185)

Transfer from share premium and share

redemption reserve (Note 31) –1,615,984 – –

At the end of the year 10,406,375,509 1,650,101 10,439,152,059 33,465

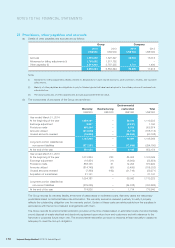

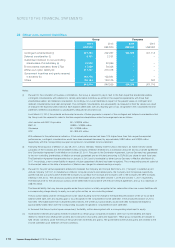

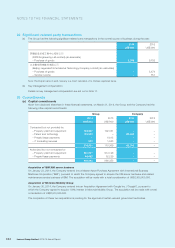

An entirely new Companies Ordinance (Cap.622) (“new CO”) that came into effect on March 3, 2014. The authorized share

capital of the Company as at March 31, 2013 was HK$500,000,000, representing 20,000,000,000 of ordinary shares, which

become the maximum number of shares that can be issued under the new CO. The limit may be removed by shareholders of

the Company passing an ordinary resolution. The new CO abolishes authorized share capital, par value, share premium, and

share redemption reserve, in respect of the share capital of Hong Kong companies. As a result, the amounts of share premium

and share redemption reserve of the Company are transferred to the share capital.

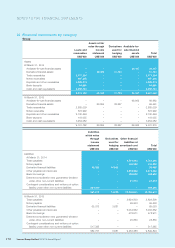

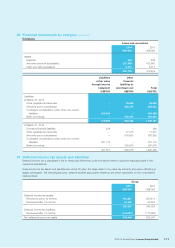

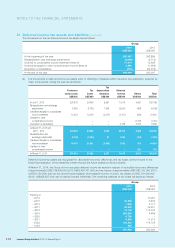

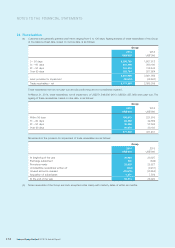

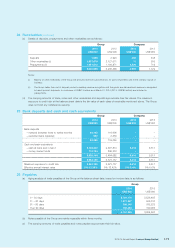

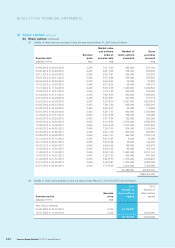

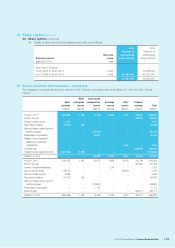

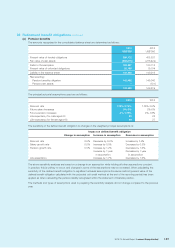

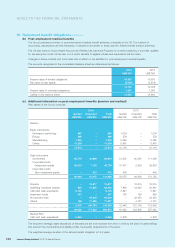

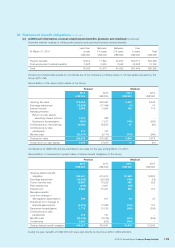

(a) Long-term incentive program

A performance-related long-term incentive program was approved on May 26, 2005 for the purpose of rewarding and

motivating directors, executives and top-performing employees of the Company and its subsidiaries (the “Participants”).

The long-term incentive program is designed to enable the Company to attract and retain the best available personnel, and

encourage and motivate Participants to work towards enhancing the value of the Company and its shares by aligning their

interests with those of the shareholders of the Company.

The Company also approved a share-based compensation package for non-executive directors.

Under the long-term incentive program, the Company may grant awards, at its discretion, using any of the two types of

equity-based compensation: (i) share appreciation rights and (ii) restricted share units, which are described below:

(i) Share Appreciation Rights (“SARs”)

An SAR entitles the holder to receive the appreciation in value of the Company’s share price above a predetermined

level.

(ii) Restricted Share Units (“RSUs”)

An RSU equals to the value of one ordinary share of the Company. Once vested, an RSU is converted to an ordinary

share.